- Ohio

Kevin Kabat told the board of Fifth Third Bancorp that he intends to step down as CEO in November. Kabat, who had led the Cincinnati company since 2007, will remain executive vice chairman through next April.

July 8 -

Fifth Third Bancorp in Cincinnati will close or sell about 100 branches=, or about 7% of its total branch network.

June 22 -

A new Fifth Third social media campaign offers recent college graduates free one-on-one career counseling. The initiative is part of a trend of banks allocating marketing dollars to unusual perks and charitable giving to differentiate their brands.

June 16 -

First Niagara Financial (FNFG) in Buffalo, N.Y., didn't have to look far to find its next president and chief executive, even though the search process lasted nine months.

December 19 -

More banks are deciding to invest millions in mobile banking, video tellers and core-processing upgrades after avoiding capital spending for a long time. They says it's a good move for the long term, but some will take heat from investors and other critics in the short run.

March 26

The road to the corner office now goes through the server room.

Greg Carmichael,

Though Carmichael is hardly just an IT executive anymore he has led all Fifth Third's business lines for the past nine years as chief operating officer it is a career path that shows the greater importance banks are placing on tech and on their tech talent.

The choice "shows us what's important for the banking industry," said David Darst, an analyst with Guggenheim Securities. "You may not see many more CIOs becoming CEOs, but you're going to see more CIOs engaged in strategy in the C-suite."

Others have blazed the trail for Carmichael. First Niagara Financial Group in Buffalo, N.Y., picked Gary Crosby an executive who entered banking via the tech sector as its CEO in 2013. And a few years earlier, Grayson Hall took the reins of Regions Financial in Birmingham, Ala., after a decade as the head of its tech operations and a stint running its banking group.

Analysts saw Carmichael as a likely pick to eventually succeed Kevin Kabat, who has led the Cincinnati, Ohio, company since 2007.

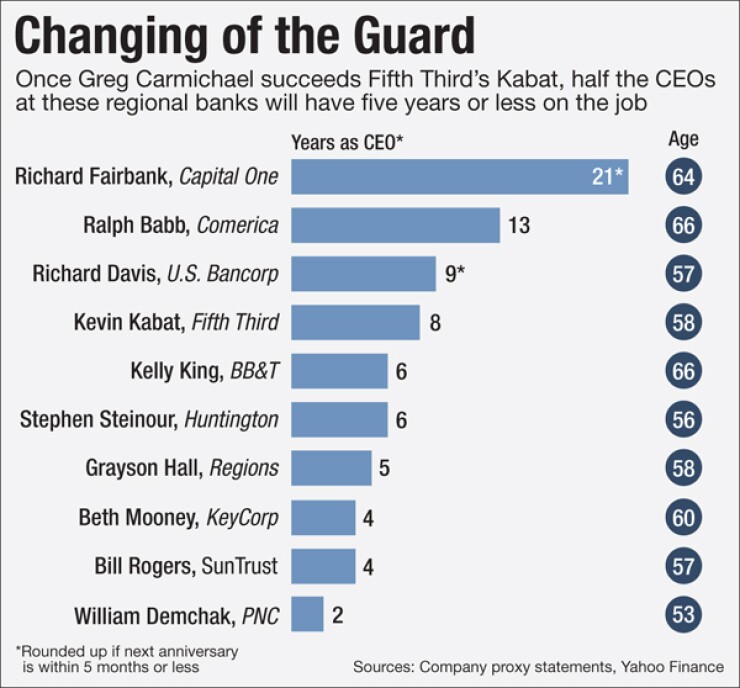

But the timing of the announcement caused some surprise. Kabat, just 58, will retire as CEO in November and remain executive vice chairman until April.

Fifth Third declined requests to interview Carmichael and Kabat on Wednesday.

Kabat's somewhat early retirement could suggest that he and the board decided the time was right for a jolt, as Fifth Third slowly shifts from survival to growth mode, said Marty Mosby, an analyst with Vining Sparks.

"They don't need to clean up or solve capital or liquidity problems what they're trying do is restart the revenue-growth machine," Mosby said.

Kabat is given high marks for steering Fifth Third through the financial crisis and recession, but the company's financial performance has recently been somewhat lackluster a reflection more of the challenges facing regional banks than Kabat's performance, analysts say.

"Anybody who was CEO during the crisis and is still standing did his job," said Paul Miller, an analyst with FBR Capital Markets.

Kabat, a veteran of more than 30 years with Fifth Third, "was very decisive in the crisis," said Scott Siefers, an analyst at Sandler O'Neill. The bank agreed to sell its Vantiv payments unit, which provided a capital buffer but left the company with fewer growth levers when the smoke cleared. And a lower stock price left Fifth Third without a strong currency to make acquisitions, which had been a means for growth before the crisis.

The bank's return on tangible common equity last year was a solid 12.1%. However, its share price has dipped more than 4% over the past year, against a 5.7% increase in the KBW Nasdaq Bank Index.

The most significant barrier to growth for Fifth Third, like other regional banks, is tight margins, said Miller.

"The economics aren't there" for many regionals, he said. "They need a steeper yield curve."

But part of the problem for Fifth Third is that it is less asset-sensitive than other regional banks, and so it stands to reap less benefit from an interest rate increase, Mosby said. Knowing that they will not be completely bailed out by a rate hike may have spurred the bank's leadership to make a change earlier rather than later, he said.

Fifth Third "has always been a company that's invested in technology," Darst said.

Carmichael, who joined Fifth Third in 2003 and added the president title in 2012, has been leading so much of the bank already that he is unlikely to change direction too dramatically as CEO. Analysts expect him to continue to focus, at least at first, on earnings growth through cost cuts, as when Fifth Third announced last month

Having a tech-savvy CEO makes sense for a bank like Fifth Third that is trying to change its retail model away from branches and toward online banking, said Siefers. It also ties in with the increasing importance of IT systems and back-office operations coming from regulators' focus on internal controls.

It may be that the traditional path to the top positions at banks working up through finance or lending operations is shifting, and there may be more promotions of tech talent to top roles, observers said. It is a change that reflects banks' new priorities, even if it may surprise some old-timers.

"We're seeing more CEOs with techie backgrounds because the banks have realized that, to survive and be profitable, they will need more efficiencies," said Rod Taylor, president of the executive search firm Taylor & Co. "The day of the techie CEO is upon us."

Paul Davis contributed to this story.