-

The Small Business Administration will allow lenders with less than $1 billion of assets to process applications in two days. The portal will open to all lenders on Tuesday.

January 13 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

Several community banks said they didn't have enough time to review the Paycheck Protection Program's application forms, forcing them to sit out Monday's reopening. The SBA is not saying when more lenders will be allowed to access its portal.

January 12 -

Bankers have several unanswered questions about the Paycheck Protection Program before it reopens to select lenders on Monday. Among them: When will forms be available, and which portal will the Small Business Administration use?

January 8 -

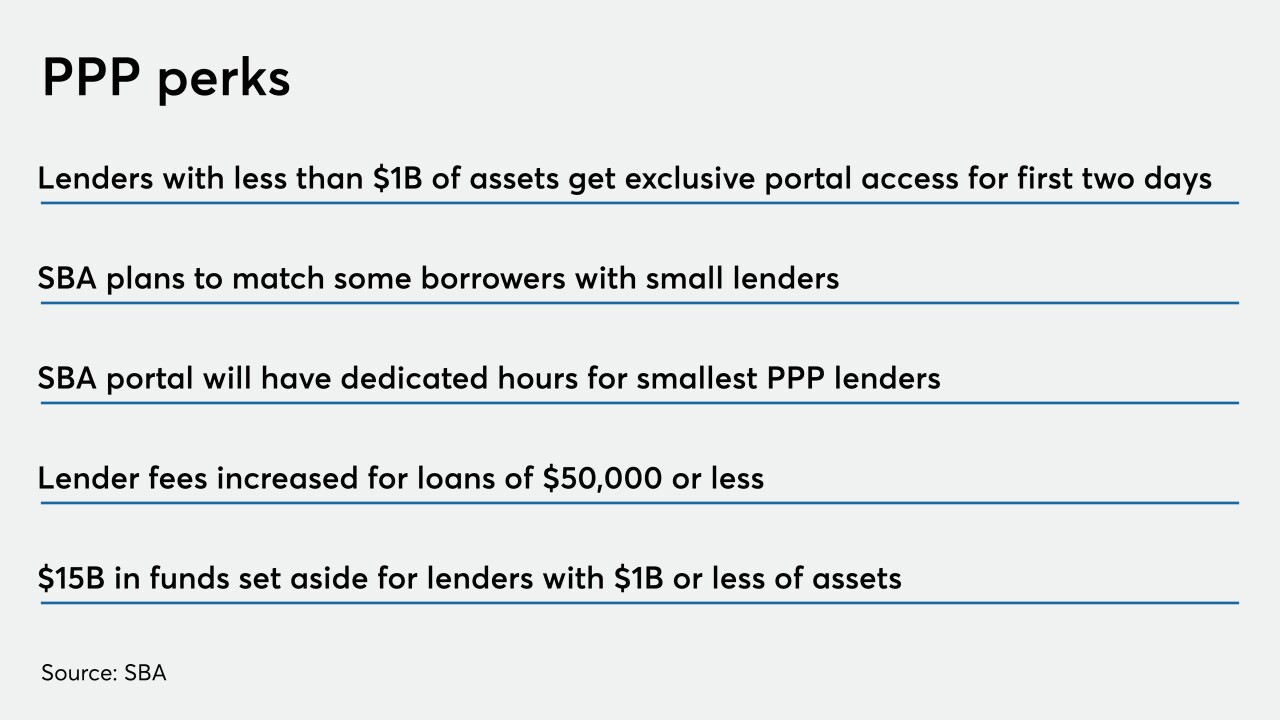

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7 -

The Office of the Comptroller of the Currency’s proposal to ensure banking services are available to polarizing businesses contradicts long-standing guidance on managing reputational risk, big banks argue. But gun makers, energy firms and others say it would correct an injustice.

January 6 -

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

January 6 -

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

January 4 -

Brian Argrett, whose City First Bank is being sold to Los Angeles-based Broadway Financial, would take the helm of the combined company at a time of increased national interest in reinvigorating minority-owned financial institutions.

January 4 -

From dealing with a flood of deposits to working with examiners virtually, credit unions were forced to quickly adapt to a new normal after the pandemic hit. Here's a look at some of the biggest changes and challenges they faced.

December 31