Brendan Pedersen covered Capitol Hill and regulatory politics for American Banker until September 2022. From 2019-2021, he covered the Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency as well as fintech policy. Originally from Chicagoland, he was previously a staff writer for Kiplinger's Personal Finance and covered local business affairs in Denver, Colorado for BusinessDen.

-

The agencies issued a rule to better enable banks to participate in two of the Federal Reserve’s lending facilities and “support the flow of credit to households and businesses.”

May 5 -

The Conference of State Bank Supervisors says parts of the plan are an overreach, while the agency should think twice about developing the proposal during the coronavirus pandemic.

May 5 -

The joint statement on the risks of cloud computing summarizes years of guidance and rules as industry reliance on third-party platforms has become more ubiquitous.

May 1 -

Federal regulators are now conducting nearly all supervision off-site as a result of the pandemic. The temporary measures are stoking a debate about whether they should be permanent.

May 1 -

In separate letters to Congress, the Fed asked for legislative action to ease Tier 1 capital minimums while the FDIC said it may use its own authority to address the market strain on banks.

April 30 -

The billionaire investor and entrepreneur sees problems with small businesses having to apply for loans to get coronavirus relief. He says a more efficient approach would be to let them run negative balances on their bank accounts.

April 26 -

In a rare show of unity, banking industry and consumer advocacy groups told congressional leaders that it is not too late to ensure individuals can access all of their coronavirus relief funds promised by the government.

April 21 -

The plan first announced in February to update the deposit insurance sign and logo at bank teller stations and ATMs became just the latest regulatory effort slowed by the coronavirus pandemic.

April 16 -

In some cases, financial institutions are required by court order to divert funds to private creditors. But the industry has added its voice to a consensus for a legislative update to ensure Americans receive their full amount.

April 16 -

Midsize businesses and state and local governments are among the beneficiaries of the central bank's latest $2 trillion effort to mitigate the economic damage caused by the coronavirus pandemic.

By Hannah LangApril 9 -

Lenders and community groups say it's a mistake for the banking agencies to move forward during a national crisis. But Comptroller of the Currency Joseph Otting says updated Community Reinvestment Act rules would speed relief to neighborhoods and small businesses.

April 8 -

First State Bank, which the FDIC sold to MVB Financial, had struggled with profitability and capital levels for several years.

April 3 -

The agency proposed changes in December to how customer relationships affect the definition of brokered funds, which has big implications for banks that are not well capitalized.

