Brendan Pedersen covered Capitol Hill and regulatory politics for American Banker until September 2022. From 2019-2021, he covered the Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency as well as fintech policy. Originally from Chicagoland, he was previously a staff writer for Kiplinger's Personal Finance and covered local business affairs in Denver, Colorado for BusinessDen.

-

Net income significantly recovered compared with a year earlier, totaling $70.4 billion. But the average net interest margin fell to another record low as lending remained sluggish, the FDIC said in its quarterly update.

September 8 -

The agency’s enforcement action against Better Future Forward says the nonprofit’s income-share agreements — an alternative education finance product — must follow the Truth in Lending Act just like other forms of student loans.

September 7 -

The Federal Deposit Insurance Corp. is soliciting feedback on banks' experiences with remote exams during the pandemic. Some welcome the review as a step toward a more modern examination system, while others contend the last year and a half exposed the drawbacks of long-distance oversight.

August 31 - AB - Policy & Regulation

Regulators and the Biden administration are considering how to respond to the sharp growth in digital assets pegged to fiat currency. Their options include establishing rules like those for bank deposits and having the Federal Reserve issue a digital dollar that competes with private-sector stablecoins.

August 26 -

The agency signaled during the Trump administration that it would approve more industrial loan companies following an extended freeze in new charters due to policy disputes. But the thaw will likely prove temporary now that the board's makeup has changed.

August 18 -

Nearly eight months of the Biden administration have gone by without a word from the White House on a nominee to lead the Office of the Comptroller of the Currency. Here are some of the candidates who have been in (and in some cases fallen out of) the running.

August 16 -

Financial Services Superintendent Linda Lacewell said she will step down Aug. 24, the same day Gov. Andrew Cuomo plans to leave following a sexual harassment investigation. The state’s attorney general found that Lacewell helped with the governor’s public relations response to the allegations.

August 13 -

The agency asked bankers to reflect on their experience with virtual monitoring over the past year amid speculation that the pandemic could speed a full conversion to off-site supervision.

August 13 -

The Boston-based cryptocurrency firm says it would welcome the tough oversight that comes with being a bank. Yet Biden-era regulators have shown apprehension about granting approvals to digital-asset firms.

August 10 -

The San Francisco company says it will "modify and strengthen" its filings with the Federal Deposit Insurance Corp. and Utah officials and "resubmit at a later date." It's the latest fintech to encounter such a setback, though some later secured approval.

August 6 -

The agreement between the state’s financial regulator and Meratas will subject the company to heightened regulation after years of criticism that income-share agreements have escaped scrutiny.

August 5 -

Sen. Patrick Toomey, the top Republican on the Banking Committee, criticized acting Comptroller of the Currency Michael Hsu and others in the Biden administration for advancing “social goals that are unrelated to banking.”

August 3 -

The Office of the Comptroller of the Currency’s pledge to rescind Trump-era Community Reinvestment Act reforms and work with other regulators suggests that an interagency agreement is within reach. But outstanding issues remain, particularly around the treatment of online banking activities.

July 30 -

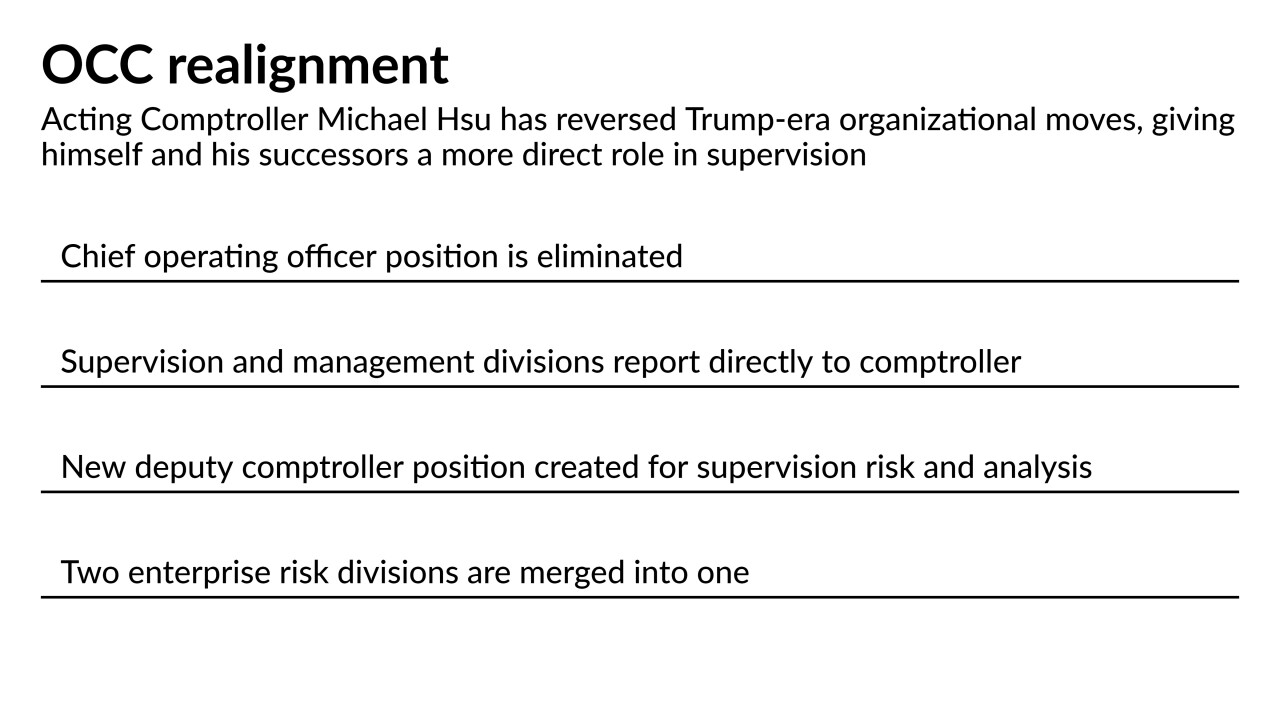

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

The Office of the Comptroller of the Currency confirmed it will rescind an unpopular rule overhauling the Community Reinvestment Act and joined other agencies in calling for a renewed interagency effort.

July 20 -

Sens. Sherrod Brown and Elizabeth Warren criticized Federal Reserve Chair Jerome Powell over reg relief policies instituted by the central bank, signaling that some progressive lawmakers may be reluctant to give him a second term.

July 15 -

Native American reservations have some of the country's highest concentrations of unbanked households. But tribes are finding ways to get their members access to capital — with or without banks.

July 14 - AB - Policy & Regulation

As the Federal Reserve mulls whether to establish its own digital currency, Chair Jerome Powell told lawmakers that cryptocurrencies designed to have the stability of bank deposits and money market funds should be regulated accordingly.

July 14 -

For the first time, the FDIC, Federal Reserve and OCC have combined efforts to advise banks on risk management procedures when working with nonbank partners.

July 13 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12