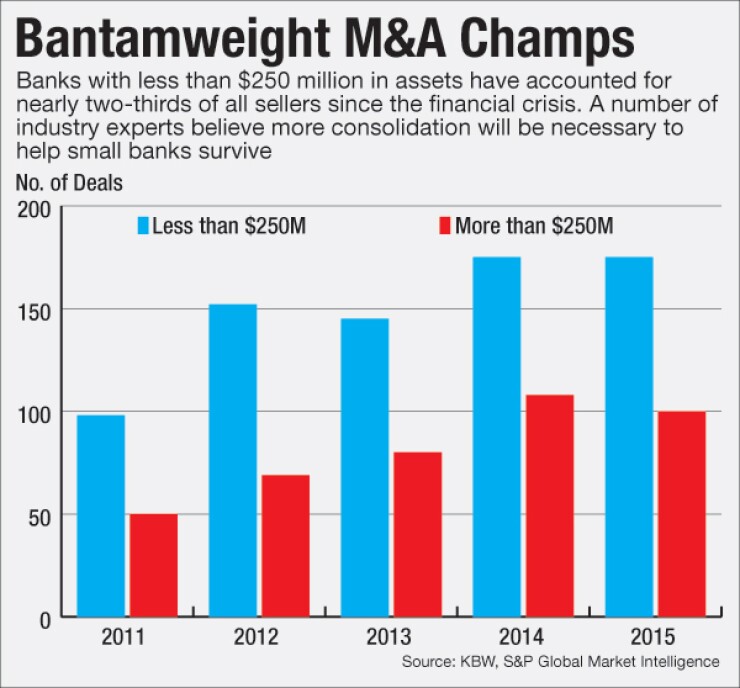

Industry consolidation is what will keep community banking viable in the face on persistent threats such as the economy, technology and regulation.

That's the view of Richard Hunt, president and chief executive of the Consumer Bankers Association. To be sure, Hunt isn't a cheerleader for a new wave of mergers; rather, he views consolidation as a necessary evil even as community banks get healthier.

"The small banks have been suffocated with regulation," Hunt said in an interview. "I'm not jumping up and down for consolidation. I'm just saying that's the reality of what's happened [given] the economy, regulation and technology."

-

The Consumer Financial Protection Bureau stepped up efforts Wednesday to encourage banks to offer simple checking and savings accounts, but many institutions said it is regulations and other factors that are preventing them from reaching the underbanked.

February 3 -

The Independent Community Bankers of America is taking issue with Wall Street's opinion that banks need scale to survive. The group has urged members to tune out "defeatist talk" about smaller banks.

April 9 -

KeyCorp believes it can surpass cost-cutting projections tied to its purchase of First Niagara Financial, while BB&T believes market duress could present it with more acquisition opportunities.

January 21

Hunt's attitude seems to contrast with past public comments from Camden Fine, president and chief executive of the Independent Community Bankers of America. In 2014,

Small banks aren't the only institutions likely to announce mergers. Hunt said he expects activity will especially pick up for banks with $10 billion to $100 billion of assets, pointing to the recent deal between

From a financial perspective, banks are in better shape than they were a decade ago. Still, any bank looking at acquisitions must make sure that they are fully in compliance with regulations before announcing a deal, Hunt said.

"Banking today is night-and-day different than in 2006," Hunt said. "Banks have better liquidity, are better capitalized and are stress tested to the nth degree. This is not your grandfather's bank."

Following is an edited transcript of the interview with Hunt.

How does M&A intersect with what you do at the Consumer Bankers Association?

RICHARD HUNT: We have been saying for some time there are three great disruptors in the marketplace today — the economy, the evolution of technology and the burdensome new regulatory environment. Any one of those would have a dramatic effect on banking, but to have all three happen simultaneously creates the perfect storm. We expect more [mergers] to continue throughout 2016 and years beyond.

Regulators must also adjust to into the 21st century. If they're still stuck in the mentality of yesteryear, then they may not have much left to regulate. We're now serving our customers in different ways than just looking at a person in the face at a branch.

What type of banks will be involved in acquisitions?

We found out with the

Is consolidation good for the industry?

With more than 6,000 banks, even if you lose 1,000 to 1,500 — the vast majority of those being community banks — you're still looking at 5,000 banks in this country. It's still competitive. I think the definition of competition will become greatly different. You don't have to have a branch in a hometown in order to be competitive because of the Internet.

How will those changes affect consumers and consumer credit?

It will help consumers because they will have a bank that has the necessary capabilities and technology to serve them. Not every bank has that capability today. But by combining forces and achieving the economies of scale, the technological platforms will be better.

Some larger banks that have announced deals have faced

Walmart recently closed 153 stores [in the United States.] Who would have thought Walmart would have done such a thing? Did Walmart need to go to the federal government to ask if they could shut down a store? They needed to do it for survival. I think it is a good thing that banks combine resources to better serve the consumer. If the consumer groups don't get in line there may not be much left to regulate. We have to be allowed to evolve.

How do acquisition-minded CEOs of big banks work with these groups?

First and foremost, you need to make sure you have a sound bank and you have taken the last five years to make sure you have your house in order, to make sure you are well capitalized, to make sure you only offer products that are fully disclosable and fair to the consumer. If you have done all of those items, the buyers that remain are the ones that the consumer activists will want to have around to serve the consumer for many decades to come. Many of these consumer groups are on the advisory boards of our banks. They are in constant dialogue, but the consumer groups need to understand that the environment has changed.

You don't seem opposed to consolidation.

I'd like each bank to be able to serve their shareholders and customers as is, but that's just not realistic. There used to be 15,000 banks in this country. Now we're at more than 6,000. I'm not jumping up and down for consolidation. I'm just saying that's the reality given what's happened with the economy, regulation and technology. Dodd-Frank is part of the reason for consolidation, but not the only reason. Even without it you would have seen consolidation, but maybe not at this rapid of a pace.