Aaron Passman is editor of Credit Union Journal, the nation’s leading credit union news resource. He was appointed editor in 2018 after two years as an assistant editor at CUJ and nearly five years as a reporter there. He has worked as a staff writer or freelancer for a variety of publications across the country and is a graduate of the University of Kansas.

-

Industry giving is likely to decline in the wake of the pandemic, but it could force the movement to update its giving platforms.

May 7 -

TruStone Financial and Firefly Credit Union have announced plans to merge, pending regulatory approval and charter changes.

May 5 -

The $468 million-asset institution said expansion isn't required now but the move is a proactive attempt to ensure its long-term viability.

May 4 -

Credit unions moved quickly to reduce branch access as the coronavirus crisis worsened. The harder decision will be when and how to begin lifting those restrictions.

May 4 -

The integration of Habersham Federal Credit Union into HALLCO Community Credit Union is expected to take several months.

May 1 -

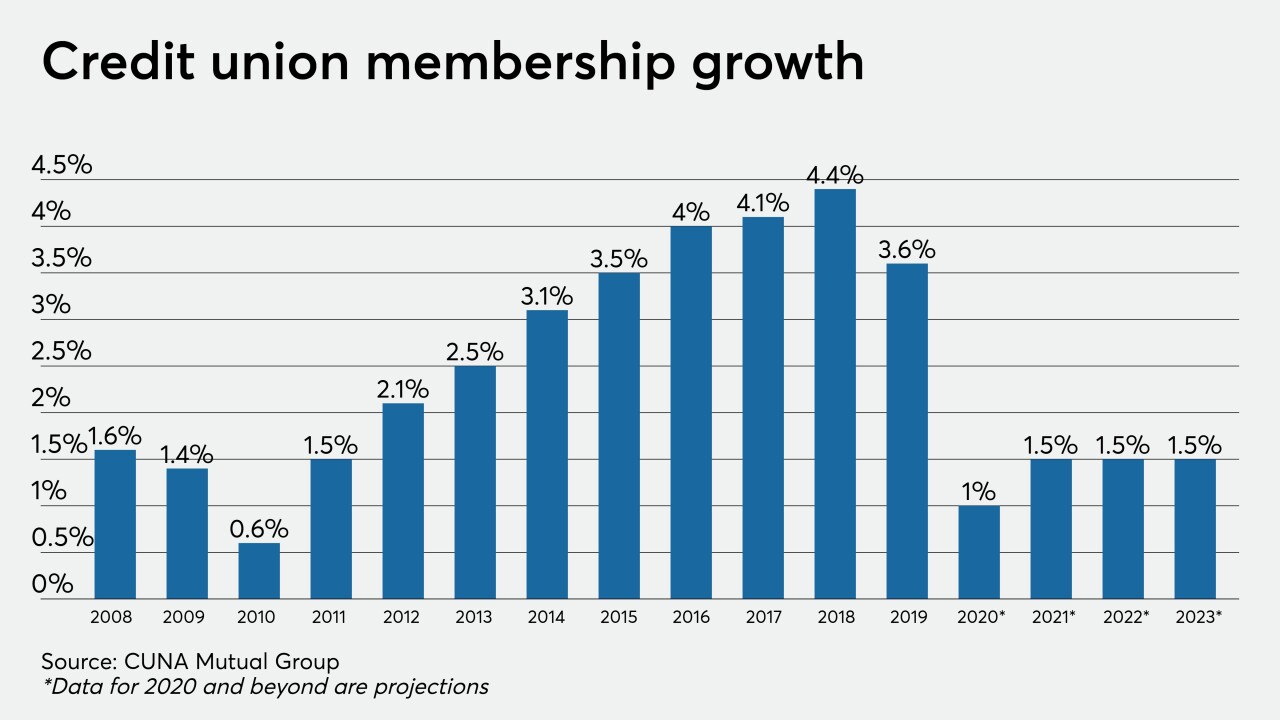

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

N.W. Iowa CU has agreed to merge into Siouxland FCU, citing rising technology costs and an increasingly complex compliance environment.

April 29 -

The credit union regulator is making $125,000 in funding available for small, low-income lenders designated as minority depository institutions.

April 28 -

Plans to update agency branding and other materials are on hold as the credit union regulator focuses on its response to the coronavirus.

April 24 -

Bank trade groups from all 50 states have called on Congress not to lift restrictions on member business lending under the guise of aiding with coronavirus relief efforts.

