-

The coming year will bring a wave of data-sharing deals between banks and fintechs, increased bank use of automated advice, marked changes to financial jobs as a result of automation, and much more.

January 6 -

A partnership between the mobile carrier and BankMobile could help stripped-down banking and deposit transfer services find a footing among U.S. customers.

January 2 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

More traditional players interested in creating a safer market for digital assets have issued a checklist that cryptocurrency firms can follow to build confidence among banks, consumers and regulators.

December 26 -

Prometheum may succeed whether others have failed because it has attempted to work closely with regulators.

December 21 -

The industry’s technology priorities and budgets are headed for a distinct shift in 2019. What’s in: new initiatives in digital banking and analytics. What’s not: new initiatives built on blockchain technology.

December 19 -

Gagan Kanjlia joins the Santa Clara, Calif.-based Silicon Valley Bank after spending two-plus years as the head of product for OnDeck, an online lending provider for small businesses. Before OnDeck, Kanjlia spent 14 years at Capital One.

December 18 -

Synchrony Bank’s tie-in with the latest Spider-Man movie is an example of ways companies are looking to add augmented reality to their mobile-marketing arsenals.

December 17 -

Augmented devices and automation will push banking services beyond the current mobile phone delivery model into a virtual world — but how, exactly? Bank of America, Wells Fargo and others are trying to find out.

December 13 -

The New Jersey bank is offering fintechs ways to stay compliant with consumer protection regulations.

December 7 -

To convince skeptical bankers about the benefits of distributed ledger technology, some suggest it needs to be separated from the volatile digital currency it underlies.

November 30 -

Building alliances with startups is the most affordable route for community banks that want to offer innovative services, but industry officials cautioned that they must be balanced with smart internal investments, too.

November 29 -

Proponents of real-time payments systems say banks must embrace them given consumer demand for more immediacy and transparency, even if criminals will try to exploit them.

November 28 -

As U.S. banks move toward faster payments, they should heed the lessons U.K. banks learned about criminals after launching their real-time transaction system, says Varo Money's fraud strategy leader.

November 27 -

The Wikibuy purchase follows acquisitions of a personal financial management provider and a firm that helps digital shoppers get price adjustments.

November 20 -

Neobanks create lots of buzz — and command the attention of venture capital firms — but there are questions about how big of a threat they pose.

November 20 -

The online-only bank hopes new leadership can help it overcome its rocky past three years.

November 14 -

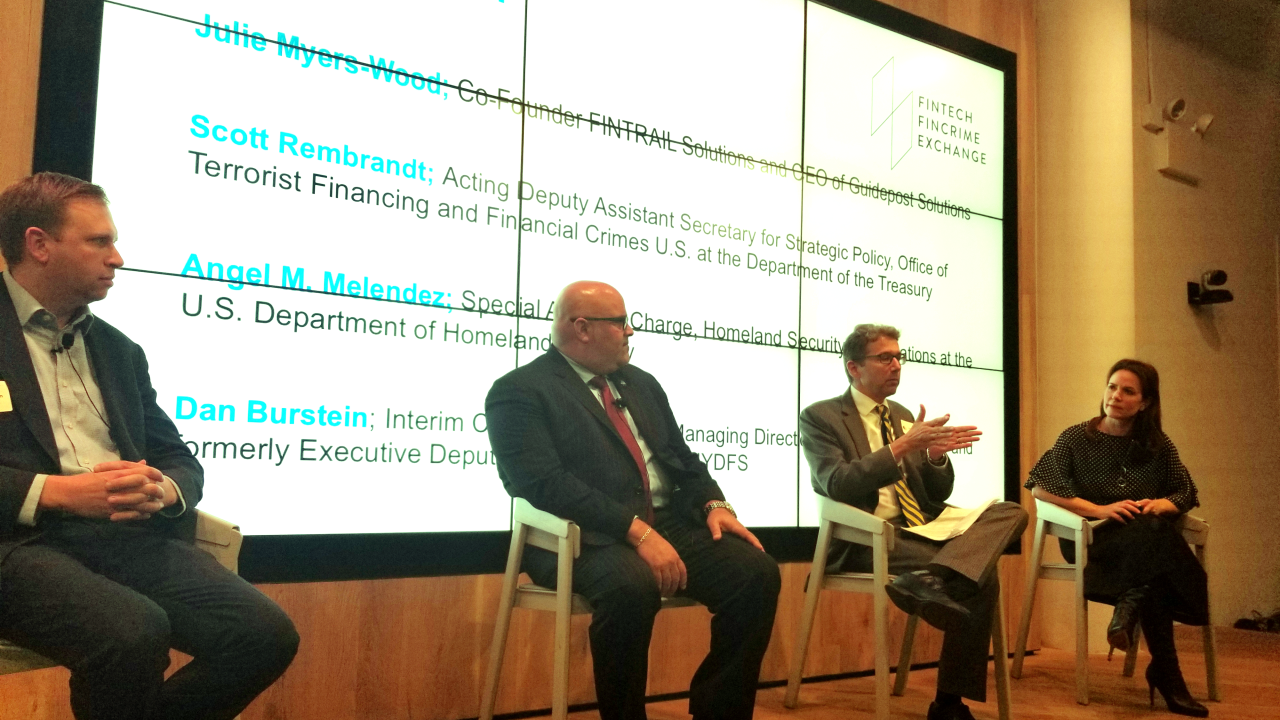

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

Staffers at the bank's flagship, multilevel branch in Manhattan say wearable tech has proven ideal for discreet communication among each other to speed customer service.

November 8