April 3 -

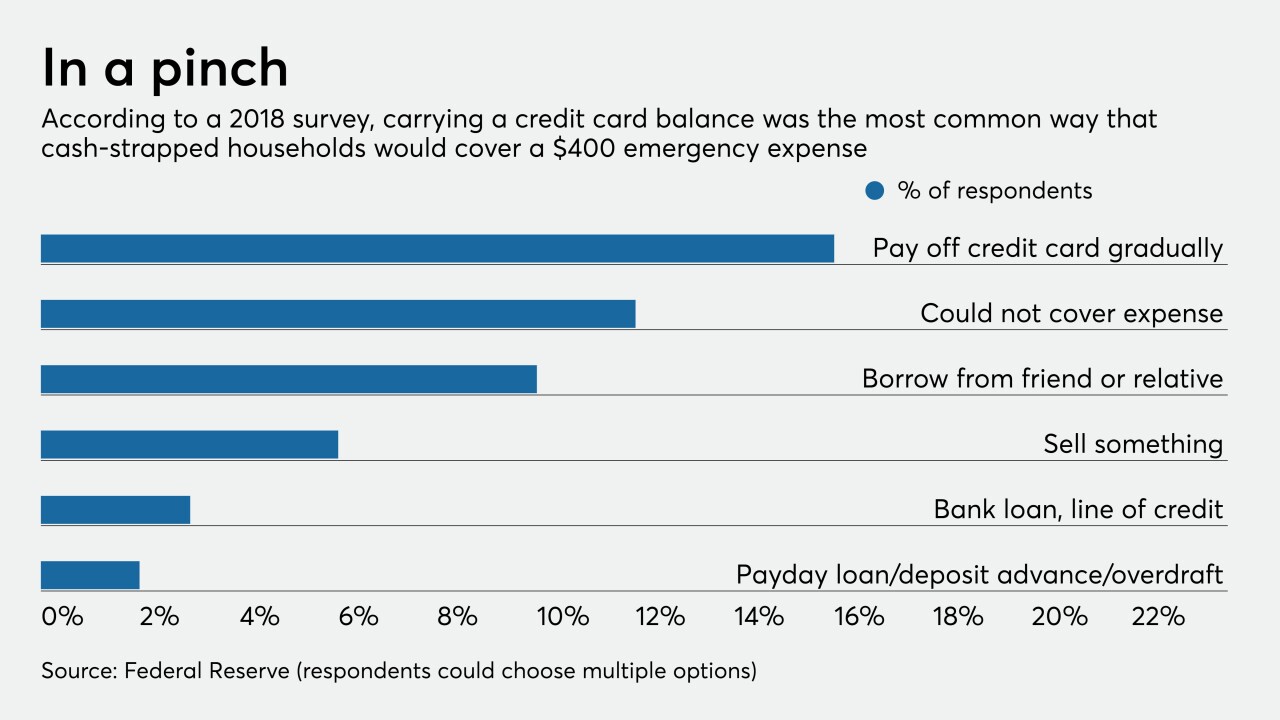

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

March 31 -

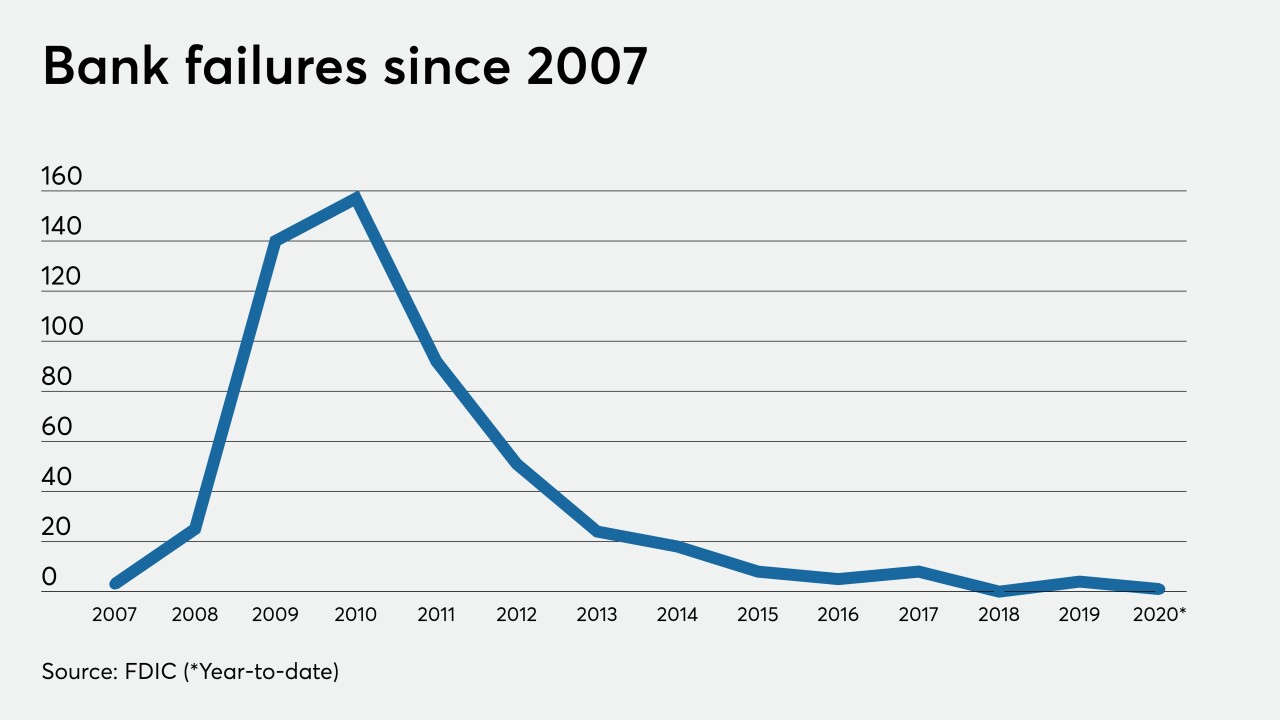

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

While analysts agree banks are in better shape than in 2008, lawmakers are dusting off a crisis-era tool used by the Federal Deposit Insurance Corp. to soothe potential liquidity fears during the coronavirus pandemic.

March 25 -

The company's plan had drawn strong criticism from bankers about Rakuten's potentially controlling an industrial loan company while engaging in its nonfinancial businesses.

March 23

![“The way [Congress] went with PPP—it turned into a traditional banking application with all the concerns that banks are going to have about dealing with credit,” the investor and entrepreneur Mark Cuban said on a recent podcast.](https://arizent.brightspotcdn.com/dims4/default/eea2c8d/2147483647/strip/true/crop/3998x2249+0+209/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F15%2Ffe%2Fc6dd9ac34092a967d8d72626f923%2Fcuban-mark-bl-042420.jpg)