Talk about pricey signage.

Associated Banc-Corp, Trinity Capital and Old National Bancorp are among the banks that recently bought or leased high-profile space in office buildings in key markets.

For some of the institutions, low interest rates may have been a carrot to buying the buildings, though another, simpler explanation was given by most bankers involved with the deals.

-

Old National Bancorp in Evansville, Ind., has given its chief executive Bob Jones the added title of chairman.

March 15 -

Associated Banc-Corp in Green Bay, Wis., reported fourth-quarter earnings of $42.8 million, a 12.2% drop from a year earlier as the company set aside a significantly higher amount of money to address potential problems in its energy portfolio.

January 22 -

Trinity Capital in Los Alamos, New Mexico, and its subsidiary Los Alamos National Bank will pay a $1.5 million penalty to the Securities and Exchange Commission following charges of accounting fraud.

October 2

"We have a great location to make a statement," John Gulas, president and chief executive of Trinity Capital in Los Alamos, N.M., said about the company's purchase of an office building on the Pan American Freeway in Albuquerque, N.M., where 144,000 cars drive by daily.

Trinity, the parent of the $1.4 billion-asset Los Alamos National Bank, will erect a "very large sign that's very easy to see," Gulas said. "We've faced some challenges in recent years, but we're here to stay and we're committed to growth. Albuquerque is the largest city in the state and a great market for us."

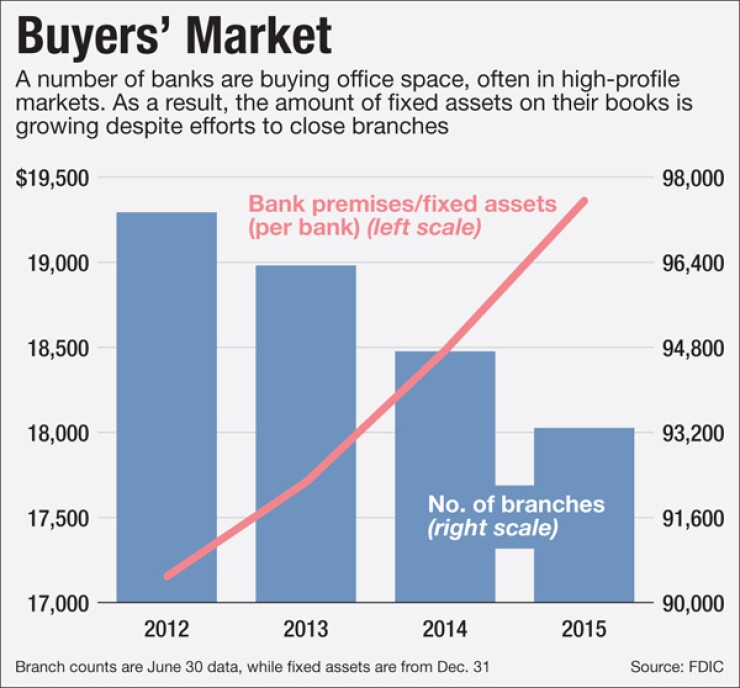

While tying up significant assets in office buildings at a time when the industry is closing branches at a record pace may seem counterintuitive, the move might make sense as long as bankers do their homework and avoid overpaying, said Ted Kovaleff, a longtime bank analyst and investor.

"If they do overpay, they should be thrown out," Kovaleff said.

Community banks, in particular, have effectively used office space to demonstrate their commitment to important markets, said Jeffrey Gerrish, chairman at Gerrish, McCreary and Smith Consultants in Memphis

"These guys wouldn't be spending money frivolously," Gerrish said. "You don't see many banks buying buildings just to put their names on them."

At Trinity, the decision to buy a prominent building arose from a marketing survey it conducted last year found that Los Alamos National lacked name recognition in Albuquerque despite adding $76 million in deposits in the city since setting up shop in 2011.

Though Gulas would not say what Trinity paid for the building, the previous owner had listed it for sale at one point for $4.5 million. Los Alamos plans to occupy the building by the end of this year.

The move was also designed to assure customers and prospects that Los Alamos, which earned $5.5 million last year after losing money in three of the prior four years, was again on solid financial ground.

Associated, meanwhile, agreed to buy the 28-story Milwaukee Center building on Kilbourn Avenue in Milwaukee. Though the $27 billion-asset Associated, of Green Bay, Wis., did not disclose the purchase price, the building has a tax value of about $50 million.

The Milwaukee Center, which is nearly 430 feet tall, is believed to be the fourth-tallest building in Wisconsin.

"Our purchase of this iconic, city-center building aligns with our efforts to become [Milwaukee's] hometown bank," Philip Flynn, Associated's president and chief executive, said in a press release announcing the planned purchase.

Associated, much like Trinity, is keen to show its commitment to a key market, though it may not move all staff and operations to the building until 2020.

"Associated is committed to playing an important role in the city's future and to further positioning ourselves for enhanced regional growth," said John Utz, Associated's Milwaukee market president.

Old National, of Evansville, Ind., is planning to move its regional headquarters in Indianapolis from a nondescript office park to one of the city's most prominent downtown buildings. The $12 billion-asset company will lease the ground floor of the iconic Indianapolis Power and Light Building on Monument Avenue.

The location is "absolutely in the center of Indianapolis," said Randy Reichmann, Old National's regional chief executive. "It's an older building, but there's a lot of character to it."

Old National, which was eager to raise its profile in Indiana's biggest largest city, will move into the space in October, Reichmann said.

Being downtown "is all you can ask for," Reichmann said. "Clearly, we're making a statement in the city. … As the largest community bank headquartered in Indiana, it is symbolic that Old National is located on Monument Circle at the crossroads of America."

Signage opportunities made the move more attractive, Reichmann said. Old National also plans to install a "state-of-the-art" branch at the location.

"It will give people a glimpse into the future of what our branches will look like," Reichmann said, adding that he hopes a high-tech showcase branch will grab its fair share of retail business. "The people who work around Monument Circle are well-compensated professionals."

Kovaleff, an Old National investor, called the company's strategy of relocating its Indianapolis operation to the heart of downtown "exactly the right move."