John Adams is executive editor of payments for American Banker. John interviews top executives in the payments, cryptocurrency and fintech industries, hosts podcasts, moderates conference panels and curates the new Payments Intelligence portal.

His work includes profiles of

John has been with American Banker and related products for 30 years, covering bank technology, advertising, mortgages and capital markets.

-

Policymakers contend the fast-growing crypto sector poses many risks for consumers, but disagreements within the blockchain industry and Congress are expected to prevent the establishment of clear rules anytime soon.

By John AdamsDecember 1 -

The former PayPal president was hired to bring an entrepreneurial spirit to the social network, and he helmed major projects such as the Diem stablecoin. His exit raises questions about the direction of the businesses he oversaw.

By John AdamsNovember 30 -

The tech entrepreneur has been increasingly focused on Bitcoin, a key growth area for the payments company he co-founded.

By John AdamsNovember 29 -

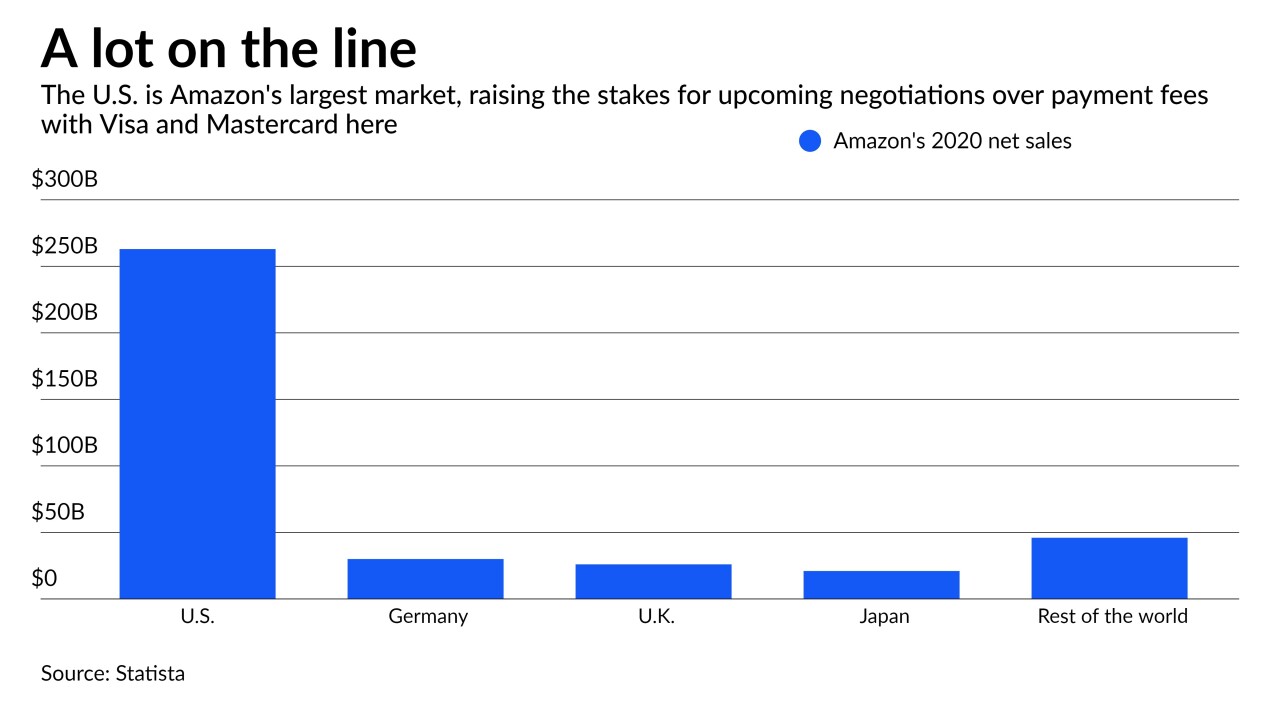

The e-commerce giant has threatened to ban Visa cards in the U.K., and its partnerships with the likes of Affirm and Venmo give it alternative ways to accept payments — and the means to make good on that ultimatum.

By John AdamsNovember 22 -

N26 and Monzo halted or delayed expansion plans here largely because competition for customers was already intense and obtaining a banking license proved difficult.

By John AdamsNovember 19 -

The online retailer’s plan to block certain credit card payments in Britain is seen as an opening move in likely negotiations with Mastercard and Visa ahead of the card networks' planned fee hikes in 2022.

