-

The legislation would let banks postpone the start date of the Current Expected Credit Losses accounting standard and delay categorizing pandemic-related loan modifications as troubled debt restructurings.

December 23 -

The legislation allows the Small Business Administration to waive fees and raise the guarantee for 7(a) and 504 loans, which could encourage more small businesses to apply for loans as the economy recovers.

December 22 -

The Oregon bank has launched a new division targeting businesses with up to $15 million in annual sales and tapped the banker who led its Paycheck Protection Program lending, Ashley Hayslip, to run it.

December 22 -

At least two items on the industry's Paycheck Protection Program wish list were delivered: provisions allowing many existing borrowers to obtain new funding and streamlined forgiveness for loans of $150,000 or less.

December 21 -

Win or lose, Citibank’s battle to recover half a billion dollars from an accidental payment is sure to prompt a review of internal controls in the industry and could have a lasting impact on the more than $1 trillion syndicated loan market.

December 21 -

The online lender, which raised $240 million, wants to take its artificial intelligence technology for evaluating borrowers to the next level and expand its partnerships with banks, its CEO says.

December 20 -

A new report from McKinsey says that cost-cutting alone won’t make up for the steep revenue declines brought on by low interest rates and sluggish loan demand. “For some banks,” argues the report’s author, “mergers might be the best way out.”

December 15 -

Fifth Third is partnering with Provide and Panacea Financial works with Sonabank in Virginia to meet the specialized needs of medical professionals who own their own practices.

December 15 -

The Columbus, Ohio, company says it has delivered on M&A promises before, and many observers say its deal for rival TCF Financial is an opportunistic move in its bid to build a Midwestern powerhouse. But others questioned whether Huntington's cost-cutting and profit expectations are too optimistic.

December 14 -

The Amarillo company is buying First National Bank of Tahoka, continuing the industry’s consolidation in the state.

December 14 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

Their $35 million refinancing of the Atlanta Hawks’ training complex is being touted as the first time that a professional sports team has secured a loan underwritten exclusively by Black banks.

December 10 -

The emergence of vaccines has boosted travel forecasts — and crude prices. The expected bump at the pump could help oil and gas companies get back on track with loan payments.

December 10 -

Time and again, Janet Yellen has warned Wall Street is piling a dangerous amount of debt onto the balance sheets of risky U.S. businesses. But as she prepares to take over as Treasury secretary, she may find it difficult to do anything quickly to rein in these markets, experts say.

December 10 -

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

A program that lets firms bundle Small Business Administration loans is on hold while Congress spars over a new budget. The impasse is causing headaches for banks that rely on loan sales for fee income.

December 9 -

Lawmakers need to create a coronavirus relief program targeting owners of smaller businesses facing more hardship than larger competitors that received much of the aid from the Paycheck Protection Program.

December 9 Signature Bank of New York

Signature Bank of New York -

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

December 8 -

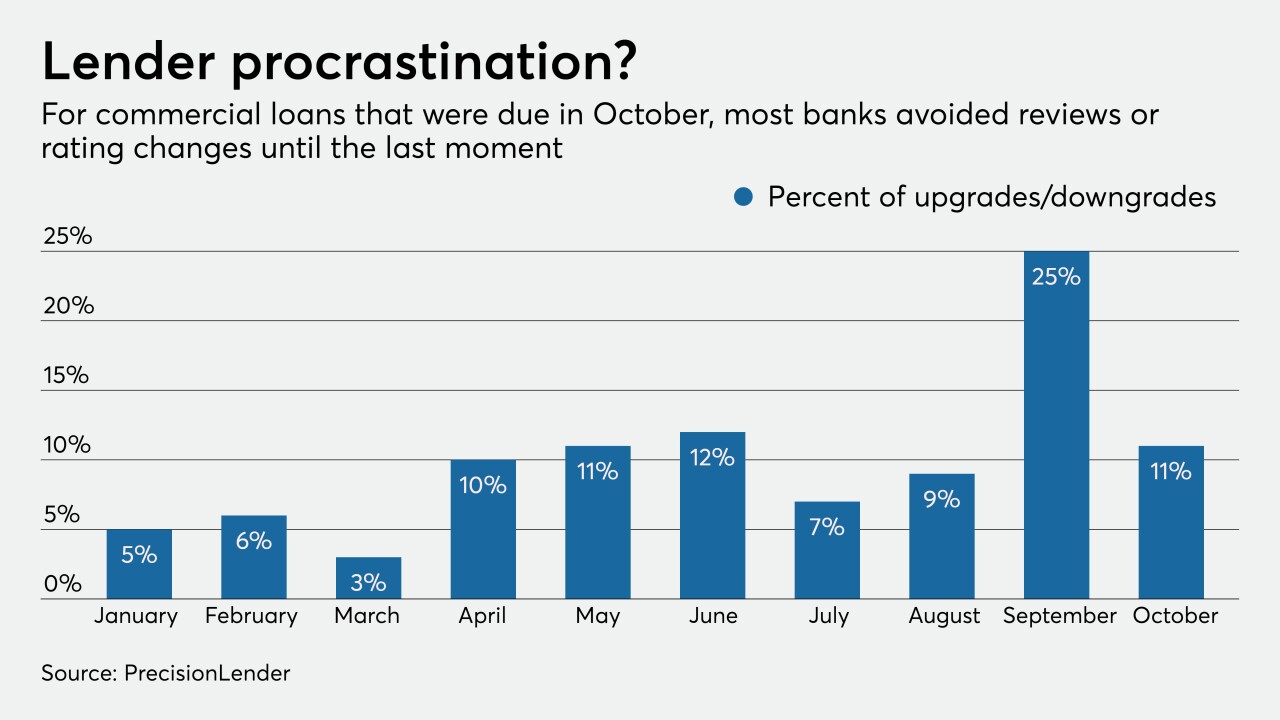

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

Montecito Bank in California began streamlining originations after a natural disaster decimated its community in 2018. The move paid off when the COVID-19 crisis hit and the bank had to quickly step up efforts to help clients.

December 8