-

The Paycheck Protection Program and encouraging digital innovation are top priorities for James Edwards, CEO of United Bank in Georgia. He also expects the American Bankers Association to promote diversity and regulatory reform in the next year.

October 26 -

Both the Federal Deposit Insurance Corp. and the American Bankers Association are encouraging the industry to offer basic products that could bring more unbanked households into the financial mainstream.

October 19 -

Gary Cohn, former head of the Trump administration’s National Economic Council and onetime top executive at Goldman Sachs, says technological changes will continue to make it harder for smaller financial institutions to compete and force many to be sold.

October 19 -

Various trade organizations sent letters to a House Financial Services Committee task force saying lawmakers should "actively discharge their oversight prerogatives" as the national bank regulator considers giving licenses to companies that do not accept deposits.

September 30 -

Various trade organizations sent letters to a House Financial Services Committee task force saying lawmakers should "actively discharge their oversight prerogatives" as the national bank regulator considers giving licenses to companies that do not accept deposits.

September 29 -

Banks and other financial firms say the proposal to reverse restrictions on investment advisers does not go far enough. Meanwhile, investor advocates say it would loosen necessary protections.

August 12 -

The agency sought feedback on potential changes to the Equal Credit Opportunity Act. But a coalition of industry and advocacy groups want a longer comment period to afford “a greater opportunity for thoughtful public participation.”

August 10 -

A site run by Keith Leggett, a former American Bankers Association senior economist, was frequently critical of credit unions and called for parity among federal regulators.

August 3 -

The regulator approved a proposal that mirrors a rule banking regulators implemented in February 2019 to cushion the Current Expected Credit Losses standard's impact on capital levels.

July 30 -

Acting Comptroller of the Currency Brian Brooks said the agency plans to issue new assessment procedures within weeks as a follow-up to recent Community Reinvestment Act reforms. He also touched on the “true lender” issue and why the agency is considering a narrow-purpose payments charter.

July 30 -

In the same manner as its previous plans for a fintech charter, the Office of the Comptroller of Currency is getting some pushback from banking trade groups on its idea to establish a payments charter.

July 29 -

Seven trade groups said they would fight any effort by the agency to establish a tailored license for payments providers such as PayPal, Stripe and Square.

July 29 -

The National Credit Union Administration will also discuss the current expected credit losses standard, which trade groups have argued that the industry should be exempt from.

July 27 -

Financial institutions want to protect customers and employees from the coronavirus but are caught in the middle of a politically charged public health debate. The stance taken by the industry’s largest trade group gives them cover.

July 23 -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 9 Sound Financial

Sound Financial -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 8 Sound Financial

Sound Financial -

In a letter to Director Mark Calabria, 17 organizations requested an additional 60 days to weigh in on the proposal meant to strengthen Fannie Mae and Freddie Mac's balance sheets post-conservatorship.

July 1 -

Credit unions won the day as the Supreme Court rejected an appeal that would have limited consumers' access to financial services. Now Congress must act to remove those field-of-membership restrictions entirely.

June 30 America's Credit Unions

America's Credit Unions -

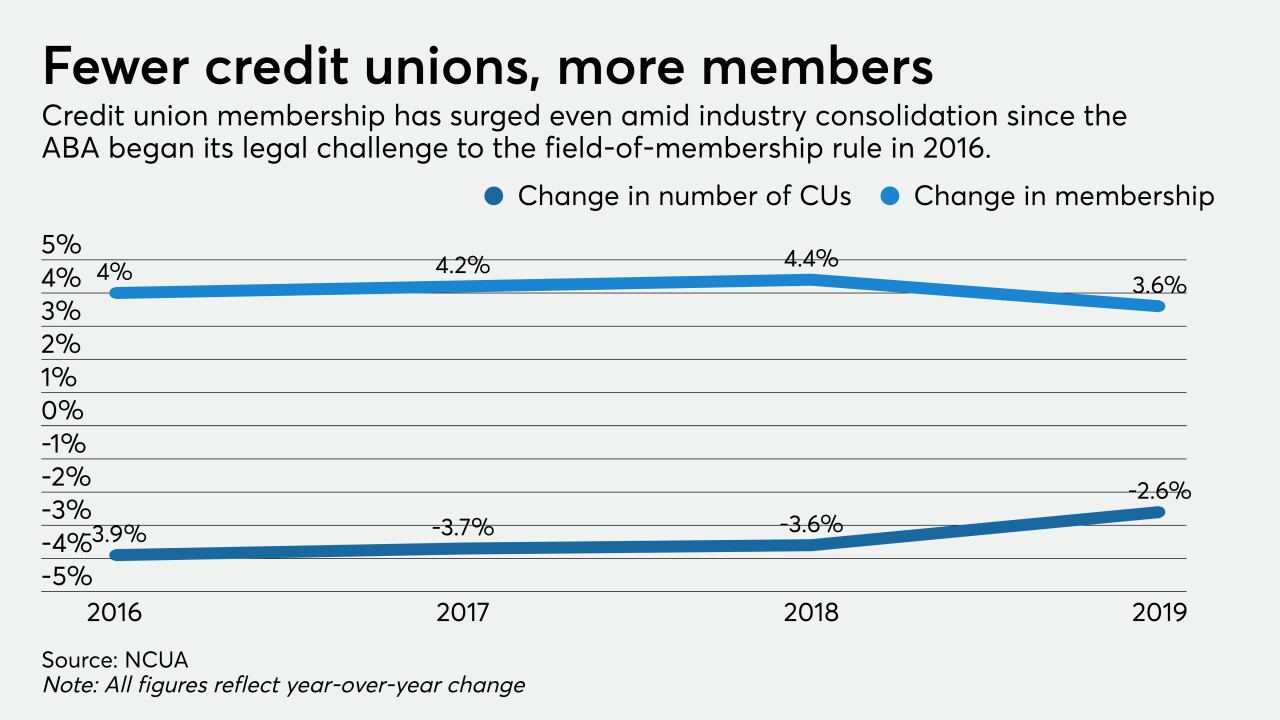

The industry claimed victory over banks as the Supreme Court elected not to hear a challenge to a controversial 2016 rule, but the landscape has shifted dramatically since NCUA approved the measure.

June 30 -

The Supreme Court ruled the Consumer Financial Protection Bureau's leadership structure is unconstitutional and refused to hear a lawsuit over the NCUA's field of membership rule. Credit unions are watching to see what happens now.

June 29