-

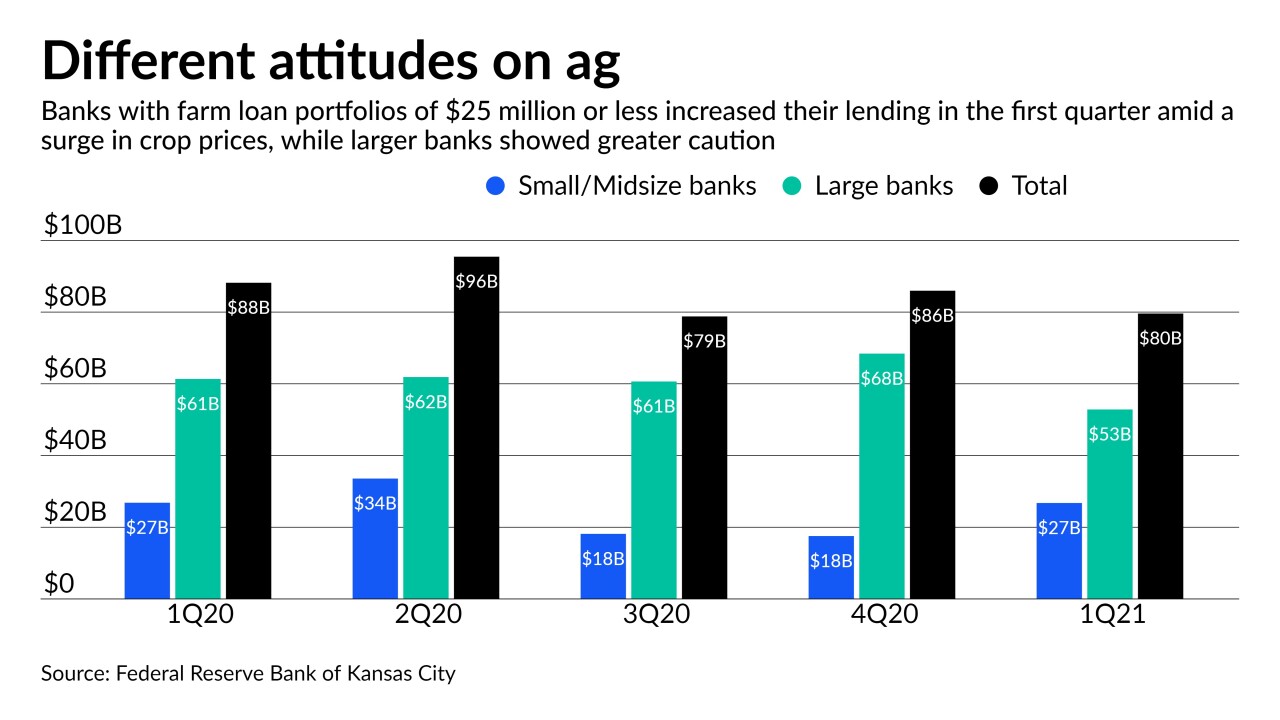

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

By Jon PriorMay 5 -

The Texas company kept allowances steady, citing lingering concerns over the pandemic and commercial real estate. Yet it plans to open 25 offices in Dallas after a similar expansion in Houston drove asset and customer growth.

By Jon PriorApril 29 -

Looming defaults and the potential for heavier regulatory scrutiny have prompted banks to pull back from the sector. Is that a good thing?

By Jon PriorApril 28 -

The company’s retail banking and auto-lending businesses in the U.S. generated a larger share of overall profits in the first quarter, and Executive Chairman Ana Botín and other executives unveiled expansion plans for both units.

By Jon PriorApril 28 -

The investment, tied to PNC's deal to acquire BBVA USA, was always going to be large but seemed to grow as CEO Bill Demchak got intimately involved in the discussions and the needs of communities and businesses hit hard by the coronavirus pandemic became more apparent.

