Community banks are packing on more debt.

Smaller institutions, intent on raising capital to bankroll growth initiatives or to pay off more costly funding, have significantly increased their reliance on subordinated debt this year.

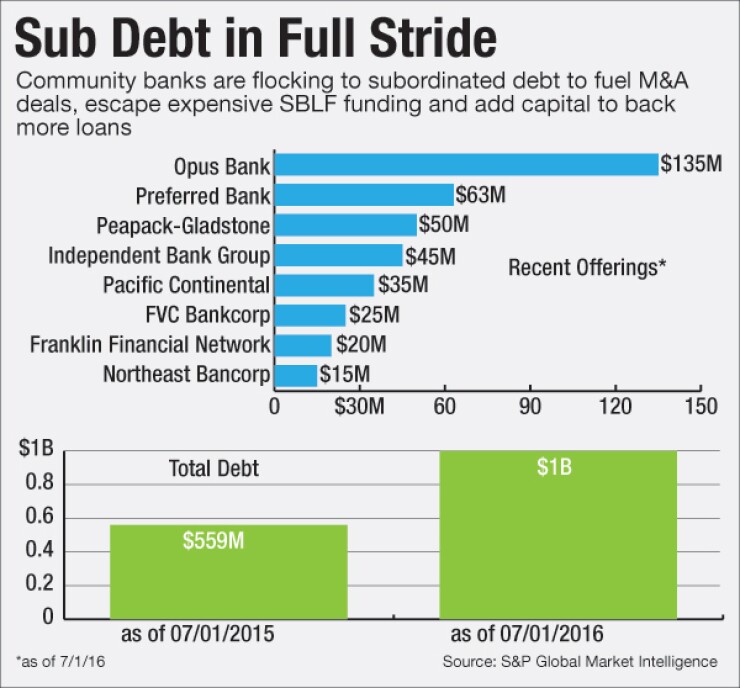

Banks with less than $10 billion in assets issued a total of $1 billion in subordinated debt through July 1, or nearly double what was issued a year earlier, based on data from S&P Global Market Intelligence.

-

North Carolina has lost more than 40% of its banks in the past decade, creating a new tier of larger institutions. More deals are expected to occur, raising questions about the pace of M&A and the fate of those bigger banks.

July 5 -

Bank consolidation in 2016 continues to lag behind last year's pace, although the average deal value is considerably larger.

July 6 -

Suffolk Bancorp said increased oversight of commercial real estate contributed to and may have accelerated its decision to sell to People's United. Other banks could make a similar choice.

June 27

There are several reasons banks are turning to debt instead of issuing stock, industry observers said.

"We didn't need to bolster our common stock and we didn't want to dilute our existing shareholders," said Michael Keim, chief financial officer at Univest Corp. of Pennsylvania in Souderton. The $2.8 billion-asset Univest issued $45 million of subordinated debt on July 1, adding to a $50 million sale last year.

Banks also like subordinated debt because the interest payments are tax-deductible and the issues help bolster Tier 2 capital ratios, said Michael Rave, a lawyer at Day Pitney.

It also helps to have a market for the debt.

"There's a lot of interest in them from institutional investors and investment banks are really pushing it," said Rave, who advised Valley National in Wayne, N.J., and

Most buyers are pension funds, mutual funds and other community banks, Rave said. Banks that issue subordinated debt are not required to disclose their buyers' identities.

Subordinated debt

This time around, loan demand has been a big reason for an increase in debt issues, as many banks try "to get their legal lending limits back up," said Lee Bradley, senior managing director at Community Capital Advisors in Duluth, Ga.

Net loans at banks with $10 billion or less in assets rose by 6.4% in the first quarter from a year earlier, to $2 trillion, according to data from the Federal Deposit Insurance Corp.

Other banks have issued subordinated debt to exit the Treasury Department's Small Business Lending Fund. Dividend payments on SBLF preferred stock

Banks are required to disclose their plans for the net proceeds of upcoming debt issues. In many instances this year, companies have said they plan to use the debt to facilitate potential acquisitions.

Peapack-Gladstone; the $1.7 billion-asset National Commerce in Birmingham, Ala.; and the $2 billion-asset

Bank M&A has

Several other factors could explain why certain banks are choosing to issue debt.

There are rumblings that regulators may want banks with high concentrations of commercial real estate to hold onto more capital, which subordinated debt can address, said Aaron James Deer, an analyst at Sandler O'Neill.

Low interest rates, meanwhile, are creating situations where holding companies can issue subordinated debt below their bank's cost of capital, said Joe Gladue, research director at Merion Capital Group. Smaller banks may have rushed to issue debt when there was a consensus that the Federal Reserve would raise interest rates, he added.

Though smaller banks are issuing more subordinated debt, overall activity has slowed compared with last year. That's because banks with more than $10 billion in assets have curbed their appetite for subordinated debt, with issuance down 21% from a year earlier.