To understand why there's been so much excitement about so-called blockchain technology, consider the drastic change coming this spring to the nearly $600 billion secondary market for leveraged loans.

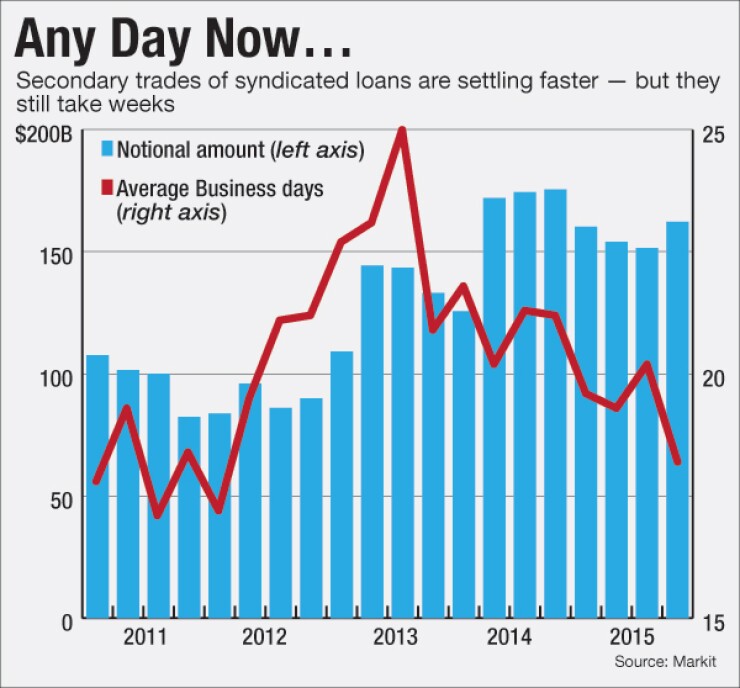

Sometime in the second quarter, the Loan Syndications and Trading Association plans to enact new rules on how investors and sellers in nondistressed loans are compensated for late-settling trades. Bearing the brunt of the changes will be buyers, who will lose out on collecting loan interest payments that are made between a loan trade's purchase agreement and ultimate settlement. That period averages three weeks.

Rather than being automatically entitled to the spread on a loan during that period, buyers will have to bring funds and documents to the table to close the transaction within seven days or forfeit the so-called delayed compensation. While sell-side firms do collect their own delayed comp in carrying charges from buyers during the period of delay, the loan trades are holding up capital on their books while waiting to clear.

-

SecondMarkets founder built a successful company by creating a market for illiquid paper. Then he went all in on bitcoin. The gamble doesnt sound quite so crazy anymore.

February 23 -

How technologies inspired and influenced by bitcoin could reshape financial services, from payments to securities settlement to document preparation and beyond.

December 17 -

It is outside the realm of possibility for bitcoin's blockchain to serve any useful purpose for the intermediaries it was designed to replace.

February 4 -

Bank of America has nearly three dozen patents pending related to blockchains. More banks are expected to seek patents as the technology associated with cryptocurrencies creeps closer to widespread use.

February 1

For the LSTA, the delayed comp changes are an overdue correction to a slow settlement practice that provided investors with no-risk income as they waited for a deal to close. "You could argue the buyer wouldn't do all the things they need to do to close that trade in a timely fashion because they are getting free delayed compensation here," said Ted Basta, the trade group's senior vice president of market data and analysis.

The directive by the LSTA has spurred complaints by investors, however, that they are being punished for the tortoise-paced settlement practice in loans. Loan buyers argue the delays are caused by the lack of automated processing of trades, rather than any incentive for them to sit on their thumbs while collecting free money.

They have a point.

The processing regime behind loan settlements is notoriously anachronistic, with agent banks often ferrying faxes and e-mails between buyers and sellers to close loan trades. Trades are often held back by exceptions that must be manually fixed — such as having to determine a trader's compliance with know-your-customer regulations, or whether a buyer is permitted to obtain the loan under borrower's consent clauses in the original credit agreement.

The delayed comp dilemma is among many of the sludgy settlement and processing practices in the capital markets. For many proponents of modernization and greater efficiency in the loan, bond, swaps, and private placement fields, it's well past time to put investors, banks, brokers and borrowers on the same technological page.

Or, perhaps, the same chain.

Over the past two years, a buzz has been building over the potential for the use of blockchain technology in financial services and markets. The original blockchain is the distributed ledger behind bitcoin, providing a constantly updated, public record of the history and ownership of each unit of the virtual currency. But most of the financial industry's recent flirtation has been with blockchain systems that are unconnected to bitcoin, or any digital token for that matter.

What has financial markets intrigued about blockchains is the potential to offer the same shared ledgers across multiple users to perform financial transactions or back-office functions in a manner that delivers real-time data to all parties involved. Instead of data, documents or other information rolling out from a central database to users' private systems, the ledger is viewable — and usable — at once by any and all nodes on a distributed network (either private or public).