By Jon PriorApril 28 -

Oil and gas companies — flush with cash from rising oil prices — are catching up on debt payments and will seek new credit later in the year as the economy recovers, the Oklahoma company says.

By Jon PriorApril 21 -

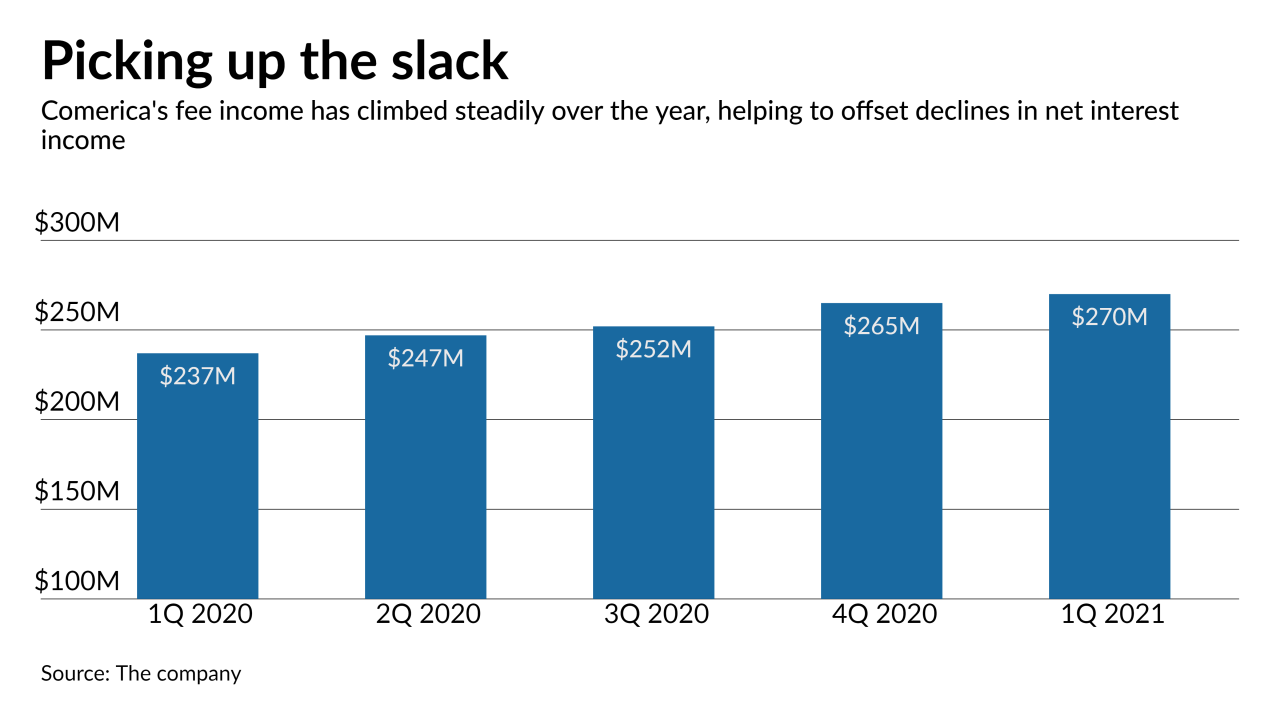

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

By Jon PriorApril 20 -

The leaders of Citizens Financial and Truist predict lending will bounce back in the second half of 2021 as the economy normalizes. But PNC chief Bill Demchak says there are scant signs that businesses are gearing up for a rebound.

By Jon PriorApril 16 -

The San Antonio company will no longer charge fees on transactions of $100 or less that take checking account balances into negative territory, as long as the customer has a $500 monthly direct deposit set up.

By Jon PriorApril 15 -

The Charlotte, N.C., company has shuttered 400 branches in the past year and intends to close nearly 500 more by early 2022. It’s also eliminating office space and reducing headcount as it aims to keep quarterly expenses under $3 billion.

By Jon PriorApril 15