John Adams is executive editor of payments for American Banker. John interviews top executives in the payments, cryptocurrency and fintech industries, hosts podcasts, moderates conference panels and curates the new Payments Intelligence portal.

His work includes profiles of

John has been with American Banker and related products for 30 years, covering bank technology, advertising, mortgages and capital markets.

-

Citigroup, BNY Mellon, JPMorgan Chase and PNC are each working to enable wireless providers, public utilities and other companies to instantly receive funds from the consumers they bill.

By John AdamsNovember 5 -

Jack Dorsey's payments company wants to reach a younger demographic while also giving adults more reasons to use its peer-to-peer service.

By John AdamsNovember 4 -

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.

By John AdamsNovember 4 -

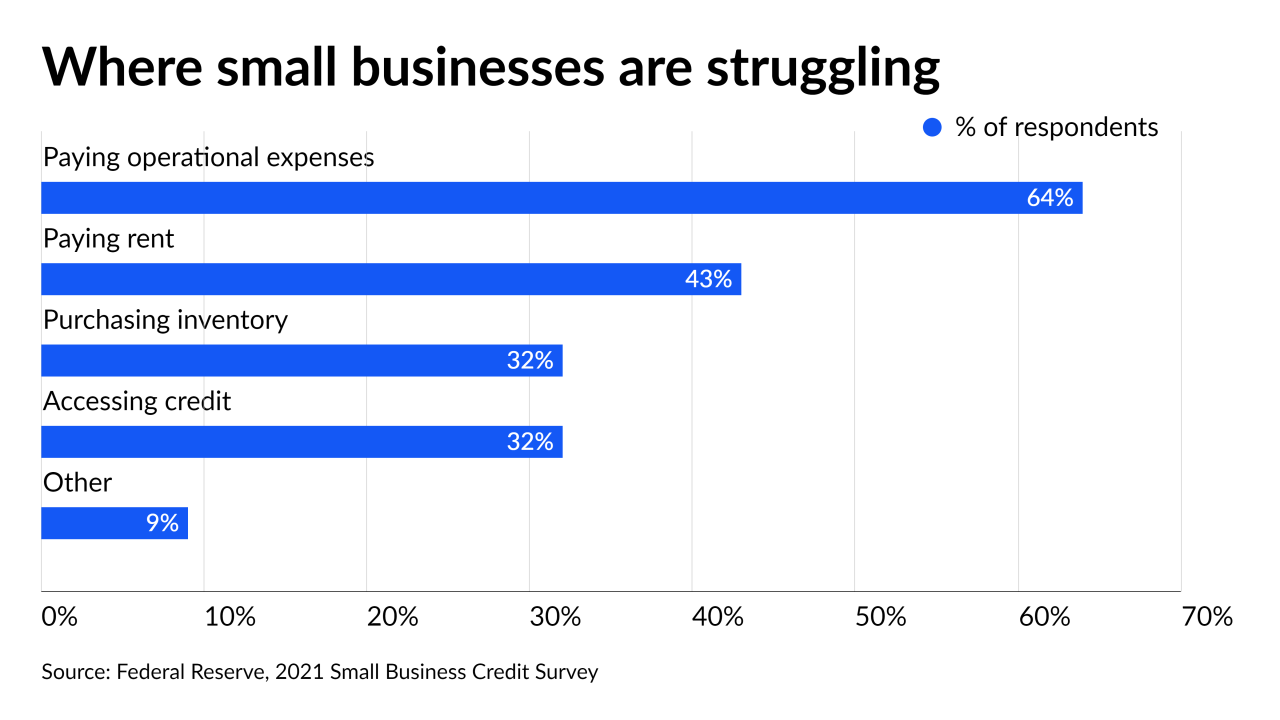

Digital upstarts like Square, Stripe and PayPal are invading community banks' turf by appealing to local merchants with a mix of electronic payments and lending. Small banks are fighting back by leaning into digital services while maintaining their personal touch.

By John AdamsNovember 3 -

The Indiana-based online banking pioneer is purchasing First Century, a similarly tech-savvy company, for $80 million. The deal would diversify its revenue and improve its prepaid card offerings for small businesses.

By John AdamsNovember 2 -

Fintechs have begun offering consumers installment-lending options to pay for airfare, putting competitive pressure on banks and credit unions that rely on travelers for significant credit card volume.

By John AdamsNovember 1 -

European authorities have linked the operation to investment scams that predate its sale to ING in 2018.

By John AdamsNovember 1 -

The card network plans to use technology acquired from CipherTrace to offer compliance and risk management services to firms that handle digital assets.

By John AdamsOctober 28 -

The partnership — combining one of the biggest buy now/pay later lenders with one of the major digital payment companies — gives merchants a compelling new offering that could enable Klarna to take wallet share away from traditional card issuers.

