Hannah Lang is a Washington-based reporter who writes about federal mortgage policy and the U.S. housing finance system for American Banker and National Mortgage News. She is a former multimedia reporter for the Capital News Service and a graduate of the University of Maryland at College Park.

-

Federal Reserve Vice Chair of Supervision Randal Quarles suggested that the massive influx of reserves stemming from the central bank's COVID-19 response may lead to a recalibration of the supplementary leverage ratio.

By Hannah LangJune 1 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

By Hannah LangMay 28 -

The Treasury secretary previewed President Biden's budget by urging lawmakers to fund the Financial Crimes Enforcement Network's establishment of a beneficial ownership regime.

By Hannah LangMay 27 -

The Federal Reserve's Randal Quarles, in testimony before the Senate Banking Committee, sought to fend off criticism from Sen. Elizabeth Warren that the central bank treated with kid gloves some foreign banks under its jurisdiction that later took heavy losses. The hearing also featured a discussion about a new framework for digital assets.

By Hannah LangMay 25 -

Sen. Pat Toomey of Pennsylvania, the top Republican on the Banking Committee, told three Federal Reserve regional presidents that a series of events tied to the impact of racism on the job market and housing systems is not within the scope of the central bank.

By Hannah LangMay 24 -

The White House directive may lead regulators to develop new mortgage underwriting standards, stress-test requirements and flood insurance policy, observers said.

By Hannah LangMay 21 -

While cryptocurrencies could have benefits, they have “not served as a convenient way to make payments, given, among other factors, their swings in value,” said the head of the Federal Reserve. He also detailed imminent Fed research on a central bank digital currency.

By Hannah LangMay 20 -

Mortgage lenders have much riding on a yearslong effort to overhaul a program that requires homeowners to hold policies in flood-prone areas. A congressional panel meeting to discuss the issue was once again split between lawmakers from storm-threatened states and those concerned about government costs.

By Hannah LangMay 18 -

After much anticipation, the Federal Reserve last year finally joined the Network for Greening the Financial System, which develops regulatory best practices for combating climate risks. But all U.S. banking regulators must participate for the effort to succeed, some observers argue.

May 18 -

Regulators around the world are exploring how to assess banks' exposures to climate change risks. But they'll have to tackle legal, economic and modeling problems that don’t have obvious solutions.

By Hannah LangMay 12 -

Some worry the Senate’s rejection of the OCC rule hampers efforts to clarify legal standards for banks selling loans to fintechs.

May 12 -

Fannie and Freddie's regulator says the companies must comply with the new Qualified Mortgage standard by the summer, while the Consumer Financial Protection Bureau has extended the deadline to 2022. The conflicting timetables have stoked uncertainty in the market.

By Kate BerryMay 7 -

The Federal Reserve said its regional banks should consider whether nontraditional financial companies meet the requirements of certain federal statutes and present “undue” risk to the financial system before granting access.

By Hannah LangMay 5 -

The head of the Federal Reserve appeared to support Congress’s expanding the scope of the Community Reinvestment Act to unregulated institutions, just as regulators weigh how to modernize the framework for banks.

By Hannah LangMay 3 -

The Federal Reserve's top supervisory official, Randal Quarles, says regulators need to get a stronger grasp of digital currencies in order to supervise them. His comments Thursday follow reports that several large banks have started offering clients the ability to invest in bitcoin funds.

By Hannah LangApril 29 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

By Hannah LangApril 28 -

It would be available to homeowners making 80% or less of their area’s median income who weren't eligible to tap into low rates last year.

By Hannah LangApril 28 -

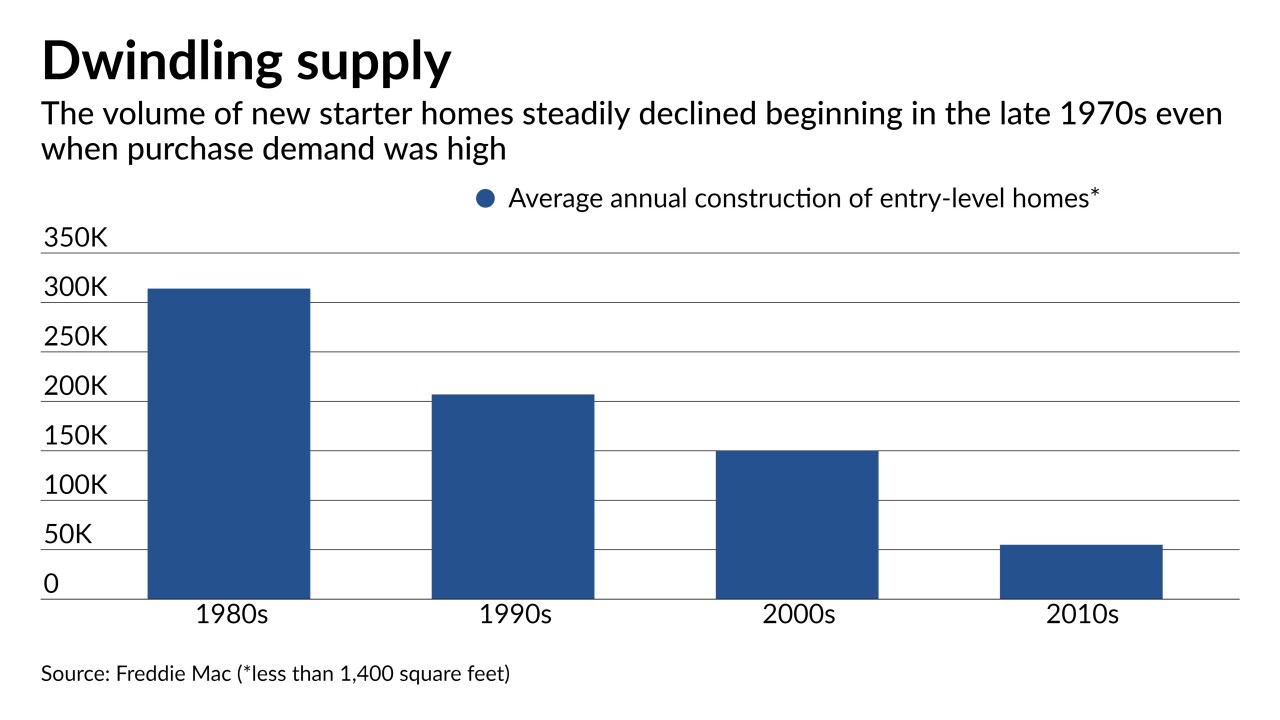

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

By Hannah LangApril 27 -

House and Senate GOP members have stepped up criticism of a plan to include banks in a global push to cut emissions, saying it could cut off financial services access for energy and fossil fuel companies.

By Hannah LangApril 21 -

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

By Hannah LangApril 20