Robert Barba is the technology editor of American Banker. Robert previously served as deputy editor of American Banker's dealmaking and strategy section. He joined American Banker in late 2007 as a community banking reporter, just in time for the financial crisis. Robert played a lead role in covering community banks' struggle for survival in the years following the downturn. Robert has appeared on Fox Business to discuss bank failures and the Treasury Department's Troubled Asset Relief Program. Prior to joining American Banker, Robert was a general business reporter at Scripps Treasure Coast Newspapers in Stuart, Fla. He began his career as a business desk intern at The Denver Post and Boulder Daily Camera. Robert is based in New York.

-

Digit's decision to charge a monthly fee for its savings help speaks to the challenge of making fintech profitable.

By Robert BarbaApril 13 -

The JPMorgan CEO detailed the bank's $9.5 billion technology budget, forthcoming upgrades and more.

By Robert BarbaApril 4 -

BMO recently won a diversity award for reaching its goal of having women in 40% of senior management jobs, and CEO Bill Downe argues equal treatment of employees will carry over to fair treatment of customers and create long-term profits for shareholders.

By Robert BarbaMarch 23 -

In a Q&A, CommonBond CEO David Klein discusses how an OCC charter might benefit customers by lowering the cost to run a student loan refinancing business.

By Robert BarbaMarch 17 -

The venture capital firms of Goldman Sachs and Citigroup, along with the fund backed by Google’s chairman, have invested in a firm that helps banks secure their cloud technology.

By Robert BarbaMarch 14 -

The cross-border payments startup will use proceeds from its Series D round to fuel growth.

By Robert BarbaMarch 9 -

State Street Global Advisors has placed a statue, titled "The Fearless Girl," across from the iconic bull statue in lower Manhattan to draw attention to gender diversity on boards.

By Robert BarbaMarch 8 -

Problems with Amazon's cloud computing services caused major disruption across the Web on Tuesday, but Capital One says it cloud strategy kept things smooth there.

By Robert BarbaMarch 2 -

The acquisition of Cryptowatch is the most recent in a series of deals struck by Kraken in the last year.

By Robert BarbaMarch 1 -

The retailer is set to announce Tuesday that it is updating its app to allow its customers to input money transfer information electronically rather than having to fill out paperwork in the store.

By Robert BarbaFebruary 28 -

A core processing startup gets $16 million and a U.K. challenger bank raises $27.6 million.

By Robert BarbaFebruary 23 -

Although much of banking is cautiously optimistic about the Trump presidency, the financial firms and organizations that serve the unbanked see the election as a mixed bag at best so far.

By Robert BarbaFebruary 22 -

In addition to transforming Columbia Banking System and navigating it through the financial crisis, Dressel was an industry leader.

By Robert BarbaFebruary 21 -

OpenFin, a devotee of open source software, has raised $15 million in Series B funding to fuel staff expansion, business development and new products.

By Robert BarbaFebruary 16 -

With another $60 million in writedowns, BBVA Compass has taken $90 million in goodwill impairment charges related to its $117 million acquisition of the neobank Simple.

By Robert BarbaFebruary 3 -

Customers Bancorp says it expects to announce a deal to divest its BankMobile unit within 60 days. It could be an attractive target for a bank with strong loan demand.

By Robert BarbaJanuary 30 -

Nyca is one of the most active venture capital firms in fintech globally and its second fund should give it plenty of dry powder to pursue further deals.

By Robert BarbaJanuary 30 -

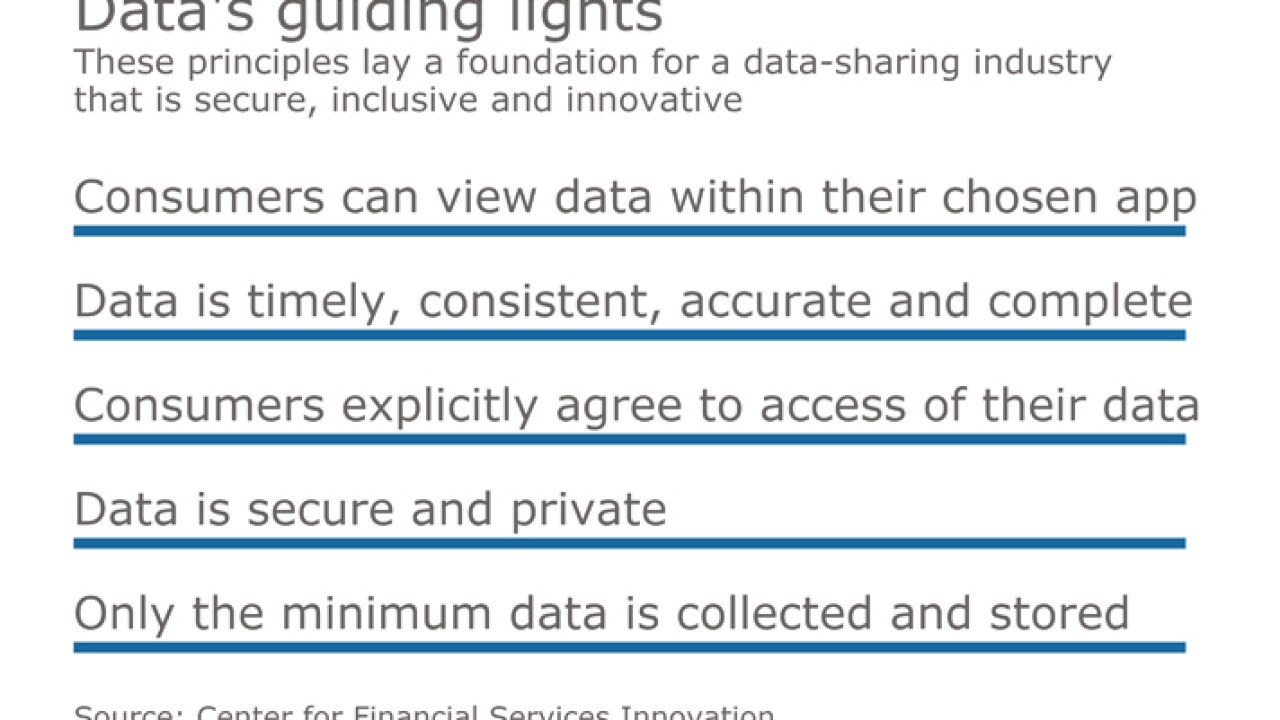

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

By Robert BarbaJanuary 25 -

Add package pickup to the growing list of things banks are doing with branches as foot traffic declines.

By Robert BarbaJanuary 23 -

The growth of digital channels is changing bank M&A values, forcing buyers to focus less on branches and more on the volume of customer data.

By Robert BarbaJanuary 10