CFPB News & Analysis

CFPB News & Analysis

-

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31 -

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

The agency solicited input on the effects of the CARD Act regulations as part of a statutory requirement that the bureau review policies 10 years after they are implemented.

August 25 -

The agency solicited input on the effects of the CARD Act regulations as part of a statutory requirement that the bureau review policies 10 years after they are implemented.

August 25 -

A borrower advocacy group is asking federal banking regulators to investigate PayPal and Synchrony Financial, which partner on a product that is used to offer high-cost education financing.

August 24 -

The bank has agreed to pay $97 million in customer restitution and a $25 million fine to settle allegations by the Consumer Financial Protection Bureau that it deceptively charged overdraft fees for certain ATM and debit card transactions.

August 20 -

The CFPB is giving stakeholders until Dec. 1 to file comments on a potential overhaul to its rules related to the Equal Credit Opportunity Act, which prohibits discrimination in credit and lending decisions.

August 19 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 19 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

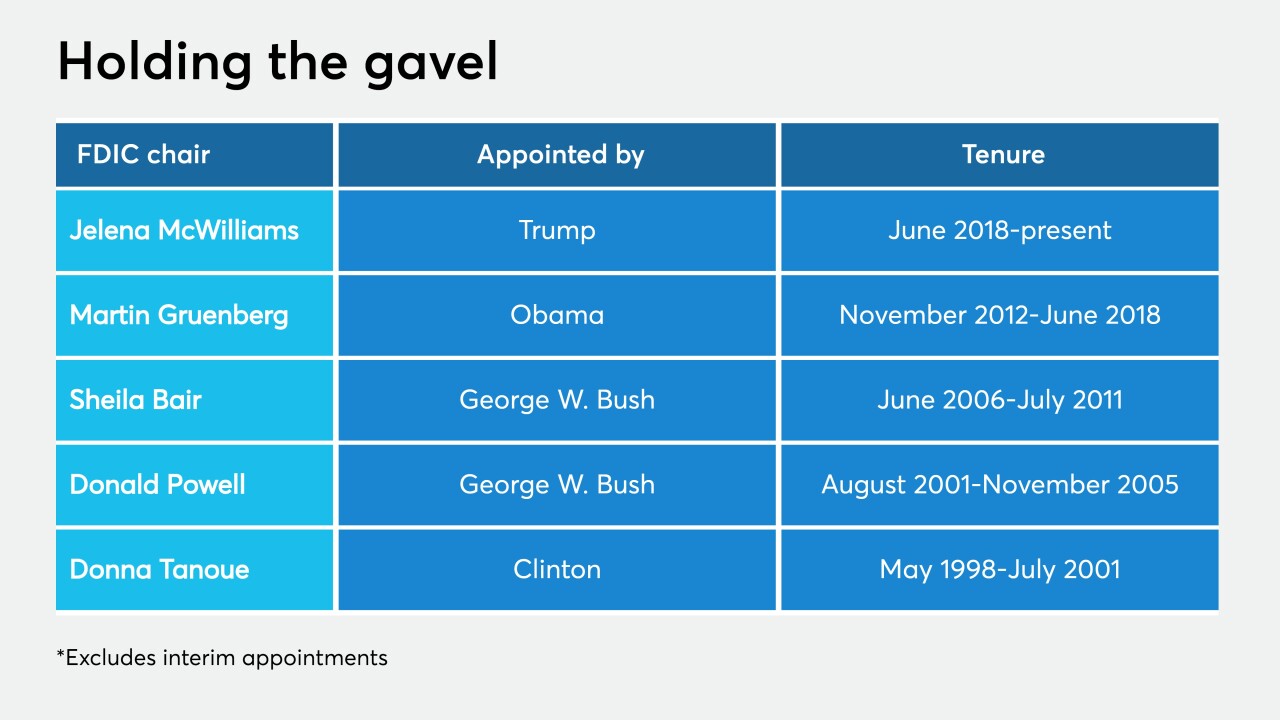

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 18 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 12 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 11 -

The agency sought feedback on potential changes to the Equal Credit Opportunity Act. But a coalition of industry and advocacy groups want a longer comment period to afford “a greater opportunity for thoughtful public participation.”

August 10 -

Kathy Kraninger told the House Financial Services Committee that she supports proposed action to revamp the bureau's leadership framework following a major Supreme Court decision.

July 30 -

Banks, data aggregators and fintechs have clashed for a decade over how consumers’ bank account data should be shared with third parties. The agency says it will offer a plan, and industry officials have plenty of suggestions already.

July 30 -

Regulators are urging banks to offer small-dollar loans again and lifting existing restrictions on nonbank lenders. But the real challenge is making those loans favorable to consumers without losing money.

July 29 -

Members of the Senate Banking Committee took the agency’s leader to task for eliminating underwriting requirements for small-dollar lenders, which lawmakers said has left consumers more vulnerable during the pandemic.

July 29