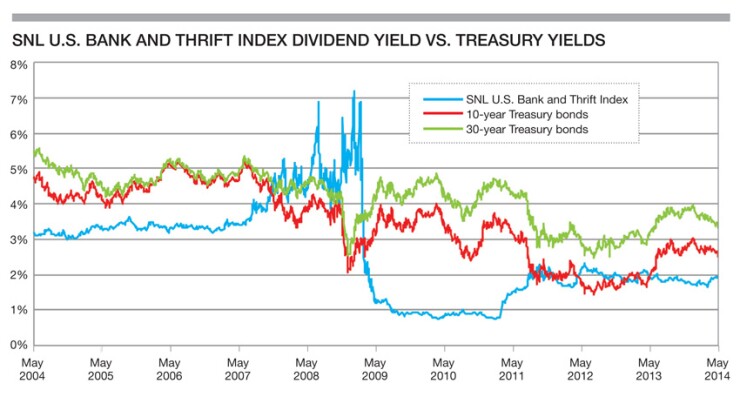

Though dividend yields in the banking sector aren't what they used to be before the economic crisis, the pall is long gone.

The dividend yield on the SNL U.S. Bank and Thrift Index has been hovering around 2% for about two and a half years, double what it had been in the wake of the crisis.

And, as the ranking of the 25 banks and thrifts with the highest dividend yields shows, some are paying two or three times the industry average. Generally they are smaller banks (18 of the top 25 are under $5 billion of assets) and based in the Northeast corner of the country (only four are from elsewhere).

"I think it's evidence of lesser regulatory scrutiny on the payout ratio of these smaller banks," Jefferson Harralson, the associate director of research at KBW, says of the size bias. Regulators are more conservative with institutions above $50 billion of assets.

Of the 25 largest institutions by asset size, only two show up in the group with the highest dividend yields New York Community Bancorp and People's United Financial. Both are under $50 billion of assets, though New York Community is getting close to that mark. And both are in the Northeast.

Collyn Gilbert, a KBW analyst who covers New York Community and People's, says the dividend is key for many investors in these companies. The same is true of Valley National Bancorp, another company she covers that is also in the ranking. "All three of them have made dividend payouts a big part of the strategy," she says. But especially for New York Community, "the question that's on everybody's mind is, 'Are they going to be forced to cut it at some point?'"

Gilbert says it makes sense that the Northeast dominates the ranking, as it is a low-growth region where banks tend to be highly capitalized. "I think the investor who looks at banks in this region probably likes the notion of the dividend," she says. "In Texas and on the West Coast, where you're seeing better growth prospects, you'd want to see the capital reinvested in the business."