-

A consortium of financial companies said premiums are rising despite a relatively low level of overall risk, causing some banks to reconsider their policies.

April 5 -

Treasury assistant secretary for economic policy Ben Harris, one of Joe Biden's top economic aides, has left the administration after years of advising the president.

April 5 -

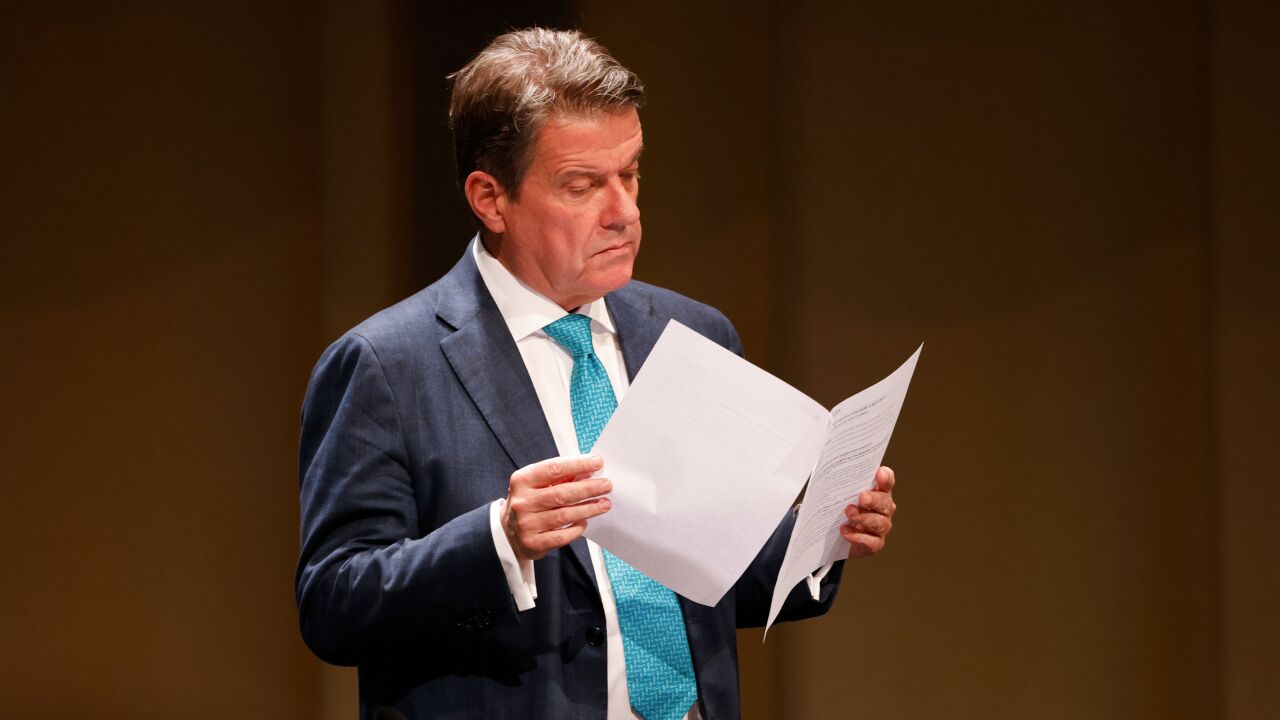

Despite shareholder worries, UBS Chairman Kelleher expresses confidence in navigating the challenges of integrating Credit Suisse at the at the company's annual general meeting of shareholders in Basel, Switzerland.

April 5 -

Users of the stablecoin Tether were able to access the U.S. banking system via the Signet payments platform, which was operated by failed Signature Bank.

April 5 -

Rising vacancy levels, soaring interest rates and weaknesses exposed by recent bank failures have analysts and investors worried about banks' outsized exposure to high-rise office, apartment and retail properties.

April 5 -

Stripe said growth in payments volume slowed last year after a pandemic surge, even as it helped more large business clients handle payments over the internet.

April 5 -

PhonePe backs away from a buy now/pay later acquisition, Germany fines EY for Wirecard scandal, and more.

April 5 -

Despite numerous changes to the Consumer Financial Protection Bureau's final rule on Section 1071 of the Dodd-Frank Act, lenders worry that expenses associated with reporting small-business lending data will cause smaller institutions to end their underwriting programs.

April 5 -

The cost and scope of data sharing were among bankers' top complaints, while fintechs would like fewer restrictions, a report by the Consumer Financial Protection Bureau found.

April 5 -

The fintech founder was also Square's first chief technology officer and the chief product officer of blockchain-based payments company MobileCoin.

April 5