-

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

At a national level, loan growth has been on the decline for months and could still get worse. Here's how some credit unions are tackling the issue.

October 16 -

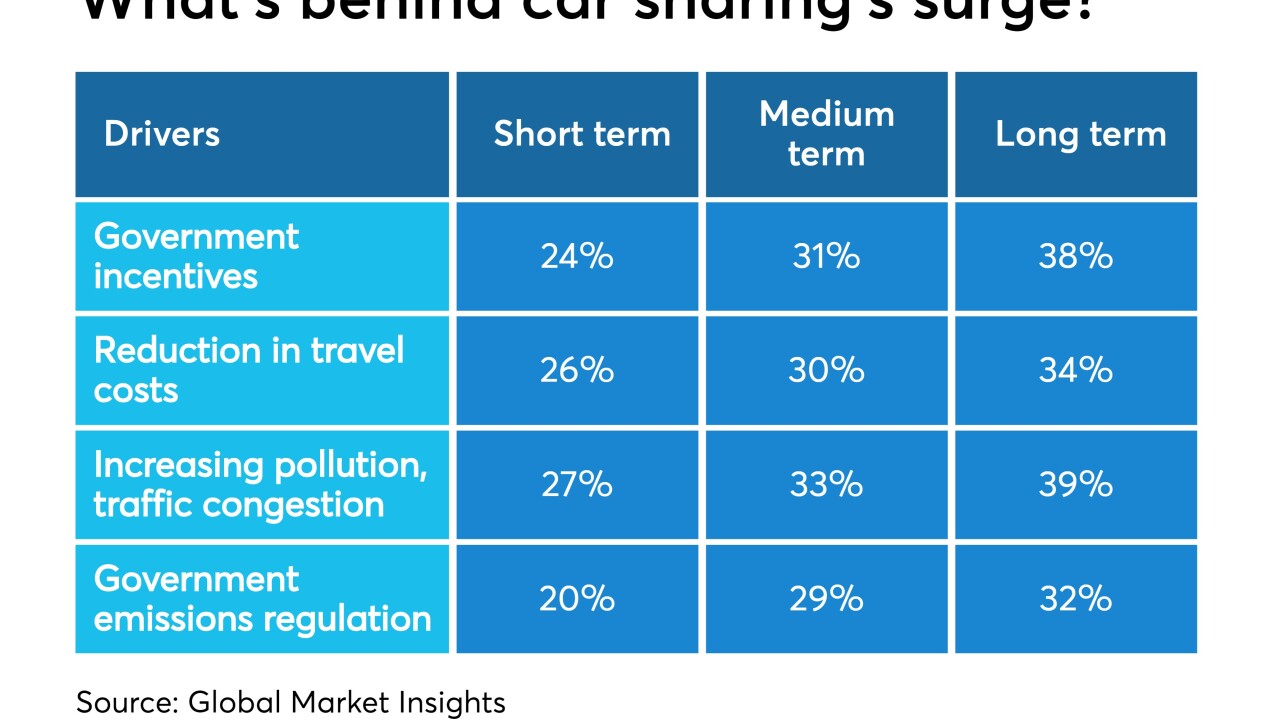

As apps like Uber and Lyft gain more traction, the need for new cars — and loans — is expected to diminish.

October 11 -

Delinquencies on indirect auto and home equity loans are trending up, while past-due rates on credit cards are declining, according to a recent report by the American Bankers Association.

October 8 -

Facebook calls an emergency meeting about its planned payments network; Well Fargo report says 200,000 jobs will be lost to robots and technology.

October 2 -

CUNA Mutual Group found that loan balances increased by 6.6% for the year ending in the second quarter.

September 20 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

A subsidiary of Citizens Financial Group placed first in a recent J.D. Power ranking of car dealer satisfaction with noncaptive auto lenders. However, that group — primarily banks and credit unions — lagged other types of auto lenders.

August 29 -

The most recent Credit Union Trends Report from CUNA Mutual Group is “indicative that both the credit cycle and the U.S. business cycle are moving into their last stage before the next economic slowdown,” according to one economist.

August 20 -

With declining interest rates, credit unions that rely heavily on interest income from their investment portfolios may struggle.

August 16 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22 -

The credit card issuer reported expense growth that rose faster than net interest income during the second quarter.

July 18 -

Credit unions reported gains in a number of key areas but member business lending and new auto loans took a hit as overall growth continued to slow.

July 18 -

The company, which announced the conclusion of a three-year-old credit card partnership with TD Bank, is shifting to digital financing of individual consumer purchases.

July 18 -

Alleged discrimination over immigration status is the latest legal headache for Wells Fargo.

July 17 -

The autonomous vehicle lending market isn’t expected to peak for decades, but some CUs are already jumping in, and they could be at the forefront of rapid shifts in the automotive industry.

July 12 -

CUs in both states surpassed total asset milestones, but many business lines are growing at a slower pace than they were one year ago.

July 11