April 23 -

The value of serving a specific employer or a limited field of membership has diminished over the years. COVID-19 is just the latest crisis that shows how dangerous this concentration can be.

April 23 -

The credit union regulator created its Office of Ethics Counsel after two high-profile incidents tarnished the agency's reputation.

April 22 -

Major national and international summer shows were all canceled within 24 hours of one another, and many smaller state-level events have already been called off or postponed.

April 21 -

Congress won’t be back to Washington for at least two weeks but credit unions already have a laundry list of requests for lawmakers to consider.

April 20 -

This is the first time since 2014 that the regulator won't penalize credit unions that file within 30 days of the deadline.

April 20 -

State and federal trade associations are calling on lawmakers to move past an impasse after the Paycheck Protection Program ran out of money in just two weeks.

April 17 -

Despite limiting branch access and embracing social distancing, member-facing employees at some institutions have contracted COVID-19, and those few could be the tip of the iceberg.

April 17 -

The National Credit Union Administration is giving lenders and borrowers extra time to complete appraisals to ensure mortgages are still being completed despite the pandemic.

April 16 -

Legislation announced Wednesday would allow credit unions to make coronavirus relief loans to businesses without fear of bumping up against the member business lending cap.

April 16 -

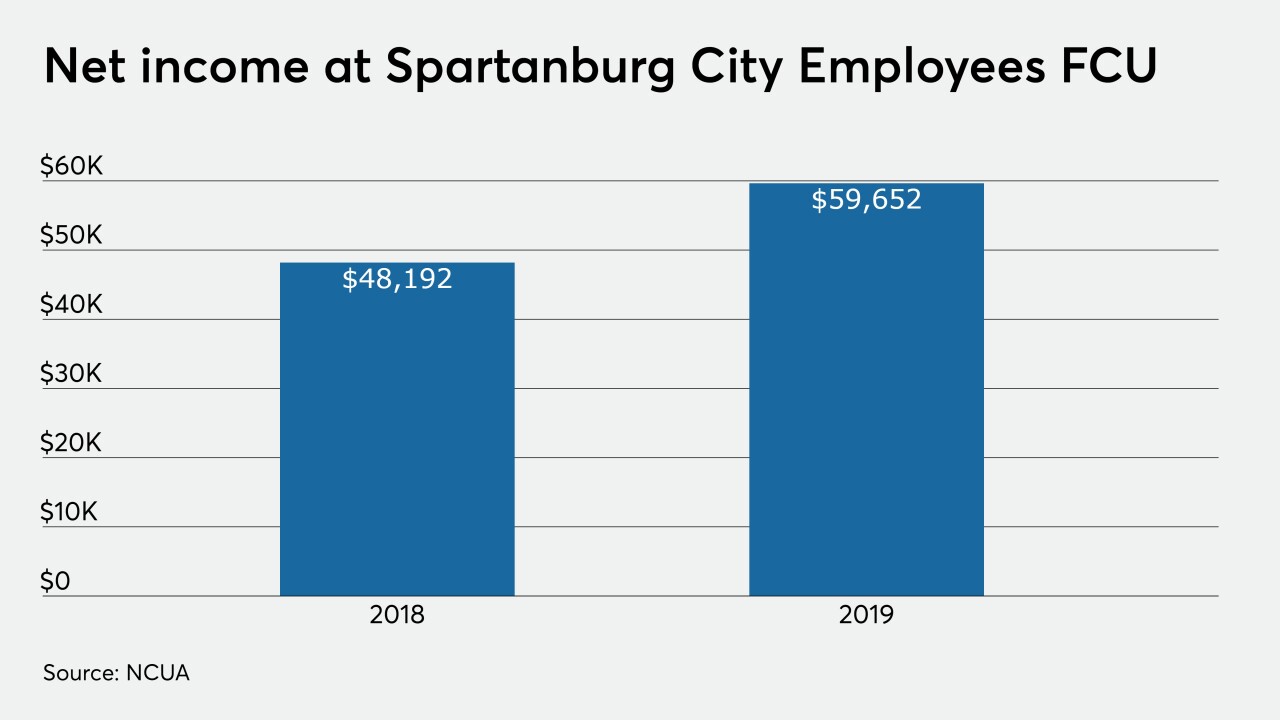

The $1.8 billion-asset institution will likely absorb Spartanburg City Employees FCU later this year, following a vote of that CU's members next month.

April 15