By John AdamsOctober 26 -

Steve Squeri said installment lenders primarily cater to debit card users and that even American Express's own BNPL product does not compete with the company's credit and charge cards.

By John AdamsOctober 22 -

After Visa's deal to acquire Plaid fell through as a result of regulatory pressure, the data aggregator found new fintech partners including Square and Dwolla to support an account-to-account transfer service.

By John AdamsOctober 21 -

The social network's test of its Novi wallet drew criticism from Democratic senators who say the company does not have a strong track record of protecting user data.

By John AdamsOctober 20 -

The payment company has agreed to buy the India-based reconciliation company in its latest investment in back-office technology for internet businesses.

By John AdamsOctober 20 -

Fintechs have led the way in installment lending, but banks, credit card issuers and payments companies are responding with products of their own. Here's an overview of what they're rolling out.

October 19 -

Best known as a website management company, GoDaddy began directly offering digital and offline payments after learning that its clients were getting those services from fintechs. The company is also now selling terminals for in-store payments.

By John AdamsOctober 18 -

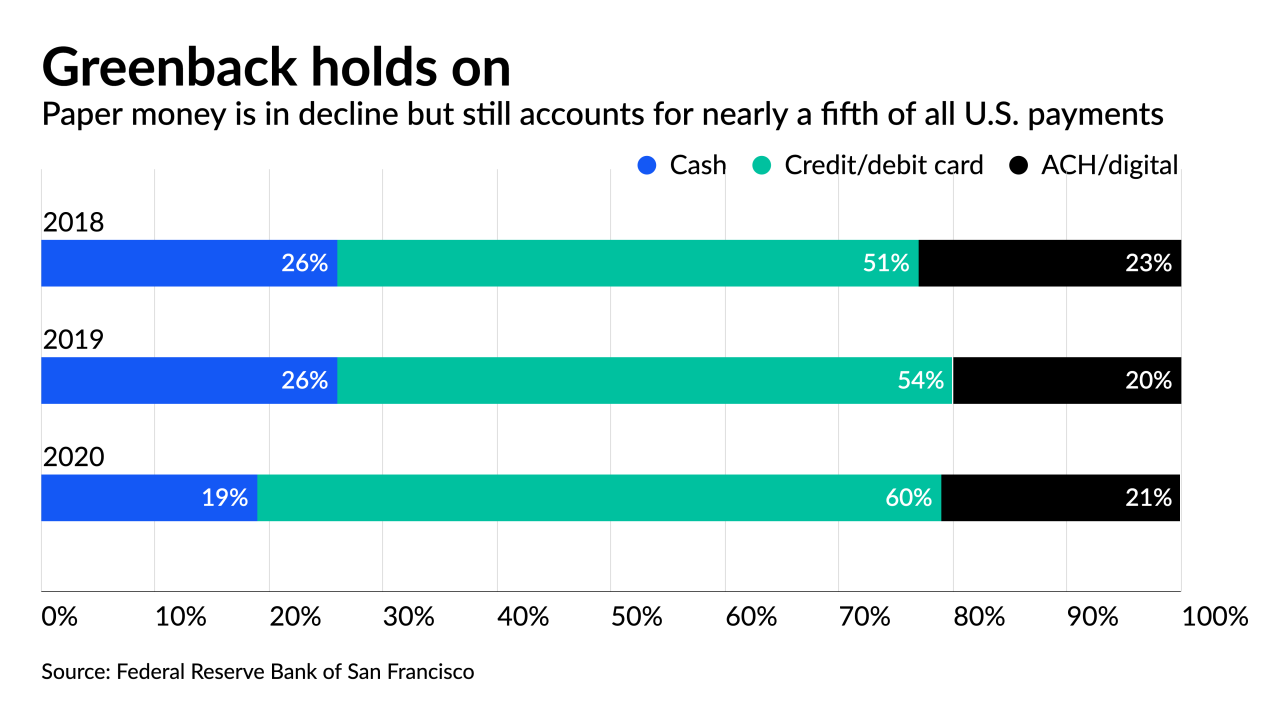

During a House hearing, Democrats advocated for measures that ensure businesses keep accepting paper money, while Republicans argued in favor of chartering more fintechs and promoted stablecoins to extend access to the underbanked.

By John AdamsOctober 15 -

The $317 million deal will provide the London company with a large base of American clients and help it compete with technology firms like Square, PayPal and Stripe.

By John AdamsOctober 14 -

Chase Payment Solutions combines Chase Merchant Services with WePay, a fintech the bank bought in 2017, to provide more tailored offerings — such as card acceptance without a merchant account — to entrepreneurs.

By John AdamsOctober 14 -

The payments firm dropped support for Bitcoin payments in 2018, but company executives say the increasing popularity of digital currency makes it a good time to reenter the market.

By John AdamsOctober 13 -

The bank-supported blockchain organization plans to use the acquired assets to speed testing for digital currencies.

By John AdamsOctober 12