Questions are multiplying about a key component of the Consumer Financial Protection Bureau's payday lending plan: the new credit-reporting system that would have to underlie it all.

The proposal would require payday lenders to submit credit information on their target market of subprime borrowers and to pull credit files when making loan decisions.

Yet in two months since the plan was issued it has not become any clearer where exactly the necessary data would be drawn from, and who would collect it and spit it back out as usable credit reports.

-

More than two dozen Democratic senators are calling on the Consumer Financial Protection Bureau to strengthen its payday lending proposal, arguing that it has loopholes that can be exploited by abusive lenders.

July 20 -

Reports from the big three credit bureaus do not include information about payday loans, but a CFPB proposal figures to shake up that arms-length relationship.

July 6 -

WASHINGTON Community banks and credit unions would be forced to stop making short-term, small dollar loans if the Consumer Financial Protection Bureau's payday lending proposal is adopted, two trade groups said Monday.

June 27

A new system would have to be created because the big three credit bureaus

That said, the CFPB plans would not mandate the creation of such information systems, nor does it plan to distribute requests for proposals or let out contracts for bid. Instead, it will rely on the private sector to develop it on its own, perhaps spurred on by the opportunity of a new source of profits.

That may be its fatal flaw, one lender said.

"They have thrown this thing up on the wall, but I don't think they have any certainty that anybody will even be able to provide this [credit-reporting service]," said Jamie Fulmer, a spokesman for Advance America, a payday lending firm in Spartanburg, S.C.

The CFPB believes that, if its proposed rule is finalized, "specialty consumer reporting agencies and state databases that already collect and report loan information" on the payday loan market "would be able to meet the bureau's registration criteria," said CFPB spokesman Sam Gilford, who noted that the proposal is still in the public-comment phase.

Why It's Difficult

Lenders would have to confirm a borrower's "ability to repay" before making a loan. To verify such information, lenders would rely on an "information system" as described in the CFPB's proposal that would act like a credit bureau.

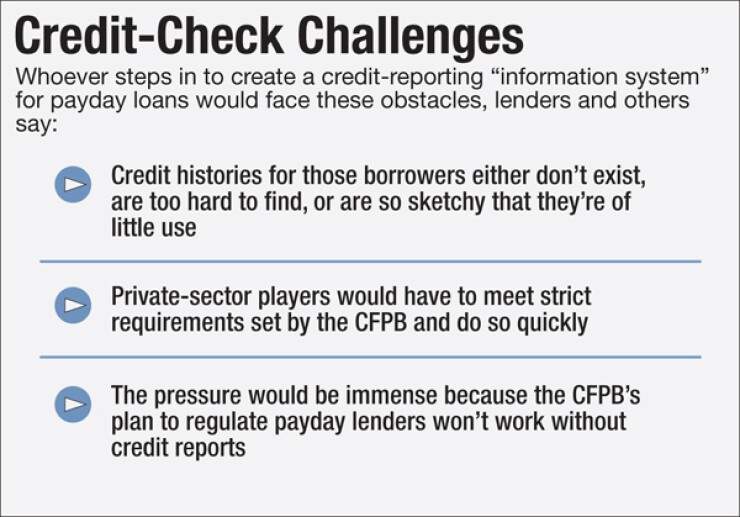

The payday lending industry's reaction boils down to three concerns:

- Credit histories for consumers who use payday, title and installment loans either are too threadbare to be usable, too scattered among public and private sources to be unified in a single location, or simply don't exist.

- It will be extraordinarily difficult, if not impossible, to build and implement the technology for these new credit bureaus from scratch to the CFPB's specifications.

- Without this network of new credit bureaus, the CFPB's plan to regulate payday, auto-title and installment lenders won't work.

"The credit history of subprime borrowers is made up of disparate information that exists in far-flung and isolated databases," said Charles Halloran, chief operating officer at the Community Financial Services Association of America, the trade group for payday lenders.

To implement the system nationwide "in the Rube Goldberg way that the CFPB wants, and on the CFPB's timeline, is going to be extremely difficult," Halloran said.

It wouldn't be "commercially viable" for any company to aggregate all of the various databases they would need to create one reliable source of credit histories for consumers who use payday loans, Halloran said. For example, landlord-tenant registries could be a potential source of data, but they are only one small piece of the puzzle.

"It's hard to think of one entity that knows your payday history and also your credit history and also your ability-to-repay components," Halloran said.

Most payday lenders already lack the technology and regulatory compliance sophistication of banks and collect little underwriting information on their customers. Requiring them to verify an applicant's debt and to file reports with a credit bureau is a tall order and may force many companies out of the business, said Craig Nazzaro, an attorney at Baker, Donelson, Bearman, Caldwell & Berkowitz who advises consumer lenders on compliance issues.

"Most of these products are small-dollar loans and this regulation will add significant time and money into the underwriting process," Nazzaro said. "It may simply become too expensive to comply with."

Who Would Do It?

The big credit bureaus could probably develop the system the CFPB wants if the investment seemed worthwhile to them, experts said.

But there's still no indication so far that Equifax, TransUnion and Experian are interested. Stuart Pratt, president of the Consumer Data Industry Association, which represents the big three, declined to comment for this article.

A smaller player is taking a long, hard look at trying to win the CFPB's blessing to become a so-called registered information system.

Veritec, a Jacksonville, Fla., maker of regulatory-compliance software, provides an electronic verification system to 14 of the 35 states that allow payday lending.

Veritec's product, which the CFPB cited as a model in its 1,300-page rule proposal, could be adapted to meet the CFPB's information system proposal, said Tommy Reinheimer, chief executive.

His rivals are less sure. What the CFPB has currently proposed is not feasible, said Tim Ranney, CEO at Clarity Services in Clearwater, Fla., a so-called "thin file" credit bureau that collects data on subprime consumers. The CFPB wants all payday and title lenders to file reports to six different credit bureaus within a limited period of time, he said.

"It's an insurmountable challenge as far as we're concerned," Ranney said. "Think of some of the smaller lenders that are one-store operations and run their business with a PC on the counter."

Clarity has developed a solution that it believes would help the CFPB meet its goal for an information system, Ranney said. Clarity's product would produce the equivalent of a "credit card hold" on a payday-loan application.

That would give the lender time to verify an application, typically days or weeks, depending on the lender's reporting cycle; and it would help prevent the problem of "loan stacking," in which a consumer obtains multiple payday loans in quick succession, without the lenders knowing of the other loans.

Clarity's technology, called a Temporary Account Record, in March

However, the CFPB has given no indication that it's interested in Clarity's product, Ranney said.

The CFPB did not comment on Clarity's proposal.

Lingering Worries

Even Veritec's leaders question whether the CFPB's concept is workable. That's because the work that goes into making a payday loan is fundamentally different than that for a residential mortgage, commercial line of credit or other typical bank loan.

"Folks are trying to put underwriting standards on a product that does not have underwriting," said Nathan Groff, chief government relations officer at Veritec.

"You physically cannot do a $100 payday loan with the same type of regulatory oversight and forced underwriting as a $200,000 mortgage," Groff said.

It's also going to be difficult to implement real-time data capture for payday loans, as the CFPB has stated in its proposal, Reinheimer said.

"Most credit reporting agencies do not currently have the capability to capture and report transaction-level events in real time," Reinheimer said.

Clarity Services and Veritec plan to submit comments to the CFPB. Reinheimer believes that the CFPB will need to adjust its proposal to the issues raised by the industry for the plan to work. The deadline for submitting comments is Oct. 7.