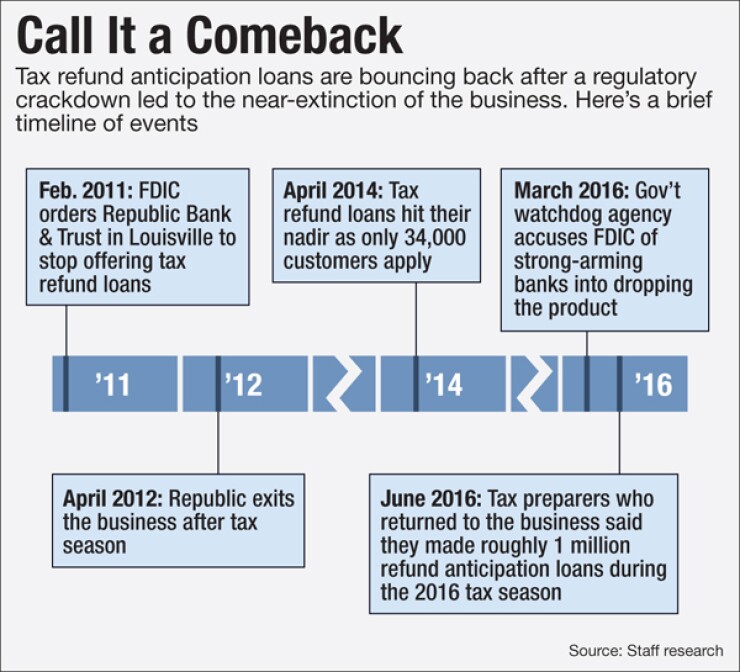

At the same time federal regulators are cracking down on payday loans, another form of short-term credit for low-income Americans is staging an unexpected comeback.

During the most recent tax season, roughly 1 million loans were made to consumers who were waiting to receive their refund checks, according to a new estimate from H&R Block. Just two years earlier, fewer than 35,000 U.S. taxpayers even

Today, several smaller banks have dipped their toes back into the water, including Republic Bank & Trust and River City Bank, both in Louisville, Ky., which offer the loans through tax-preparation firms. The renewed interest comes at a time when the tax-prep industry is rebranding the stigmatized loan product and marketing it as free to consumers. There are also signs of a regulatory thaw.

-

Under the new model, tax preparers must pay lenders for originating loans and are prohibited from passing costs on to borrowers. But consumer advocates argue that pricing of tax preparation services is so opaque that customers could be paying loan fees and not even know it.

February 8 -

The FDIC allegedly rigged exam reports, selectively leaked information to a competitor and hampered a firm's acquisition plans in order to force banks from offering refund anticipation loans.

March 15 -

The Consumer Financial Protection Bureau filed a lawsuit Tuesday against the owner of several tax-preparation outlets that allegedly steered low-income clients into expensive loans against their anticipated refunds.

April 14

The turnaround demonstrates the enduring demand for speedier access to tax refunds among consumers who live paycheck to paycheck.

"They don't qualify for normal credit. They don't have bank accounts. They don't qualify for normal credit cards," John Hewitt, chief executive of Liberty Tax Service, said Tuesday during the firm's quarterly earnings call.

Liberty, which has more than 4,300 locations in the United States and Canada, is among the tax-prep firms that offer fee-free loans to their customers. The company bills the loans as "refund advances," in order to distinguish them from the product's earlier incarnation.

Liberty's bank partners include Republic Bank, which charges the Virginia Beach, Va.-based tax-prep firm $35 for each approved loan.

"Tax preparation is one of the few services that do not provide meaningful price information to consumers," the National Consumer Law Center and the Consumer Federation of America

Following the 2012 tax season, the $4.2 billion-asset Republic Bank, a unit of Republic Bancorp, stopped offering refund anticipation loans, amid pressure by the Federal Deposit Insurance Corp. But the FDIC's methods have recently been questioned.

In March 2016, the FDIC inspector general's office

The re-emergence of the tax refund loan this year has benefited both Liberty Tax Service and Republic Bank.

Republic recorded $5.2 million in interest income from the product during the first quarter, while setting aside a $3.6 million estimated provision for losses on the loans. Liberty reported that its revenue grew by 7% during the 2016 fiscal year.

Even though Liberty and other tax-prep firms do not charge customers for refund anticipation loans, the product can be used to get them in the door and sell them other offerings. In addition, customers may receive the proceeds of their loan on a reloadable card, which can generate fees.

"Financial products revenue grew 22% to $45.3 million due to the company's new Refund Advance product as well as favorable pricing," Liberty said Tuesday in a press release.

H&R Block, which prepared about one in seven U.S. tax returns during fiscal year 2015, stopped offering refund anticipation loans after the 2010 tax season, and has yet to bring them back. But now the Kansas City, Mo.-based tax preparer is facing pressure to offer loans again, since its financial performance has been flagging.

H&R Block reported last week that its earnings from continuing operations fell by 21% to $384 million during the most recent fiscal year. The company's stock price has fallen from over $36 in November to below $24 in midday trading on Wednesday.

"Clearly this was a disappointing season on many fronts," CEO Bill Cobb said Thursday during the company's earnings call. "Next season will not feel the same."

Cobb said that during the most recent tax season, H&R Block lost 6% of clients who seek assistance with their returns. He attributed the decline in part to the revival of the refund anticipation loan at Liberty Tax Service, Jackson Hewitt and other independent competitors.

Analysts who cover H&R Block are now clamoring for the company to bring back the refund anticipation loan.

"Frankly, ever since the company stopped offering it a number of years back, its tax season performance has been inconsistent to poor," said Mark Palmer, an analyst at BTIG Partners.

"I believe that in order to stay competitive H&R Block has to offer this product next year," Gil Luria, managing director at Wedbush Securities, said in an email.

Meanwhile, consumer advocates are worried that H&R Block will re-enter the market.

"If they do determine that they can only get new market share by moving back into a model that uses loans first and prep second, then it's very concerning," Adam Rust, director of research at Reinvestment Partners, a community development group based in Durham, N.C, said in an email.

H&R Block previously owned its own bank, but sold it. Consequently, if the tax preparer chooses to offer refund anticipation loans again, it would need to partner with another institution.

While the market for refund anticipation loans remains far smaller than it was in the early 2000s, when JPMorgan Chase and HSBC offered the product, consumer demand could grow if the Consumer Financial Protection Bureau sharply curtails the availability of payday loans. Rust said that he does not believe that the CFPB's forthcoming payday lending regulations would affect refund anticipation lending.