-

Credit unions enjoyed especially strong loan demand from car buyers — helping to push overall loan growth to twice the rate of what banks saw in the first quarter — following a lull stemming from pandemic-era setbacks.

June 15 -

Loans to car sellers plummeted earlier in the pandemic due to chip shortages that hampered vehicle production. But supply improvements since last fall have fueled the start of a rebound.

January 21 -

A lawsuit filed by Attorney General Maura Healey last year said Credit Acceptance Corp. in Michigan made predatory loans to Bay State borrowers and used deceptive practices to collect debt.

September 1 -

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The price for the 20% stake in Santander Consumer USA Holdings that Santander does not already own is significantly higher than what the buyer first offered in July.

August 24 -

Tanya Sanders, who joined the company in 2019, takes the reins as the division's loan growth is on an upswing. She will succeed Laura Schupbach, who is retiring after 26 years at Wells.

July 21 -

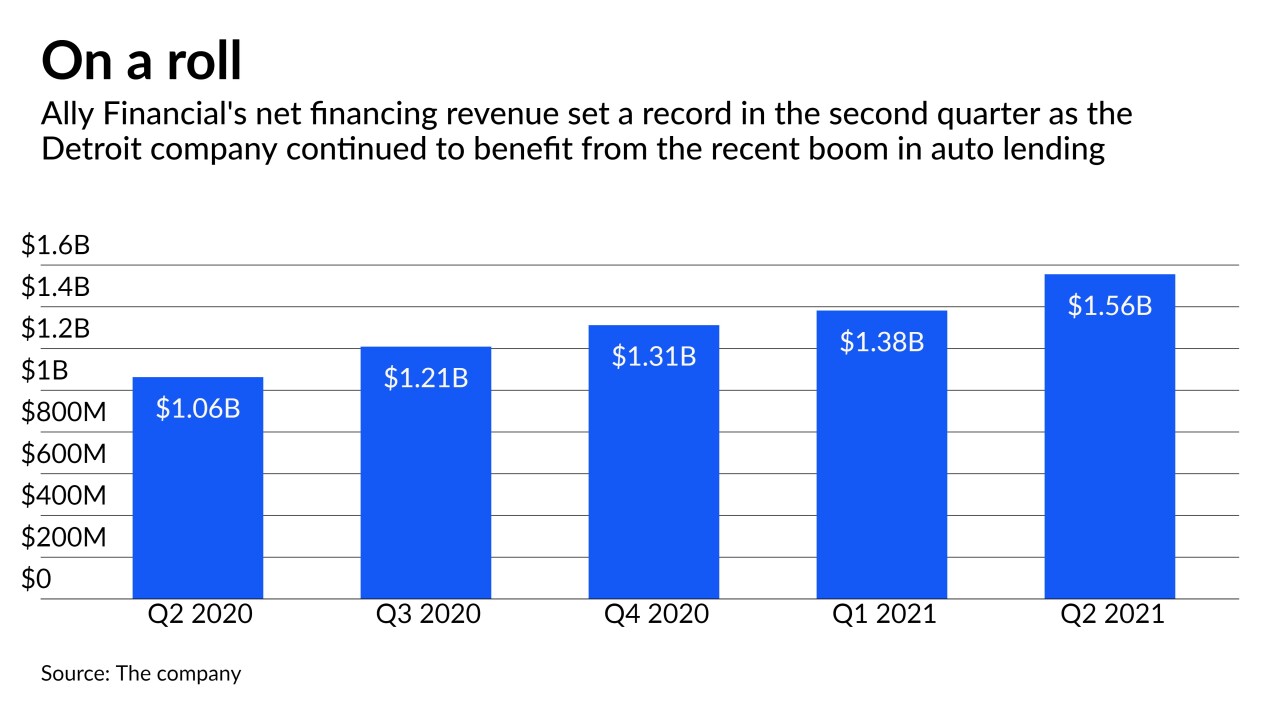

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

July 2 -

Car sales are booming, but credit unions are financing fewer purchases of new vehicles as borrowers migrate to digital channels.

June 14 -

The nation’s largest mortgage lender plans to use a new partnership with the financial technology company AutoFi to sell more cars to its home loan customers.

May 5 -

More than a year into the pandemic, with the U.S. economy improving and consumers having paid down debt, bankers are finally loosening the reins in auto lending and credit cards.

May 5 -

Looming defaults and the potential for heavier regulatory scrutiny have prompted banks to pull back from the sector. Is that a good thing?

April 28 -

The company’s retail banking and auto-lending businesses in the U.S. generated a larger share of overall profits in the first quarter, and Executive Chairman Ana Botín and other executives unveiled expansion plans for both units.

April 28 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16 -

-

In the midst of the pandemic recession, banks have benefited from government stimulus payments to consumers, low interest rates and constraints on the supply of new vehicles. But intensifying competition and real concerns about borrowers’ ability to pay loans that went into forbearance could soon threaten profits and credit quality.

March 4 -

Rohit Chopra, President Biden’s nominee to lead the Consumer Financial Protection Bureau, has not minced words in calling out private companies for wrongdoing. He could get a grilling from Banking Committee Republicans and some opposition on the Senate floor.

February 26 -

After a slowdown in 2020, inventory shortages and other factors could make the months ahead a grind for many lenders.

January 20 -

The Detroit automaker says it will stick to car loans and steer clear of mortgage lending if regulators approve its application to establish an industrial bank.

December 17 -

The Pittsburgh company also sold a portfolio of indirect auto loans and repaid a large amount of Federal Home Loan Bank borrowings.

December 10