-

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

JPMorgan and Santander show off their uses for the technology; commercial and industrial loans outstanding are rising.

May 17 -

The New York-based firm said it now reaches 4.3 million members, a 58 percent increase over the previous year.

May 9 -

Ryan, McConnell say they have a deal on a bipartisan Dodd-Frank rollback; New York won more than $5 billion in settlements from big banks under the former AG.

May 9 -

Bill supporters say the guidance — which held indirect auto lenders liable for unintentional discrimination at partner dealerships — violated Dodd-Frank, but consumer advocates say the legislation would expose minority borrowers to mistreatment.

May 8 -

Auto lenders would be well advised to keep up their guard as states — particularly blue ones — take steps of their own to crack down on what they see as abusive practices.

May 7 -

Readers applaud acting Consumer Financial Protection Bureau Director Mick Mulvaney’s cost-cutting ideas, slam recent calls for postal banking, opine on banks limiting their business with firearms dealers and more.

May 3 -

The agency’s 2013 guidance is frequently portrayed as either an overdue push to stamp out lending discrimination or a case study in regulatory overreach. In truth, its impact was minimal.

April 30 -

Not a penny of the $1 billion fine against Wells Fargo will end up in the hands of customers harmed by practices flagged by regulators.

April 27 -

Record originations on "better-yielding" used-car loans helped drive a 14% increase in its first-quarter profit. But Ally's shares were down Thursday on concerns of rising deposit costs.

April 26 -

The firm reported that its new credit union clients — representing an aggregate of more than 450,000 members — signed on for GrooveCar's online vehicle-buying program.

April 26 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 Public Citizen

Public Citizen -

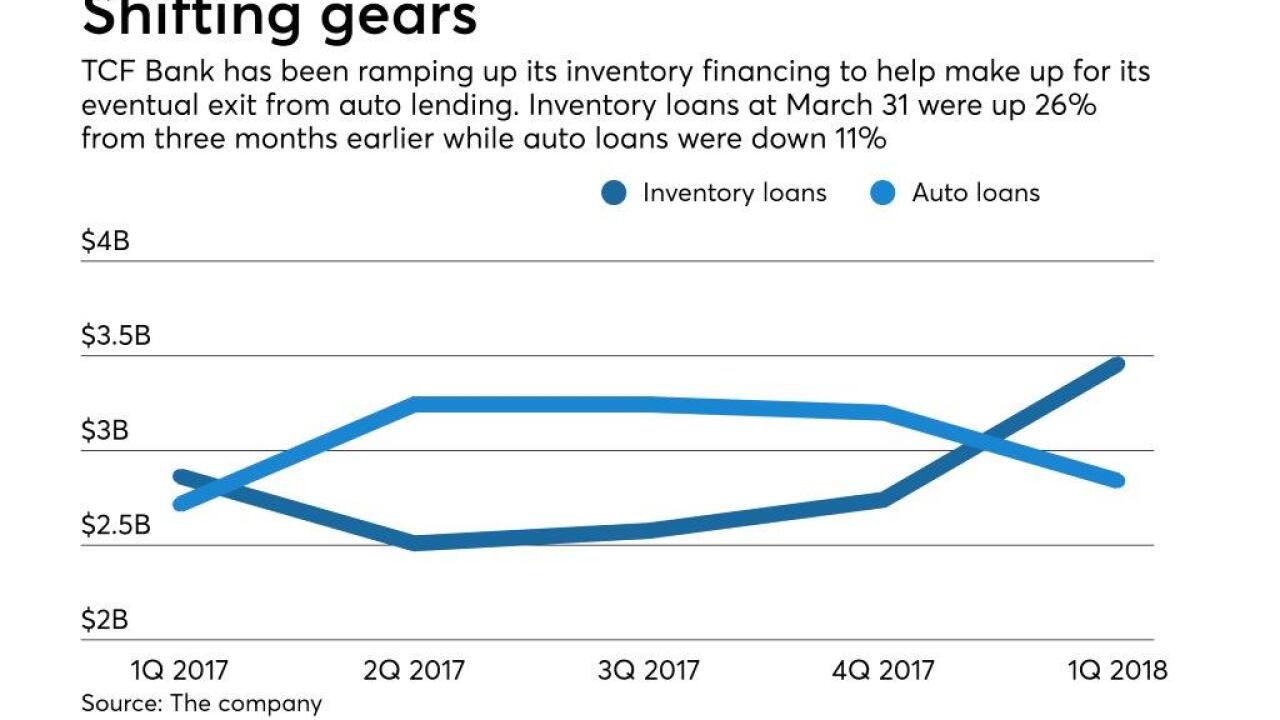

The move toward more asset-based finance shows how CEO Craig Dahl, in his second year at the helm, is reshaping the Minnesota company after its surprise exit from auto lending last year.

April 23 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The issues at Wells Fargo extend beyond the fines; Ally Financial's auto finance chief departs; ICBA chief Cam Fine signs off; and more from this week's most-read stories.

April 20 -

The eight credit unions represent a “reach increase” of nearly 7 million consumers and combined assets of over $1.7 billion.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

Readers react to the Senate overriding the Consumer Financial Protection Bureau's auto lending guidance, weigh in on House efforts to reform the Dodd-Frank Act and debate technology being used to replace new branches.

April 19 -

Tim Russi played a key role in the company’s transition away from its once-close relationship on General Motors. He will be succeeded by Doug Timmerman, a 32-year Ally veteran.

April 19