-

The biggest lenders seem to have handled the corporate rush for cash heading into the economic shutdown caused by the coronavirus pandemic. But their ability to collect is as uncertain as the economic outlook for the next year.

By Jon PriorApril 15 -

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

By Jon PriorApril 14 -

Bankers say they’re still trying to figure out if the Fed’s complex loan-buying vehicles will help them cater to the needs of midsize commercial customers hammered by the economic shock from the coronavirus outbreak.

By Jon PriorApril 9 -

Firms that spread big-dollar deposits to community banks have seen a rush in demand as small businesses seek emergency loans to weather the coronavirus pandemic.

By Jon PriorApril 7 -

Banks, under pressure to act hastily, began taking applications for government aid to small businesses hit hard by the coronavirus outbreak. But narrow eligibility rules at some banks angered business owners and lawmakers.

By Kevin WackApril 3 -

In supporting the economic recovery from the coronavirus pandemic, lenders have a chance to restore public trust damaged in the last financial crisis. But they face tough decisions on dividend cuts, executive pay, furloughs and deeper changes to their business model in the process.

By Laura AlixApril 1 -

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

By Jon PriorMarch 31 -

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

By Jon PriorMarch 26 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

By Jon PriorMarch 25 -

Some industry observers are calling on the Treasury Department to bring back the Small Business Lending Fund to help small companies stay afloat during the coronavirus pandemic and get back on their feet once the crisis passes.

By Jon PriorMarch 23 -

Banks are avoiding the once booming hospitality business, or charging a premium for additional credit, as new data shows how big a hit hoteliers have taken from the pandemic.

By Jon PriorMarch 18 -

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

By Laura AlixMarch 16 -

No-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

By Laura AlixMarch 12 -

Banks with the most exposure to oil and gas companies say they’ve added capital and changed their borrower mixes since the 2015 market fall. But skeptics question whether they can stave off losses if low prices endure.

By Jon PriorMarch 10 -

An investment firm that has been pressuring large companies to enhance disclosures said that its efforts at JPMorgan Chase, Wells Fargo, Bank of America and Bank of New York Mellon are gaining ground.

By Jon PriorMarch 4 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

E-Trade could add about 30 basis points to a key capital ratio once the deal closes, Jonathan Pruzan says.

By Jon PriorFebruary 27 -

A spike in loan-loss provisions dragged down first-quarter profits at the Toronto company’s U.S. unit.

By Jon PriorFebruary 25 -

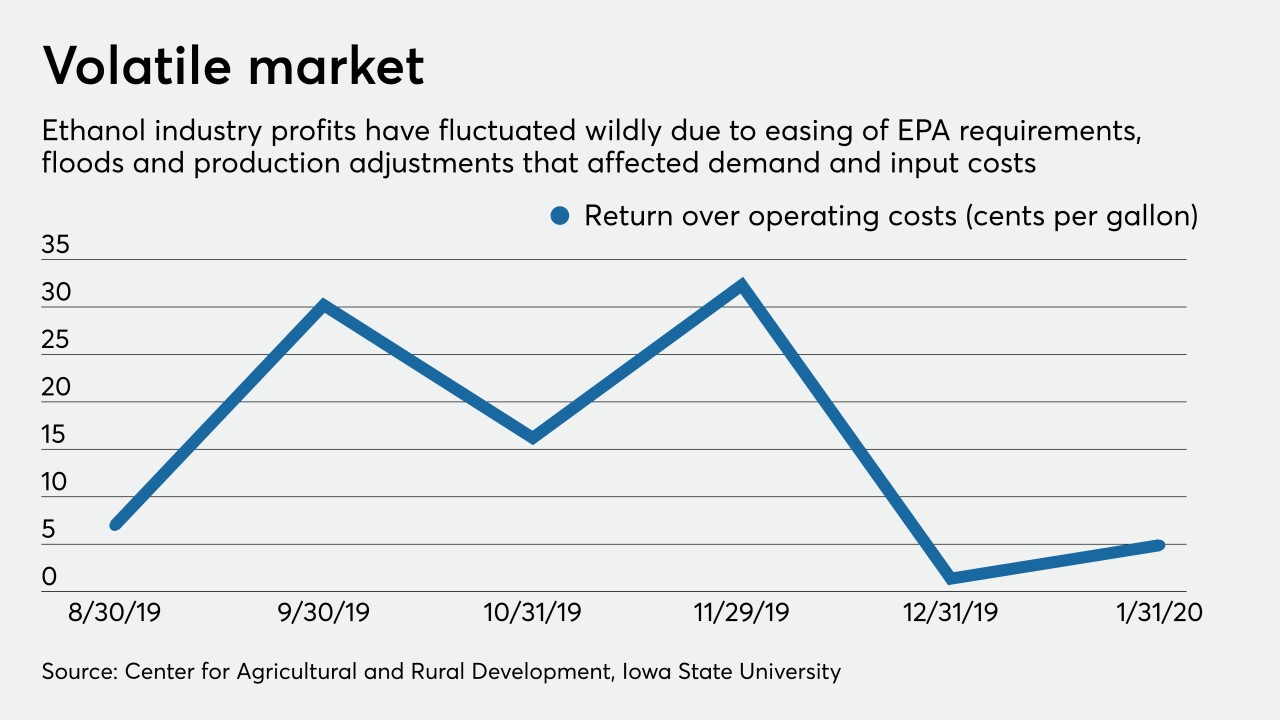

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

By Jon PriorFebruary 12 -

A New Jersey jury has put banks and other businesses on notice about their liability for incidents involving clients who mistreat employees in the workplace.

By Jon PriorFebruary 12