First-time buyers have been returning as credit has eased slightly and rental rates have increased, boosting housing demand and helping lenders increase their volume.

But without sufficient new construction, the number of buyers will remain limited and prices will climb, straining in particular the first-time-homebuyer segment targeted by government programs.

"The supply from the builder perspective is just not back to normal," Fannie Mae Chief Economist Doug Duncan said. "It's up from last year, but it's still below what long-term demographics would suggest, particularly in the lower price points of housing."

-

Housing policy focused on government guarantees and the 30-year mortgage hasn't done much to help low- and middle-income homeowners build wealth.

February 5 -

More than 1 million homebuyers qualified for a mortgage in the third quarter, the first time since the financial crisis that lenders reached such a threshold, according to research by the Urban Institute.

February 3 -

Consumers' growing confidence about their ability to qualify for a mortgage is generating more foot traffic, sales orders and loan volume for some of the nation's largest homebuilders.

August 12

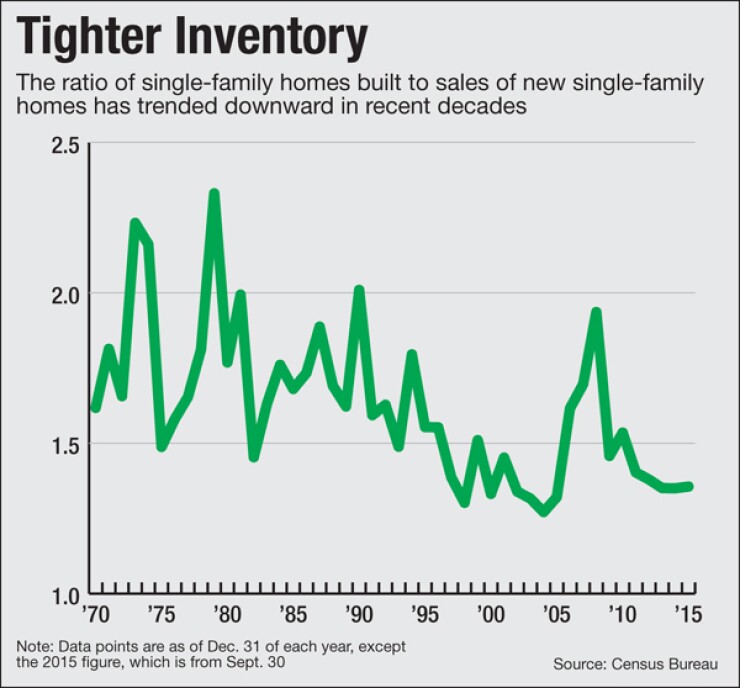

Today there are approximately 1.3 new single-family homes completed for every house sold, and while there has been some variation in this ratio over time, it has trended downward since 1970, when it was closer to 2. Access to existing housing stock also continues to be limited by extremely long foreclosure timelines and underwater properties in some areas.

"The demand side is picking up and if the supply side doesn't, you're going to see sustained home price appreciation. That is an affordability issue," Duncan said. "It's not a huge problem yet, but it's a growing problem."

This is a particular concern for lenders this year because forecasts are calling for fewer refinancings. That means there will be increased interest in financing home purchases. But with a supply-demand imbalance in housing, growth in this part of the market could be constrained.

"It won't prevent growth, but it means there potentially won't be as much entry-level housing built as the market could support," said Robert Curran, managing director and lead home-building debt analyst for Fitch Ratings.

Nobody has clear answers as to why supply has fallen short of the recent uptick in demand, but there are theories, Duncan said.

Builders are eager to supply units in the market, but Moody's Investors Service analysts found that since the last downturn home-construction companies have been more cautious about the potential for writedowns on excess land. Also Moody's research indicates that builder inventory continues to grow more slowly than expected because of construction-labor shortages that contribute to rising costs.

In addition, the regulatory costs tied to land acquisition and development have systematically risen.

"That's going to change the price point at which you can build a home and sell it profitably," Duncan said.

Right now those trends undermine the incentive that growing demand among first-time homebuyers would normally provide.

The percentage of new homes purchased by first-time buyers fell as low as 20% after the downturn, according to Moody's. More recently it has been in the 30% range, but was still below the historical average of 40%.

"We have seen more first-time homebuyers coming to the market," said Tiina Siilaberg, a vice president and senior analyst at Moody's.

Although first-time homebuyers often want lower-priced homes, builders tend to make more money per unit when they construct expensive ones. So some builders are continuing to focus on high-priced product at the risk of pricing themselves out of the growing lower end of the market.

The alternative is to build homes that are less costly to construct and can be sold at more affordable prices. However, these houses may be less attractive to consumers in other ways. Builders use cookie-cutter designs so the houses can be duplicated in bulk inexpensively, for example.

"These builders know their price points," said Brian Koss, executive vice president at the retail lender Mortgage Network. "They've got it down to a science. It's like manufacturing widgets."

Builders also consider regional differences that affect their finances in making decisions about how and whether to build first-time-buyer homes in a particular area. They might build more in markets that have longer commutes from business centers and cheaper land, or markets where a first-time buyer might have more income due to a strong regional economy.

Supply lags more in some areas than others, and the market is showing some signs of responding to the concern, if not to the degree it needs to. Although December's housing starts came in below expectations, one region (the Northeast) registered an increase and sales of new homes picked up during the month. Also the homeownership rate has risen for the first time in years.

The extent to which lenders can correct or offset a supply-demand imbalance will vary by company. Home loan professionals at commercial banks might have colleagues who could help by offering acquisition, development and construction loans to builders where it makes sense from a business and risk management perspective. There also may be opportunities for one-to-four-family financing within structures built to maximize land use.

"In most urban markets, you don't have a lot of raw land available," noted Ray Rodriguez, a regional sales manager for TD Bank. But there is still room to expand first-time-buyer and other one-to-four-family lending through originations to borrowers such as condominium buyers or purchases of two-to-four-family units where a consumer can make the purchase more affordable by renting part of it out, he said.

Lenders have to be careful about referrals involving builders given the Consumer Financial Protection Bureau's scrutiny of marketing services agreements, but they can avoid the concern by being sure those referrals are made without compensation.

Continuing builder consolidation could reduce referrals and construction financing, but the extent to which it does remains to be seen.

Typically only the smaller, private builders primarily rely on construction loans while most of the larger companies utilize other financing such as lines of credit and public debt. Also, larger builders are more likely to have in-house mortgage units to help finance consumer purchases of their homes, and these units tend to finance the majority of their customers.

But some builders shut down their in-house mortgage lending units because of growing regulation and compliance concerns after the downturn, so they are less common than they were before the crisis.

Currently, the top 10 publicly rated builders control approximately 30% of the market, according to Moody's.