-

Former Wells Fargo customer Shahriar Jabbari filed a lawsuit against the bank Wednesday accusing it of violating the Fair Credit Reporting Act.

May 14 -

The bank's most recent ATM update offers something novel: customers can redeem their credit card rewards for cash or deposit them in other accounts at its 12,500 ATMs.

February 9 -

Wells Fargo, a longtime laggard in the ultracompetitive credit card market, has been developing two new credit cards with partner American Express. Executive Brent Vallat also explains how a new bankwide rewards program could help its credit card growth.

March 21 -

Aggressive sales and performance goals could be a case of Big Data Gone Wild.

January 7 -

New fees from big banks are raising the questions of whether they will lead to an exodus of customers or if the cost of moving institutions is just too high. American Banker's Kevin Wack set out to answer that question by switching banks himself.

October 25 -

More than one-quarter of customers buy a banking product from their primary bank's competitors. Can banks use mobile technology to sell more effectively and stem the tide?

December 24

Wells Fargo's aggressive sales culture is more than a potential target for regulators — it also puts the bank at risk for large-scale customer defections, says a new study of consumer attitudes at the 10 largest banks.

The study's overall results raise concerns for a number of banks, which are taking pronounced steps in an era of thin margins — like heavy cost cuts and emphasis on fee-generating businesses — that customers say annoy them. But the Wells findings command attention because many of its rivals are trying to replicate its cross-selling success even as its practices have drawn increased public scrutiny of late.

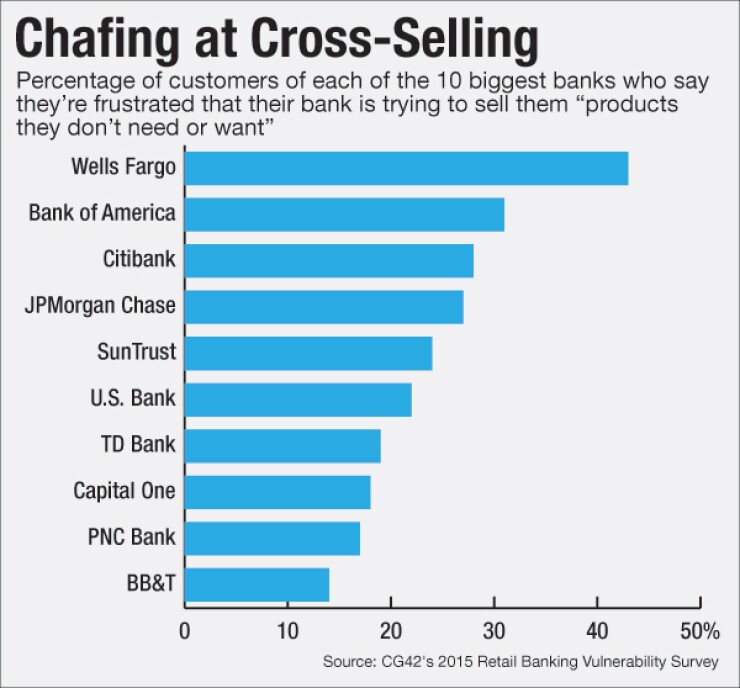

Of the 10 banks Wells has the highest percentage of retail customers who report being frustrated by their bank's excessive sales pressure, according to the 2015 Retail Banking Vulnerability Study from the management consultancy CG42.

Forty-three percent of Wells Fargo customers polled said they are frustrated with "trying to be sold on products I don't need or want," according to the study, which was released Tuesday. The average for the other nine banks was 24%.

A Wells Fargo spokeswoman said she cannot comment on the CG42 study because she has not seen it, but said the bank's "culture is focused on the best interests of its customers and creating a supportive, caring and ethical environment for our team members," including "training, audits and processes that work together to support our vision and values and our commitment to customers receiving only the products and services they need and will benefit from."

High-pressure sales tactics have been Wells Fargo's "signature frustration" in the three studies CG42 has conducted, the first two in 2011 and 2013, said Stephen Beck, managing partner with the consultancy.

"Their sales culture is well-known, and customers are frustrated by it. They don't like it," he said.

