Brendan Pedersen covered Capitol Hill and regulatory politics for American Banker until September 2022. From 2019-2021, he covered the Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency as well as fintech policy. Originally from Chicagoland, he was previously a staff writer for Kiplinger's Personal Finance and covered local business affairs in Denver, Colorado for BusinessDen.

-

The agreement between the state’s financial regulator and Meratas will subject the company to heightened regulation after years of criticism that income-share agreements have escaped scrutiny.

August 5 -

Sen. Patrick Toomey, the top Republican on the Banking Committee, criticized acting Comptroller of the Currency Michael Hsu and others in the Biden administration for advancing “social goals that are unrelated to banking.”

August 3 -

The Office of the Comptroller of the Currency’s pledge to rescind Trump-era Community Reinvestment Act reforms and work with other regulators suggests that an interagency agreement is within reach. But outstanding issues remain, particularly around the treatment of online banking activities.

July 30 -

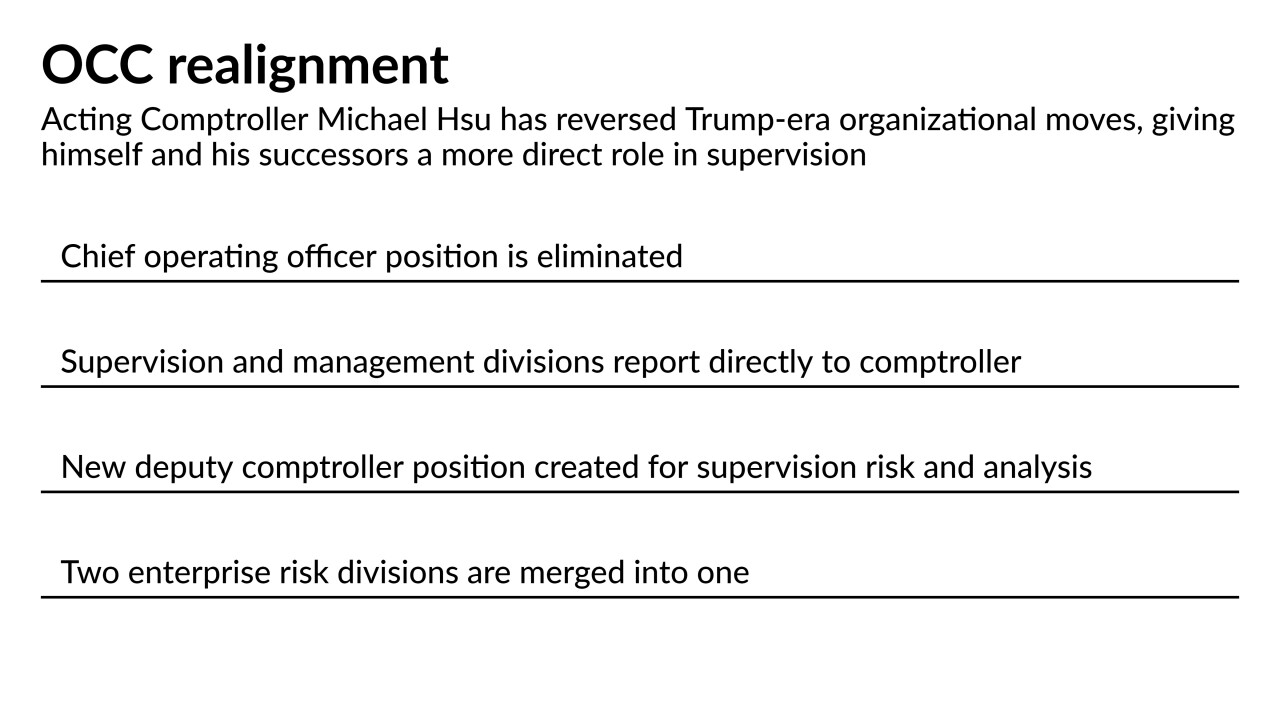

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

The Office of the Comptroller of the Currency confirmed it will rescind an unpopular rule overhauling the Community Reinvestment Act and joined other agencies in calling for a renewed interagency effort.

July 20 -

Sens. Sherrod Brown and Elizabeth Warren criticized Federal Reserve Chair Jerome Powell over reg relief policies instituted by the central bank, signaling that some progressive lawmakers may be reluctant to give him a second term.

July 15 -

Native American reservations have some of the country's highest concentrations of unbanked households. But tribes are finding ways to get their members access to capital — with or without banks.

July 14 - AB - Policy & Regulation

As the Federal Reserve mulls whether to establish its own digital currency, Chair Jerome Powell told lawmakers that cryptocurrencies designed to have the stability of bank deposits and money market funds should be regulated accordingly.

July 14 -

For the first time, the FDIC, Federal Reserve and OCC have combined efforts to advise banks on risk management procedures when working with nonbank partners.

July 13 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12 -

The White House is calling on the Department of Justice and federal regulators to give bank deals more scrutiny as part of a broader executive order meant to encourage competition across the U.S. economy.

By Jon PriorJuly 9 -

The chief operating officer now oversees numerous divisions at the Office of the Comptroller of the Currency. But as part of a reorganization, the COO’s position is being eliminated and several units will come under the direct authority of the comptroller.

July 6 -

A congressional resolution that invalidates the regulation issued last fall by the Office of the Comptroller of the Currency would help regulators crack down on so-called rent-a-bank schemes that promote predatory lending, the president said before signing the measure.

July 1 -

The House voted on Thursday to dismantle a Trump-era rule that sought to make it easier for national banks to make and sell loans through fintech partnerships.

June 24 -

A state regulator group has agreed to pause its lawsuit challenging Figure Technologies’ application as the federal agency reviews chartering policies. But analysts caution that the underlying conflict over nontraditional firms seeking banking powers is far from resolved.

June 18 -

The appointments of former senior leaders from a rival regulator could force the Office of the Comptroller of the Currency to embrace interagency cooperation after taking a go-it-alone approach during the Trump administration, some observers say. Others worry about another extreme: the Federal Reserve having outsize influence over financial policy.

June 11 -

State regulators had notched a victory in 2019 when a judge sided with the New York State Department of Financial Services in a case challenging the Office of the Comptroller of the Currency's charter. But an appeals court panel overturned that decision.

June 3 -

The acting comptroller of the currency, appointed by the Biden administration, signaled that the regulation meant to provide legal clarity about the secondary market is safe for the time being.

June 2 -

Acting Comptroller of the Currency Michael Hsu faces a host of “pressing issues” from fintech charter decisions to reforming the Community Reinvestment Act. But in contrast to predecessors, he suggests some decisions should be left to a Senate-confirmed head of the agency.

June 2 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

By Hannah LangMay 28