David Heun is an associate editor for technology at American Banker.

-

Payment processors have eyed the gambling industry as a just-out-of-reach gold mine for the past few years, especially with the expansion of online and mobile gaming, but the warning signs have always been very large.

By David HeunDecember 28 -

Carrier billing provider Boku says it has expanded its agreement with Microsoft to provide services for the first time in France to all Windows 10 devices on the Orange France network.

By David HeunDecember 27 -

Continuing a fast global expansion pace for both companies, digital money transfer providers WorldRemit and Xpress Money are partnering to open new remittance routes to Southeast Asia.

By David HeunDecember 27 -

Facing security challenges at its member banks and competition from other tech providers, the Society for Worldwide Interbank Financial Telecommunication [Swift] plans to put its best foot forward in 2017.

By David HeunDecember 19 -

Online shoppers can expect fraudsters to be at the height of their creativity during the 2016 holiday season.

By David HeunDecember 16 -

Banks are often taken for granted in digital wallets, treated as a "dumb pipe" for funding another account. PayPal is working to provide a more welcoming atmosphere with deals recently announced with Citigroup, FIS and two other banks.

By David HeunDecember 15 -

Consumers have long had options to pay for high-value purchases through monthly installments, but payments providers — from PayPal to Mastercard — have typically focused on other ways to lift purchase volume.

By David HeunDecember 15 -

The percentage of EMV transactions in the United States is miniscule compared to other parts of the world, but the migration to chip cards in the U.S. is lifting the technology's global growth — now at 42.4% of all card transactions.

By David HeunDecember 14 -

In expanding its work with Facebook, American Express has introduced the Add a Card feature on its bot for Facebook Messenger.

By David HeunDecember 12 -

Too many data breach reports show that companies suffering compromises were unaware that cardholder data was present in their systems. The Payment Card Industry Security Standards Council wants to fix this.

By David HeunDecember 12 -

LevelUp has worked mostly with smaller merchants. It's relationship with the merchant-focused Chase Pay will give it access to a much larger group of retailers.

By David HeunDecember 9 -

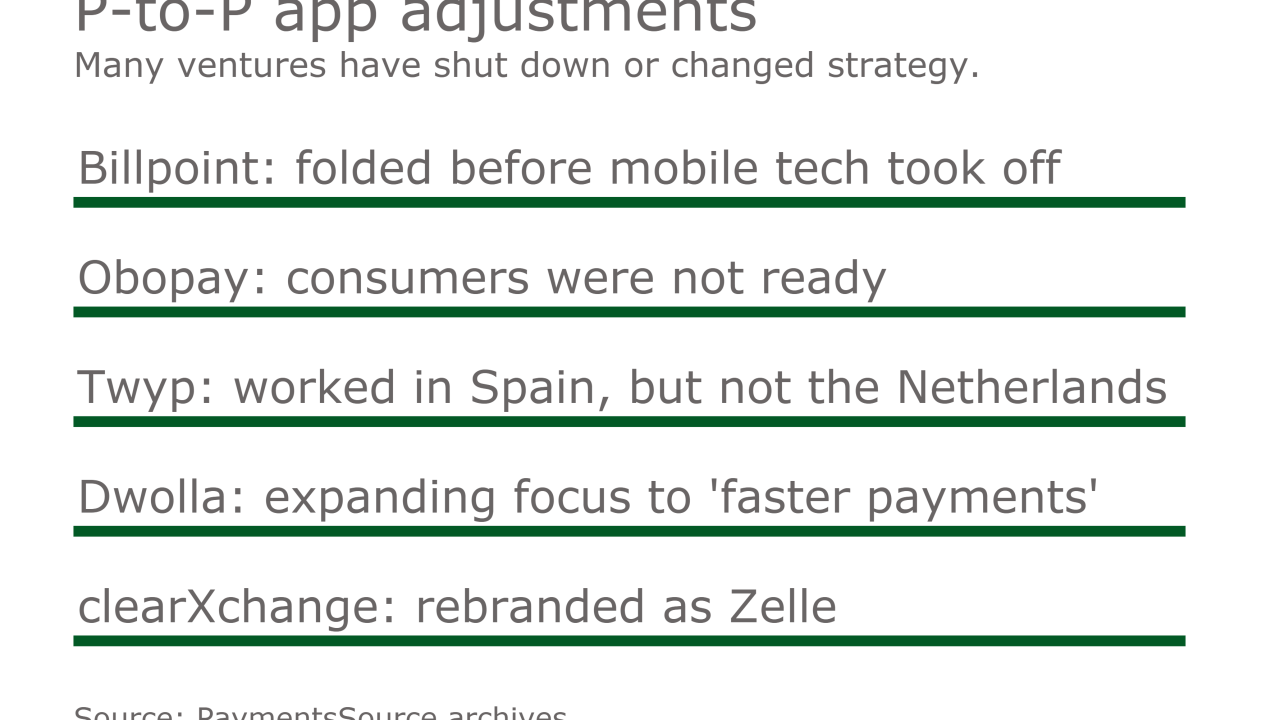

Large banks will soon launch Zelle, their person-to-person payments app. Will it succeed or will it be another name on a growing list of such platforms that never panned out?

By David HeunDecember 9 -

The potential user base is huge. Tencent Holdings has 846 million global monthly active-user WeChat accounts, and more than 300 million have linked bank cards.

By David HeunDecember 9 -

Consumer tastes for person-to-person payment apps differ widely from one market to another, and also change rapidly over time.

By David HeunDecember 8 -

The collaboration gives Apple Pay an entry into the freelance payment market, an industry that's growing fast but underserved.

By David HeunDecember 7 -

The Secure Keys dongle has worked well to vet internal staff at Google, and the search giant sees a number of other uses for the hardware.

By David HeunDecember 7 -

Vantiv has made a name for itself the past two years in advancing integrated payments at the point of sale, while also welcoming application developers to interact with the company's technology through

Vantiv ONE . Its latest move puts its focus on e-commerce.By David HeunDecember 6 -

The opening of the 2016 holiday season, which marks the first full year since the country's major EMV fraud liability shift, is proving what data security experts feared all along.

By David HeunDecember 6 -

The opening of the 2016 holiday season, which marks the first full year since the country's major EMV fraud liability shift, is proving what data security experts feared all along.

By David HeunDecember 6 -

Apple Pay users will have the option to make payments with gift and loyalty cards through an arrangement with Blackhawk Network's digital stored value system.

By David HeunDecember 5