There are signs that regulators do not like it, either. The Office of the Comptroller of the Currency and the Federal Reserve Bank of San Francisco are investigating whether Wells' push to meet sales quotas led to abusive practices, like opening up unwanted accounts for customers and signing them up for products without consent,

This backlash against Wells' high-pressure sales strategy has been mounting. The

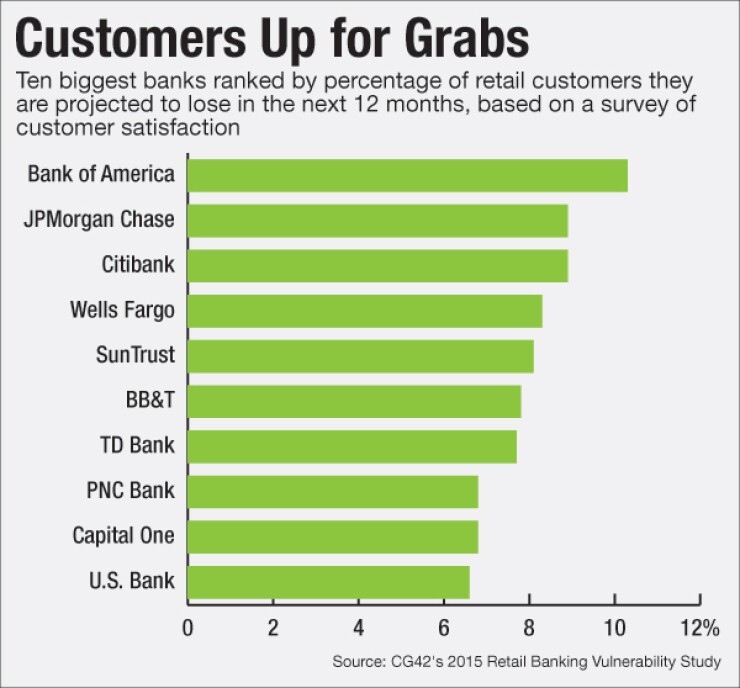

In addition to the regulatory headache, Wells' focus on cross-selling is causing customers to consider switching banks, CG42 said. Twenty-five percent of the bank's customers are "at risk" to switch to a new bank, CG42 concluded, and it estimates that 8.3% will switch in the next 12 months.

Those estimates are based on about 3,000 survey respondents nationwide and a proprietary technique for estimating customer defections.

"Most people would look at [Wells Fargo's sales culture] as a strength, but there is a bad side if it's contributing to 25% of their customer base being at risk," Beck said.

Wells had the fourth-highest percentage of "at-risk" customers among the top ten banks, tied with SunTrust and behind Capital One, Citibank and Bank of America.

The CG42 study claims that a remarkably high percentage of retail customers at all 10 banks are poised to defect to a competitor. Overall, 23% of the customers of the ten biggest banks are classified as "vulnerable" to being poached, and of these, 8% are projected to switch in the next 12 months, the consultancy said.

Beck acknowledges that his consultancy has tended to overestimate how many customers switch banks, which is a

Another piece of good news is that banks have gotten better at removing frustrations since CG42 has been doing its study. The percentage of "vulnerable" customers has declined in each of the biannual surveys, from 26% in 2013 and 33% in 2011, according to the consultancy.

"The good news in this report is that banks have done some positive things to impact customer experience," said Beck. "Having said that, the signature problems are related to revenue pressures that banks find themselves under."

As Beck sees it, banks have been good at reducing frustrations when doing so is financially painless — for instance, by improving out-of-date technology. But investing in new tech is often good for the bank as well as its customers — it can help reduce costs by streamlining back-office processes and reducing the need for staff.

Banks have not done as well at removing frustrations, like excessive fees and high prices, that help their revenue, Beck said.

"None of the major [banks] have decided to take a bold move and address the problems that their customers really care about," he said. "They've addressed the things that are easy."

Branch cutbacks, often seen as an easy way to boost profitability, have led to increased complaints about branch convenience and staffing, CG42 said. Since 2013, the ten largest banks tracked by the study have cut 7% of their branches, the consultancy said. That has corresponded with an increase in customer complaints about branch inconvenience.

Citigroup customers reported the most frustration around branch convenience — which "is unsurprising given [that] Citibank has closed 22% of its branches since 2013," the study notes. Forty-six percent of Citi customers say they're frustrated by "limited/inconvenient branch locations," the worst result of any of the banks in the study. The other nine banks averaged 27% customer frustration with branch location.

B of A, the bank classified as most vulnerable to customer attrition, was the third-most vulnerable two years ago, and the decline is partly due to increasing frustration around customer service, the study found.

B of A's most common frustration points were related to fees and pricing, but "basic customer service and staff quality seem to compound the problem," the study said. Customers increasingly mention issues like long wait time at branches, long hold times on the phone and having to deal with employees who are not knowledgeable, it said.

A Bank of America spokesman said, "We take our clients' feedback very seriously and we are confident in our relationship strategy and the investments we are making to improve our clients' experience with us."

The bank whose vulnerability score improved the most since 2013 was BB&T, which went from second most vulnerable to sixth. TD Bank, PNC, Capital One and U.S. Bank rounded out the rankings. PNC, U.S. Bank and TD have consistently been among the five least vulnerable banks in each ranking, the study said.