-

The firm reported that its new credit union clients — representing an aggregate of more than 450,000 members — signed on for GrooveCar's online vehicle-buying program.

April 26 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 Public Citizen

Public Citizen -

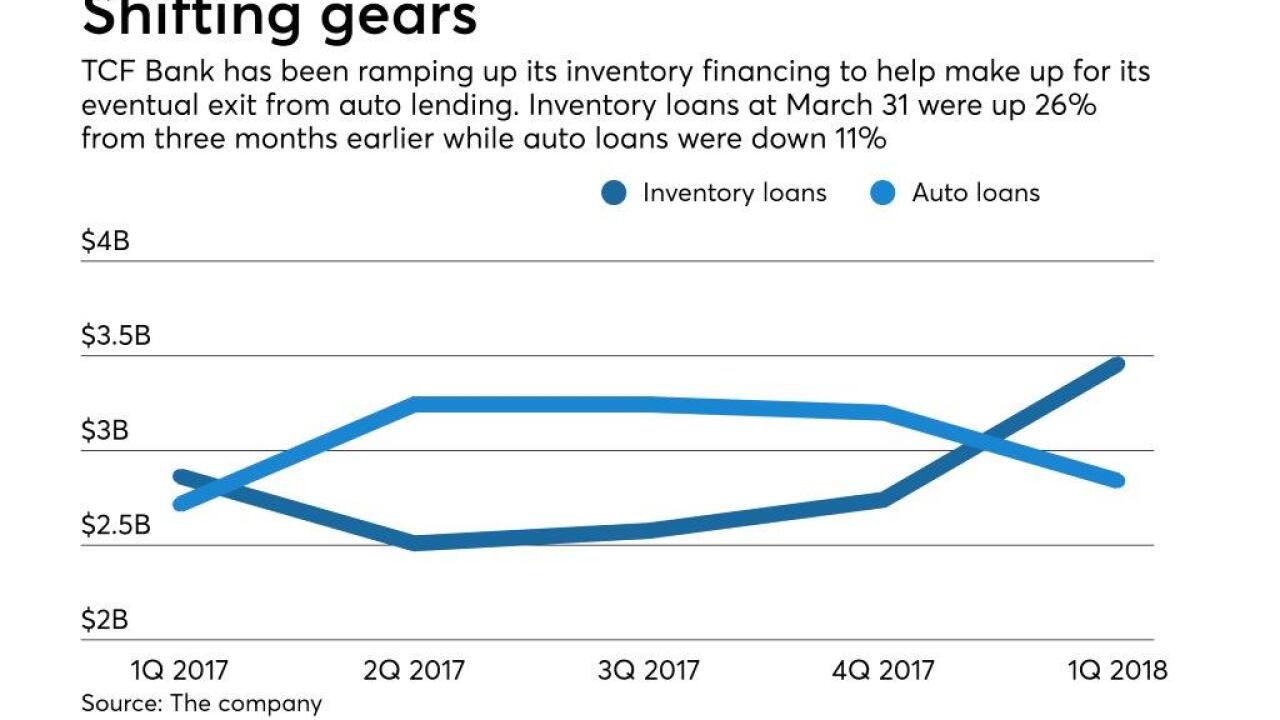

The move toward more asset-based finance shows how CEO Craig Dahl, in his second year at the helm, is reshaping the Minnesota company after its surprise exit from auto lending last year.

April 23 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The issues at Wells Fargo extend beyond the fines; Ally Financial's auto finance chief departs; ICBA chief Cam Fine signs off; and more from this week's most-read stories.

April 20 -

The eight credit unions represent a “reach increase” of nearly 7 million consumers and combined assets of over $1.7 billion.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

Readers react to the Senate overriding the Consumer Financial Protection Bureau's auto lending guidance, weigh in on House efforts to reform the Dodd-Frank Act and debate technology being used to replace new branches.

April 19 -

Tim Russi played a key role in the company’s transition away from its once-close relationship on General Motors. He will be succeeded by Doug Timmerman, a 32-year Ally veteran.

April 19 -

Bill to end the guidance intended to fight discriminatory lending now goes to the House; card company’s push to make more loans to customers pays dividends.

April 19 -

Passage of a resolution blocking guidance on auto loan pricing could set a precedent that allows Congress to nullify other long-past regulatory issuances.

April 18 -

The Senate voted Wednesday to block guidance issued by the Consumer Financial Protection Bureau in 2013 that was meant to stop discriminatory markups on indirect loans made by car dealers.

April 18 -

The Senate is expected to pass a bill that would ax controversial guidance on loans at car dealerships; lower tax rate may have skewed year-on-year comparisons.

April 18 -

As the Senate closes in on overturning the Consumer Financial Protection Bureau's 2013 indirect auto loan rule, a central question is how lasting the congressional measure will be in limiting the CFPB's authority.

April 17 -

Lawmakers should not toss out an agency rule aimed at curbing auto dealer markups that adversely impact borrowers of color.

April 17

-

Sixty-four consumer groups are speaking out against a Senate measure, expected to be voted on this week, that would overturn the Consumer Financial Protection Bureau's 2013 regulation on discriminatory pricing by auto lenders.

April 16 -

A 28% increase in lease assets helped offset stagnant growth in traditional auto lending.

April 13 -

Concerned about rising default rates, banks "significantly" tightened underwriting in the first quarter, the Bank of England said in a report published Thursday.

April 12 -

Retail banking chief Christian Sewing will become CEO immediately; higher deposit rates could trim lending margins as banks head into earnings season.

April 9