"It's both automation and sharing the automation," said Preston Byrne, the chief operating officer and co-founder of Eris Industries, a startup blockchain company based in London whose open-source platform is used for developing shared ledgers tied to syndicated loan origination and issuance.

"You can automate anything" on a Microsoft SQL server platform, said Byrne. "That was doable 10 years ago. But what you can't do is automate something at the same time in two different places with an SQL server."

Many of the exact case uses of blockchain technology remain theoretical.

In a recent

"Importantly, while there has been a great deal of discussion around implementing real-time settlement using distributed ledger technology, the current U.S. equity market convention of T+3 [three days to settle a trade] is based on laws and market structures," the report stated. "Modernizing current practices and laws to enable real-time settlement are not dependent on the use of blockchain technologies.

However, the DTCC did single out syndicated loans as an area "where blockchain could fill the gap that has not been filled by proprietary automated workflow solutions."

Chris Whalen, a senior managing director at Kroll Bond Rating Agency, is even more skeptical about the applicability of a technology invented by a

"Ultimately the blockchain was created to replicate an exchange of [digital] cash between two individuals, not to enable global payments or securities transactions," Whalen wrote in a recent research note.

Nevertheless, the industry is under enormous pressure to reduce its operational costs.

At a conference last summer hosted by American Banker, former JPMorgan executive-turned-blockchain-champion Blythe Masters spoke of the need for improving settlement latency in the back office. She noted the delays of days, weeks or months in back-end processing, and the inefficiencies in record-keeping (and the related hazards in regulation and compliance) and settlement, which can take days or even months to complete.

"I believe that [blockchain] technology has the potential to truly change the way the financial world operates, to reduce costs, improve efficiency, reduce risks and ultimately provide better customer service, which ultimately is what financially services needs to be all about," Masters said.

Her startup, Digital Asset Holdings, has been one of the most watched firms in the blockchain space. In February, Masters' firm announced the company has formed strategic partnerships with Accenture, PricewaterhouseCoopers and Broadridge to drive adoption of blockchain solutions for clients.

Accenture will be the preferred systems integrator, implementing the tools from Digital Asset. Both companies are founding members of the Linux Hyperledger Project that involves banks, clearing houses like the DTCC and tech companies collaborating on potential solutions.

According to a blockchain industry

While not working on settlement solutions, Eris has been focused on the handling of the origination and issuance of syndicated loans. The company has its own alliance with PwC, and several "bulge-bracket banks" are testing Eris' open-source software to handle lifecycle management of debt instruments, according to Byrne.

Few details have emerged about specific uses that financial institutions are planning to develop with blockchain technology. That seems less a trade secret than the reality that banks aren't sure how blockchain-based protocols will evolve, according to Gabriel Wang, a buyside analyst on institutional securities and investments for the technology research firm Aite Group.

The mechanism that many point to as a means of delivering blockchain's promise is the use of "

But of the all the financial sectors, the capital markets may be the most conducive to blockchain's structures. Capital markets deals tend to be large-value, low-volume deals that fit into a blockchain's

"If you are trying to use this in U.S. equity markets, where you have high speed trading, algorithms, and the ticket sizes are pretty small, blockchain is not very suitable for markets like that," said Wang.

"For syndicated loans and ABS, you have this really large notional amount of volume to trade," he continued. "They are made over the phones, in which trade negotiations could take days and settlement times can be weeks. That's why a lot of blockchain vendors in the space have looked at syndicated loans, corporate bonds and ABS as a focus in their area."

In looking at efficiency gains, the potential changes to existing practices and transaction structure in capital markets are expansive. Eris' Byrne sees a host of new realities that could govern how transactions are conducted and managed through blockchain automation.

"Let's say it's a note or bond," Byrne said. "Do you need a registrar anymore if the software is keeping track of who owns what? Do you need a clearing system if all of the software that is managing the lifecycle is not only tracking who owns what, but also all the transfers that [can] become legally valid once someone has submitted an instruction to transfer them?

"And can you then take all those roles and collapse them into the lead manager or the arranger/agent, whoever is sitting at the top of these transactions?"

One of the first successful tests of a blockchain technology taking on a traditional role was December's announcement by Nasdaq OMX Group that a client had used its Linq blockchain ledger technology to conduct a shares transfer to a private investor — all without the benefit of a middle man clearing house. That may be a bridge too far in some areas of capital markets. As Byrne pointed out, there is a market pricing function to exchanges and clearing houses that can't be replaced or replicated in a direct blockchain connection.

These intermediaries also allow some information to be kept confidential. "Bitcoin was trading among a closed group of participants that needed perfect transparency," Byrne said. "With trading in the financial markets, you don't want perfect transparency. You want your affairs and your holdings to be opaque.

"The blockchain is a big blank slate and will do exactly what the bank tells it what to do," Byrne said. It's really up to them what those problems are."