When Sue Rexford opens a small-business banking account for her new venture - Bodhi Tree Therapeutic Massage - she will be looking for a financial institution that can provide two things: convenience and low fees. "Those are the key factors," says Rexford, a licensed massage therapist who opened Bodhi Tree in South Orange, N.J., in September.

As a small-business owner, Rexford's concerns are pretty typical. Industry experts and analysts say that branch proximity and attractive account rates and fees are among the top concerns cited by small-business owners looking to open new bank accounts.

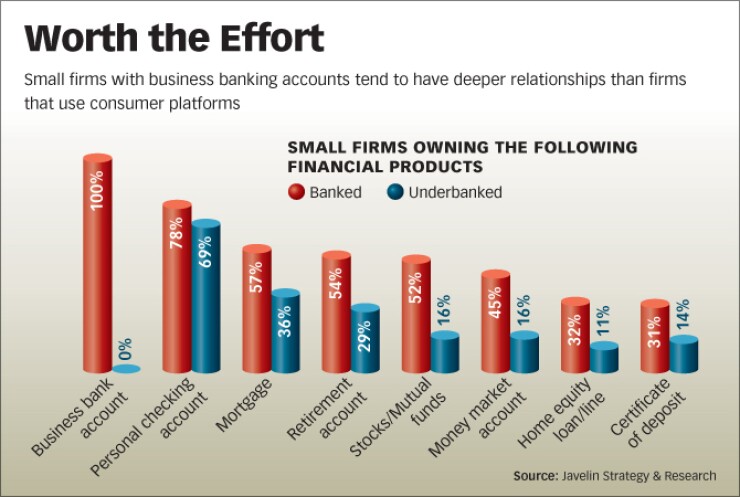

But Rexford is atypical for a self-employed entrepreneur in planning to open a business banking account at all. Among the nearly 26 million small firms in the United States, about two-thirds don't have business-bank accounts, according to a Javelin Strategy & Research report released last year.

The bulk of these firms tend to be "overlooked and underserved" by most banks, according to the report examining the underbanked business segment.

Small companies usually "hide in the consumer banking platforms," according to Javelin, a Pleasanton, Calif.-based consulting firm. That means they pay lower account maintenance fees now, but likely won't get specialized services they'll need as they grow, including payroll/invoice management, remote deposit capture, corporate cards and specialized commercial lending.

"Banks need to refine their strategies so that they are recognizing this market and helping small businesses," says Mary Monahan, a managing partner and research director of Javelin.

By successfully marketing to and serving this untapped banking segment, she adds, financial institutions can generate more revenue, while helping these firms better compete in their markets.

Bank of America Corp. is using social networking to reach out to underbanked small businesses. The Charlotte banking company sponsors a Web site called "Small Business Online Community" which it launched in October 2007 as a free forum where small business owners can network and find services from a base of established users, regardless of whether they are bank customers.

"We felt like it was important that small business owners feel like they have opportunities to collaborate with each other and don't feel like they're being sold stuff," says John Durrant, senior vice president of small business banking at the company.

The site, which currently has over 50,000 registered users, contacts posters "only if they request it," according to Durrant.

A recent post from "samuelsr," which asked if it's possible to display tweets on his firm's Web site through Twitter, received four responses within about a month. Another from "snccigars" titled "Opening a Cigar Store...any ideas!" generated more traffic - 21 replies in about three months.

The site also offers free online Web seminars as well as articles ranging from advice on how to update a business plan to whether a startup should use cash or credit for the bulk of its own purchasing.

When it comes to more traditional banking products, BofA started offering small business customers its "Business Fundamentals" package in late 2008, which Durrant says includes a standard business demand deposit account that's free if the owner also uses a debit card at least once a month. "Business Fundamentals was one way we decided to go after encouraging customers to move from a check-based payment system to online," he adds. (The package also offers free 24/7 business online banking services.)

Pushing small business into more debit and credit-card transactions is also a smart move, according recent research by Aite Group LLC.

"Small businesses have long fallen into a middle ground between retail and commercial banking," says Judson Murchie, analyst with the Boston consulting firm and author of a report issued in late November focusing on the growth opportunities in the small-business credit card marketplace.

"While small businesses often mimic the personal banking habits of their owners, much of their payment behavior reflects their nature as a business, resulting in high check volumes," he says. The increasing conversion of small business check use to other payment vehicles is one of several reasons small business credit cards are primed for growth, according to Murchie.

For example, if small business credit card spending increased from its current 4 percent market share to 14 percent, Aite Group estimates that interchange revenues from small business credit card usage would increase more than 300 percent, to over $10 billion a year.

Of the nearly $5 trillion small businesses spend as a segment annually, only about 4 percent of that amount is charged on a small business credit card, according to the Aite Group report, "Small Business Credit Cards: An Opportunity for All."

Capital One Financial Corp., already well-known as a consumer credit card powerhouse, sees opportunity in the underbanked small business marketplace. "I think there is a mass-market, small business segment," says Bob Kottler, executive vice president of Capital One Small Business, on firms with under five employees and $250,000 in annual revenues.

In an effort to encourage these firms to open small business accounts, the McClean Va.-company in May began allowing customers to combine their business checking account and credit card rewards with those earned on their personal Capital One accounts.

He notes Capital One also has found it's important to offer streamlined online banking to the mass-market end of small businesses that resemble the company's consumer offerings. "We offer a very similar online banking experience both for their personal business and their small business," he said. "Then as they grow and need more sophisticated products, we'll migrate them up to a place where they can get that."

Kottler says the reason underbanked small business owners may hide in the consumer banking platforms is that they are afraid that they'll get lost in a big bank's business banking division.

"It's fascinating to me the amount of marketing we need to do to convince our small business customers that they're important to us," he says.

Other banks appear to have noticed the same. TD Bank has doubled its advertising targeting small-business owners in the last year, says Jay DesMarteau, the bank's small business sales and distribution strategy manager. He declined to reveal any specific ad spending figures, but did say that the bank currently has between 30,000 to 40,000 small firms using its free BusinessDirect online banking services and expects that number to double in the next 12 months.

TD also provides incentives to employees who route customers into business accounts and offers a dedicated relationship manager to every small business customer.

"The need really has to be there," says DesMarteau. "The small business is going to need those services and the only thing you can do is make them aware of that."