-

PayPal, Amazon, Square and American Express have all built new businesses by extending credit to merchants that already rely on their payment networks. Their client relationships give them certain advantages over banks, marketplace lenders and others.

July 1 -

How the company marketed and enrolled customers into its PayPal Credit product has resulted in a $25 million enforcement action from the Consumer Financial Protection Bureau.

May 19 -

Google, Amazon, Apple, PayPal and Intuit have joined forces to promote policies they say will foster greater innovation in financial services.

November 3

Amazon, the retail juggernaut that

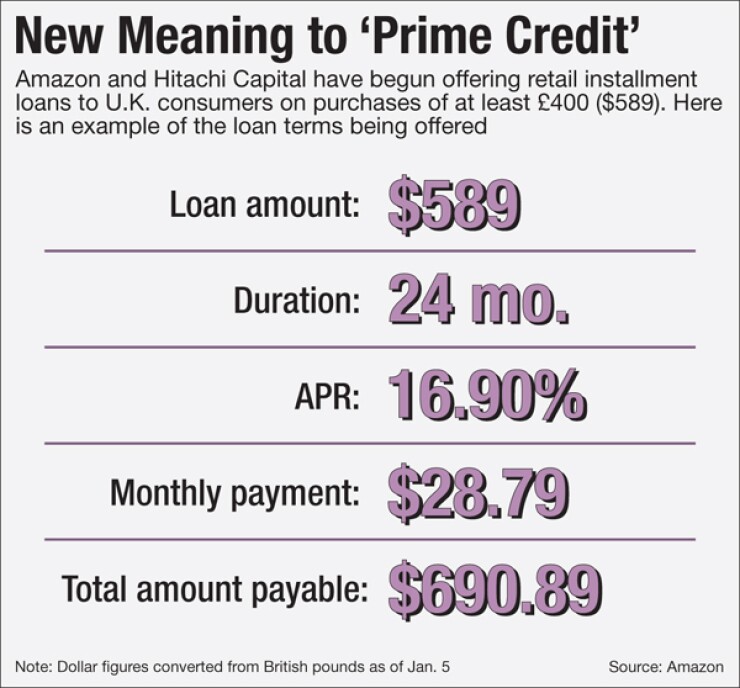

The company's U.K. arm recently started offering an installment loan product that shoppers can use to finance big-ticket purchases such as refrigerators and TVs.

In the short run, the move figures to threaten mainly the profits of British stores that offer financing plans on large appliances and other pricey wares. But analysts described Amazon's product launch as part of a larger, longer-term strategy by tech giants, including Apple, Facebook and Google, to pick away at lucrative businesses inside of banks.

"What's under attack is bank profit pools," said Dave Birch, a London-based payment consultant.

Seattle-based Amazon would not comment on whether it plans to start offering its new installment loan product on this side of the Atlantic. But several observers said they expect Amazon to roll out a U.S. version in the near future.

"Yes, very soon," Max Levchin, chief executive of Affirm, which offers a similar loan product through U.S. retailers, predicted in an email.

Amazon's U.K. loan product is available on customer orders of at least 400 British pounds, or about $590. The loan terms range from two to four years. Annual percentage rates are 16.9%.

Amazon is not bearing the risk that borrowers will fail to repay. Instead, the online retailer is partnering with Hitachi Capital, which has long offered installment loans at the cash register to U.K. shoppers who are making big purchases.

Financial terms of the deal were not disclosed. But given Amazon's massive customer base — its net sales globally totaled $25.4 billion in the third quarter — the company likely got a more favorable economic arrangement than a smaller retailer could negotiate.

Amazon is famous for its focus on customer experience, and particularly the ease with which shoppers can pay. So the success of the company's foray into the consumer-finance business is likely to hinge in large part on how painless it is for shoppers to apply and get approved for a loan.

"I'll be very curious to see how they implement it in a way that really conforms to what Amazon wants to do from a customer-experience standpoint," said Alex Johnson, an analyst at Mercator Advisory Group. "When you apply for credit, traditionally that's a long and friction-filled process."

Amazon and Hitachi Capital spent about 18 months working together to make the application process seamless, according to Theresa Lindsay, head of marketing at Hitachi Capital Consumer Finance.

"Everything is conducted within the same site. You're not fired off anywhere else. And it's all done incredibly quickly," she said.

When it comes to facilitating fast loan decisions, Amazon has a leg up over smaller retailers, due to its tech expertise and its vast reservoir of customer data. The e-commerce giant has also proven adept at persuading customers to use its preferred payment methods, such as the Amazon.com store card.

Those factors suggest that Amazon now poses a competitive threat to the big card-issuing banks that have traditionally dominated the unsecured consumer credit market. In some ways, Amazon's position today resembles Walmart's perch in the early 2000s, when bankers saw the Bentonville, Ark.-based retail giant as a major threat.

"I think there are many parallels to the Walmart controversy," said Jo Ann Barefoot, a consultant to consumer finance companies.

Unlike Walmart a decade ago, Amazon is not seeking a banking license. But it is showing a growing interest in financial services businesses. Since 2012, Amazon has been offering loans to small businesses that sell products through the site. The company

If Amazon decides to start offering consumer credit the U.S., it could face bigger regulatory challenges than it has encountered in the U.K.

"I think the U.K. is probably the easiest place to take initiatives today. The regulatory structure is simpler," Barefoot said.

In the U.S., Amazon could choose to partner with a bank. That is the approach taken by PayPal, which partners with Comenity Capital Bank to offer financing for online purchases through a product known as PayPal Credit.

But those sorts of arrangements are facing scrutiny from