-

A thorough process for approving experiments with artificial intelligence, clear philosophical principles and diverse human involvement are some of the ways BofA says it's working to ensure AI does no harm.

October 8 -

The bank has been deploying artificial intelligence in every business line, conducting research to find out what consumers think about the technology, and holding a roundtable with experts to define "responsible" AI.

September 12 -

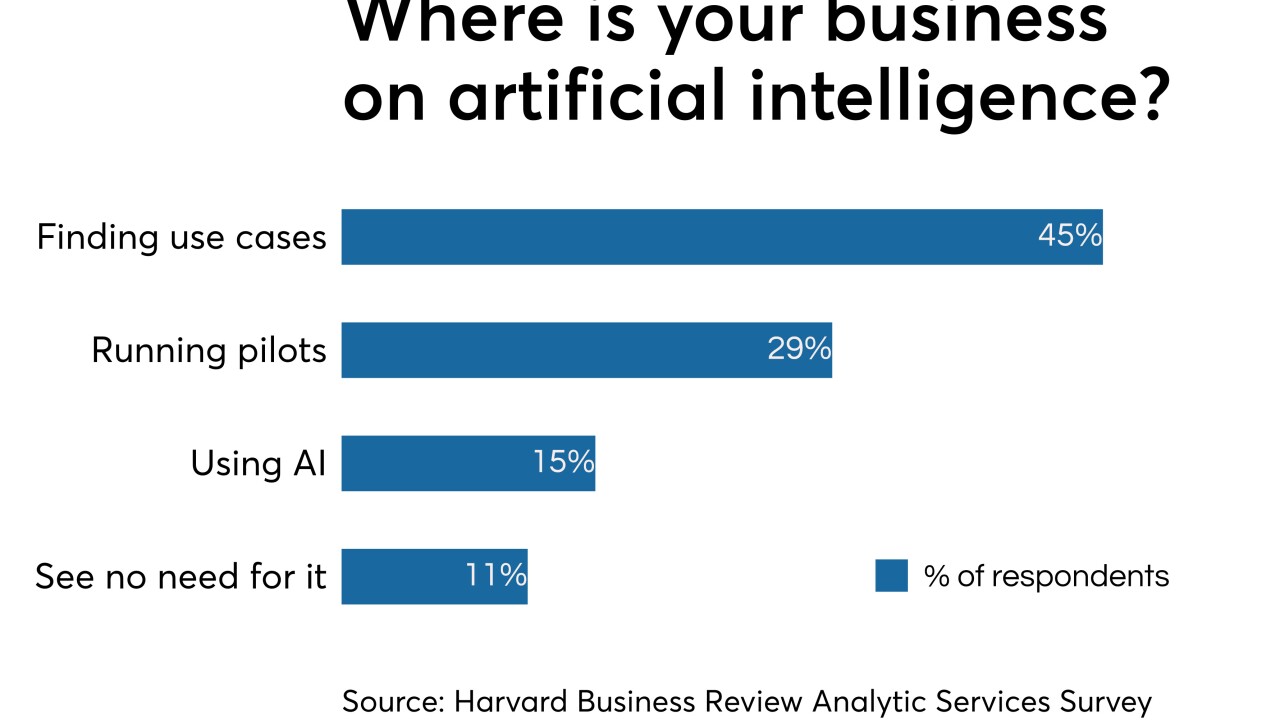

Credit decisions were a natural place to start with artificial intelligence, but now banks and credit unions are taking the technology to all parts of their businesses.

September 11 -

Enova has used AI in credit decisions for years. Now it’s having AI do the work of document verification, know-your-customer checks and more.

September 5 -

The acquisition of Radius Intelligence fits with the online lender's existing focus on small commercial borrowers.

September 3 -

Banks are using Receptiviti’s software to find signs of stress, collusion and questionable sales practices among employees.

August 26 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

Capacity, formerly Jane.ai, originally designed its chatbot to answer consumers' questions, but when employees started using it, that gave the startup an idea for a new business line.

