Bryan Jordan is willing to do something most Americans aren’t — wager that Washington will get its work done.

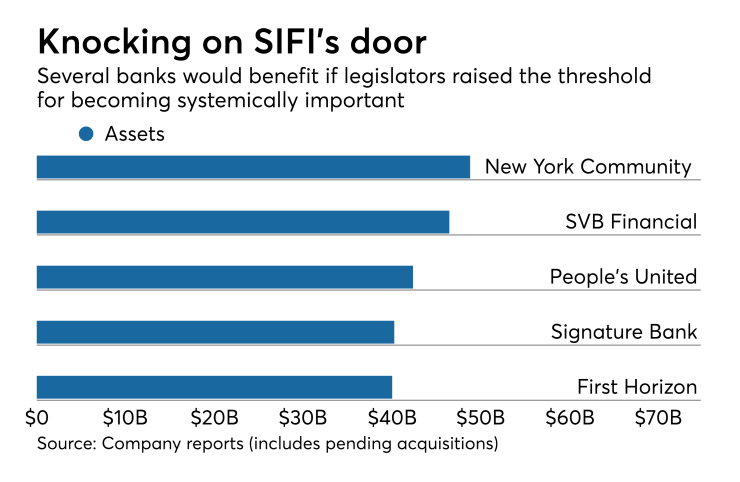

The agreement that his company, First Horizon National in Memphis, Tenn., announced Thursday to buy Capital Bank Financial in Charlotte, N.C., would push it much closer to $50 billion of assets — the point at which banks become systemically important financial institutions under federal law and regulatory oversight ramps up.

Jordan acknowledged that in the past he has downplayed M&A speculation involving First Horizon because SIFI-related compliance costs were too much of a disincentive, but he said new signals from Washington have convinced him that banks such as his will get a break.

“I still remain optimistic that we will see some legislative relief on the bright line as outlined in Dodd-Frank,” Jordan said during a conference call to discuss

And he indicated that potential solutions do not rely completely on congressional action.

“From a practical perspective the Federal Reserve, the [Office of the Comptroller of the Currency] and other primary regulators have started to indicate some differentiation around that bright line,” distinguishing between companies that are slight above $50 billion and “those that are significantly above,” Jordan said.

The conversation highlights how much certain provisions of Dodd-Frank have affected the bank M&A market, driving deals in some cases and deterring them in others. It is also another example of how confident many bankers are that President Trump will be able to enact change, whether it involves lower taxes or regulatory tweaks that bring relief to small and midsize banks.

Still, First Horizon would have some fallback room if Jordan’s political reads prove wrong. Adding Capital Bank would only get the combined company to $40 billion in assets. That leaves plenty of room for organic growth under the status quo and probably would not present a major issue unless the company lined up another big acquisition.

“We’re comfortably back from that line today,” Jordan said. “We don’t want to cross it unnecessarily.”

Meanwhile, management has been building up infrastructure in risk management, stress testing and other areas, Jordan said, to make SIFI-related costs “more incremental” if the threshold stays in place and First Horizon crosses it some day.

First Horizon is eager to take advantage of the scale it would have by buying Capital Bank and entering new markets. Adding South Florida, where Capital has 30 branches and $1.6 billion in deposits, would be a big win for First Horizon.

Moreover, the deal should help it achieve several key financial targets — 15% return on equity, a return on assets of at least 1.1% and an efficiency ratio in the low 60s.

“We think we have the ability to hit those targets in 2019 or pretty soon after that,” Jordan said in an interview. Higher interest rates and an ability to put capital to work by boosting lending at Capital Bank will help further those goals.

There are several risks Jordan and his team must navigate around in the next five years as First Horizon looks to earn back the deal’s projected 9.5% dilution to tangible book value. That number certainly got the attention of analysts and investors; First Horizon’s shares fell 2.6% in midafternoon trading.

“The five-year earnback is on the higher end of what we view as the acceptable range,” said Brady Gailey, an analyst at Keefe, Bruyette & Woods. “We like the strategic move. It is great to see these two companies get together. It’s just really the price paid that I think is causing the market to sell First Horizon stock today.”

The long earnback period is “notable,” John Pancari, an analyst at Evercore, wrote in a note to clients, adding that based on some calculations it could take up to eight years to earn back the dilution to tangible book value.

In many ways, the company must rely heavily on Capital Bank’s management and top-performing loan officers. North Carolina, which is home to roughly half of Capital’s deposits, is in a state of flux given rapid consolidation among its biggest community banks.

Gene Taylor, Capital Bank’s chairman and CEO, has agreed to become First Horizon’s vice chairman. Taylor characterized his retention as more than just an obligatory move to ensure a smooth transition.

“We actively recruited talent with a message that they could be part of a growth company,” Taylor said in an interview. “I believe there’s still a growth story here that can benefit from being part of a bigger organization.”

Taylor also weighed in on consolidation in North Carolina, saying that many other sellers had larger concentrations of commercial real estate than Capital Bank. A bigger focus on commercial-and-industrial lending should give First Horizon opportunities to expand lending relationships with Capital’s existing clients, providing a financial incentive for its lenders to stay put.

Jordan, Taylor and other leaders will be visiting with those lenders in coming months as a show of support. Taylor said First Horizon also provides asset-based lending capabilities, something that many of Capital Bank’s lenders had spent years been clamoring for.

“We view people as our most important asset,” Jordan said. “One of the most important things on our agenda is engaging on an effort to retain the Capital Bank folks who are essential to us.”

First Horizon has little experience integrating whole-bank deals. It has only completed one since 2005 — buying TrustAtlantic Financial in 2015 — and none of its deals have been anywhere close to the size of Capital Bank.

Jordan acknowledged those facts but quickly noted that he has recruited a number of executives who have handled big integrations elsewhere, including Chief Risk Officer Yousef Valine, who was part of the blockbuster 2001 merger of First Union and Wachovia.

Jordan said he started to consider Capital Bank as a serious target when it bought Green Bankshares in Greeneville, Tenn., in late 2011. "It just took us time to get to it," he said.

Taylor and Chief Financial Officer Chris Marshall, both former Bank of America executives, also have integration experience. Capital Bank has bought five whole banks, including CommunityOne Bancorp last year.

“I have a lot of faith First Horizon will do a good job” with integration, Gailey said. “I think First Horizon’s ability to retain talent … is going to be a big piece of this deal. I’m sure they will do that.”

First Horizon plans to cut about 30% of Capital Bank’s expenses, including the closure of about 26 overlapping branches.

“We will start in the next several weeks planning the integration,” Jordan said. “It will be a slow, methodical process. We will measure twice and cut once.”

Other bankers are proving that highly dilutive deals can be worthwhile.

KeyCorp CEO Beth Mooney, for instance, has largely assuaged early critics of her purchase of First Niagara Financial Group. The Cleveland company recently

“We think the numbers provided are very reasonable … and I think there’s upside in the deal that we didn’t model in,” Jordan said. “Then again, whether its 1% or 9.5% dilution, it means nothing if you don’t perform.”

First Horizon will also focus most of its efforts over the next three years on integrating Capital Bank, though Jordan said management will eventually take a look at a glaring gap — Atlanta.

“There will be an opportunity to look at that down the road,” he said.

Allison Prang contributed to this article.