JPMorgan Chase plans to add branches in nine new markets this year while continuing its expansion into cities it first entered in 2018.

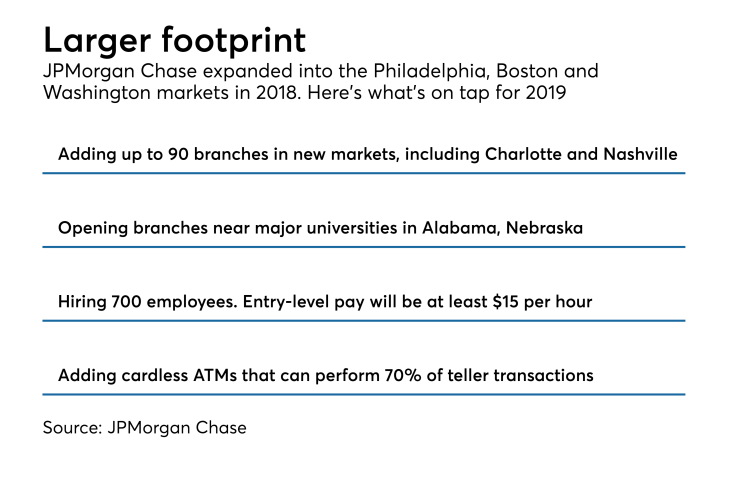

The nation's largest bank said Wednesday that it intends to open as many as 90 branches in new markets, including Charlotte, N.C., Nashville and St. Louis.

It also said it will add "dozens" of locations in the Philadelphia, Boston and Greater Washington, D.C., markets. The company opened six branches in and around Washington last year and one each in Philadelphia and Boston, according to Federal Deposit Insurance Corp. data.

The moves are part of a broader expansion, announced early last year, in which the company plans to

JPMorgan, with $2.6 trillion of assets, is using its heft to add new retail locations, even as many other banks are shrinking their branch networks. It aims to accelerate deposit-gathering, expand sales of other products and services and gain approval to

“This expansion marks a major milestone for our firm by allowing us to serve more customers, small businesses and communities across the country,” Thasunda Duckett, CEO of Chase Consumer Banking, said in a news release.

The bank will hire up to 700 employees to staff the new locations opening this year. In all it plans to hire up to 3,000 workers in new markets over the next five years.

JPMorgan is also expanding aggressively now because it had been

The other major markets where the bank will add branches in 2019 are Raleigh, N.C., Greenville, S.C., Kansas City, Kan., Minneapolis, Pittsburgh and Providence, R.I.

JPMorgan will also open branches in Alabama and Nebraska, both new states, in locations near major universities. It plans to expand more broadly in those states in 2020.

JPMorgan has received approval from state regulators in all of the new states where it will open branches, a company spokeswoman said. The new branches will be located in a combination of newly built offices and leased offices that have already been constructed.

About 30% of the total new branches that JPMorgan will open in the next five years will be located in low-to-moderate income communities.

The new branches will be a mix of full-service facilities that can handle the needs of both individuals and small businesses; and smaller branches that rely more heavily on technology to provide basic transactional services.

Some branches will also include space for group sessions, called Chase Chats, to provide advice on financial health. Capital One has

JPMorgan will begin opening the new branches this summer. Entry-level workers at these new branches will earn between $15 and $16.50 per hour, plus benefits.