August 21 -

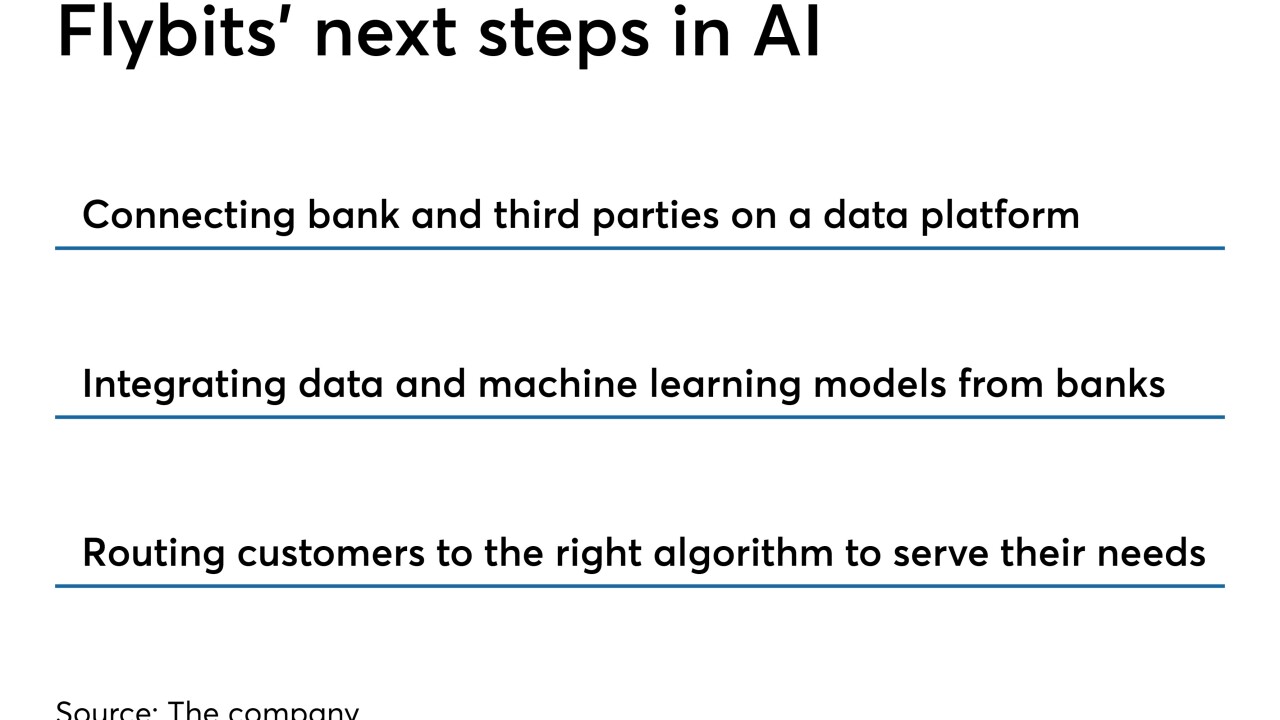

Flybits is building a marketplace to connect banks with third parties that might want to share data across channels.

July 18 -

The bank is taking a concept that has worked for years in the credit card world — artificial-intelligence-based fraud detection — and applying it to corporate customers' transactions.

July 15 -

Most people who won't tell another human being they're broke, but they will tell a chatbot, said Patrick Kelly, assistant vice president for digital product development at USAA.

November 1 -

Michelle Moore, head of digital banking at Bank of America, explains the top use case for the virtual assistant so far.

November 1 -

Burak Arik, founder and CEO of Maxitech, said the fintech's banking customers want to be able to offer virtual assistants for a wide array of purposes including personal financial and letting people pay their rent with a voice command.

November 1 -

To teach its automated advice platform how to help advisers communicate with clients, the company has sought to develop a bank of knowledge about psychology and other expertise beyond traditional wealth management.

July 12 -

First Horizon is using artificial intelligence software to analyze employee feedback on workplace surveys.

June 27 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

Some banks are experimenting with virtual assistants that, going beyond the routine tasks they perform today, could offer investment advice or make mortgage loans 24/7. But will they ever be able to talk a nervous client through a market crash?

August 23 -

Like many financial companies, the brokerage wants to go where customers are. Since that means communicating with them via a third-party platform, it is working through privacy and security issues.

August 22 -

Artificial intelligence is helping detect breaches the human eye can’t. But it also gives hackers an edge.

August 17 -

Merger creates a $20 billion payments processor; government seeks to delay fiduciary rule so it can make revisions.

August 10