By John AdamsNovember 17 -

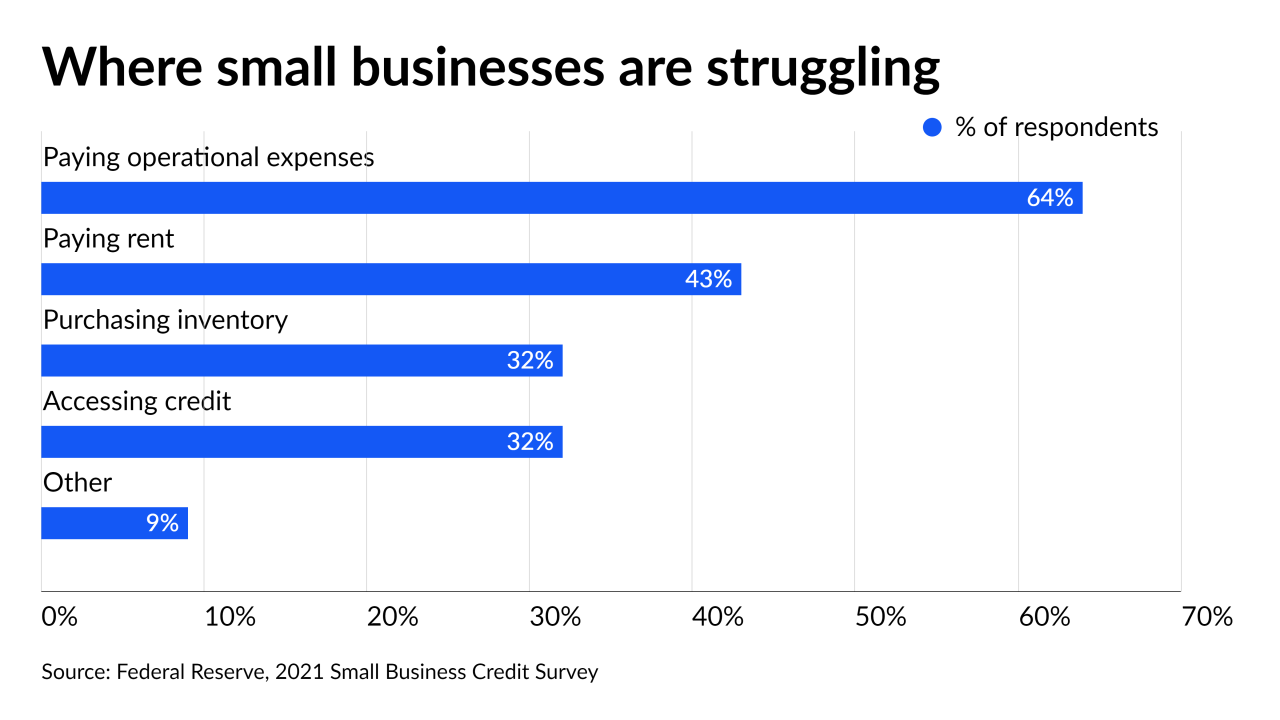

Backups at ports have created inventory and cash-flow challenges for many businesses. Bank of the West, Swift, SAP and others are offering customers faster payments services, short-term loans and virtual cards to ease liquidity pressures.

By John AdamsNovember 16 -

The data aggregator is recruiting partners such as Railsbank, Silicon Valley Bank and Marqeta for a project designed to make certain digital transactions easier to complete.

By John AdamsNovember 10 -

The bank is partnering with Anthemis to match investors with female entrepreneurs, who according to Findexable research attract just 1.5% of investment in the sector.

By John AdamsNovember 8 -

The institution joins a small but growing list of large banks that allow businesses like utilities and mobile carriers to instantly accept consumer transactions.

By John AdamsNovember 8 -

Citigroup, BNY Mellon, JPMorgan Chase and PNC are each working to enable wireless providers, public utilities and other companies to instantly receive funds from the consumers they bill.

By John AdamsNovember 5 -

Jack Dorsey's payments company wants to reach a younger demographic while also giving adults more reasons to use its peer-to-peer service.

By John AdamsNovember 4 -

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.

By John AdamsNovember 4 -

Digital upstarts like Square, Stripe and PayPal are invading community banks' turf by appealing to local merchants with a mix of electronic payments and lending. Small banks are fighting back by leaning into digital services while maintaining their personal touch.

By John AdamsNovember 3 -

The Indiana-based online banking pioneer is purchasing First Century, a similarly tech-savvy company, for $80 million. The deal would diversify its revenue and improve its prepaid card offerings for small businesses.

By John AdamsNovember 2 -

Fintechs have begun offering consumers installment-lending options to pay for airfare, putting competitive pressure on banks and credit unions that rely on travelers for significant credit card volume.

By John AdamsNovember 1 -

European authorities have linked the operation to investment scams that predate its sale to ING in 2018.

By John AdamsNovember 1 -

The card network plans to use technology acquired from CipherTrace to offer compliance and risk management services to firms that handle digital assets.

By John AdamsOctober 28 -

The partnership — combining one of the biggest buy now/pay later lenders with one of the major digital payment companies — gives merchants a compelling new offering that could enable Klarna to take wallet share away from traditional card issuers.

By John AdamsOctober 26 -

Steve Squeri said installment lenders primarily cater to debit card users and that even American Express's own BNPL product does not compete with the company's credit and charge cards.

By John AdamsOctober 22