HarborOne Bancorp realized it needed a chief information officer last year after a series of acquisitions tripled the moving parts in its tech infrastructure.

Stepping into the role at the Brockton, Mass., co-operative bank was Brad Goedken, a veteran executive of several large banks including Bank of America and SunTrust, who started two weeks ago by sorting out the $3.7 billion-asset company's tech vendor contracts.

Though he's just begun, Goedken is diving deep into the bank’s business, meeting with the IT team, getting to know the bank’s core provider and considering where automation and data analytics might be applied in the bank. But unlike at his past banking posts, the small institution is somewhat at the mercy of its vendors, and Goedken is figuring out how to give its contracts some teeth.

“While the big banks have their objective, these vendors want more business and there is value in them serving banks at all levels and scales,” Goedken said. “I want to negotiate service level agreements so that when a system is down and our bank’s customers are impacted, the check that I write them gets decreased.”

The complexity of bank technology vendor contracts is at an all-time high, said Paul Schaus, founder and CEO of CCG Catalyst.

For some contracts, Schaus has to negotiate 200 to 300 more terms on behalf of the bank. For a community bank, average contract sizes are 140 to 160 pages while big banks have contracts that are thousands of pages long.

Since smaller institutions are more reliant on vendors, community banks especially should consider what terms should be negotiated aside from price, including people, processes and management, Schaus said.

“The first lie in negotiations is that it’s a partnership,” Schaus said. “It’s not a partnership, it’s a business relationship.”

Goedken will be reviewing HarborOne’s vendor agreements and applying what he's learned in previous roles at bigger banks, including as chief information officer with the SunTrust, Capital One and Bank of America mortgage businesses and Citi in auto finance. He was also a senior vice president and head of origination technology at Wells Fargo.

While none of the bank’s contracts are up for renewal currently, Goedken has his eye on what vendors might be willing to do for a win in the short term. Around the time of the financial crisis, Goedken worked with a bank that persuaded a vendor to renegotiate a contract by offering the vendor a business processing arm the bank was looking to get rid of. During his days as a consultant, Goedken persuaded a vendor to create a lower price tier for a community bank.

“I've interacted with some of the largest vendors in our industry,” he said. “I’ve also been burnt through my career and learned the things that need to be in there.”

The process Goedken is undertaking reflects the change HarborOne has undergone, said Joseph Casey, the chief operating officer.

In 2013, HarborOne converted from a credit union to a mutual bank, and in 2016 it became a 45% stock-owned company. It bought Merrimack Mortgage, Cumberland Mortgage and Coastway Bancorp in 2018. Its rapid growth is one reason its CEO, James Blake, was among American Banker’s five community bankers to

“We wanted to not only address our rapid growth but wanted to prepare for the processes of raising additional capital now to be fully public,” Casey said. “We have more vendors than other institutions our size and we didn’t have a common view or standard when we engaged in those vendor contracts.”

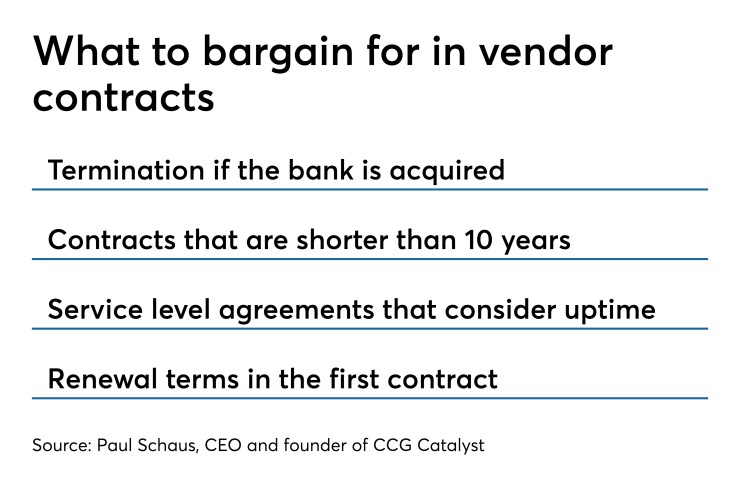

Schaus encouraged small banks to consider terms for what happens if the bank is acquired, shorter contract limits to allow for more leverage but not so short that it creates instability for the bank’s business, and consider who is in charge of verifying the service-level agreement is being met. He also suggested small banks take advantage of the first contract negotiation with a vendor to negotiate renewal contract terms that will take effect automatically.

“In the first contract, the vendor will fight you more on terms,” he said. “They have to send a team in and do demos and pay salespeople commissions. On the renewal contracts, there’s no cost of sale.”

Most important, community banks should remember that nothing in a vendor contract is non-negotiable, Schaus said.

"I've been shocked at what I've been able to negotiate," he said. "You have to be creative when you build these critters."