-

The CEO says he is getting stronger and working remotely; if the lockdown lasts several months, the GSEs may need a bailout, FHFA head Mark Calabria says.

April 3 -

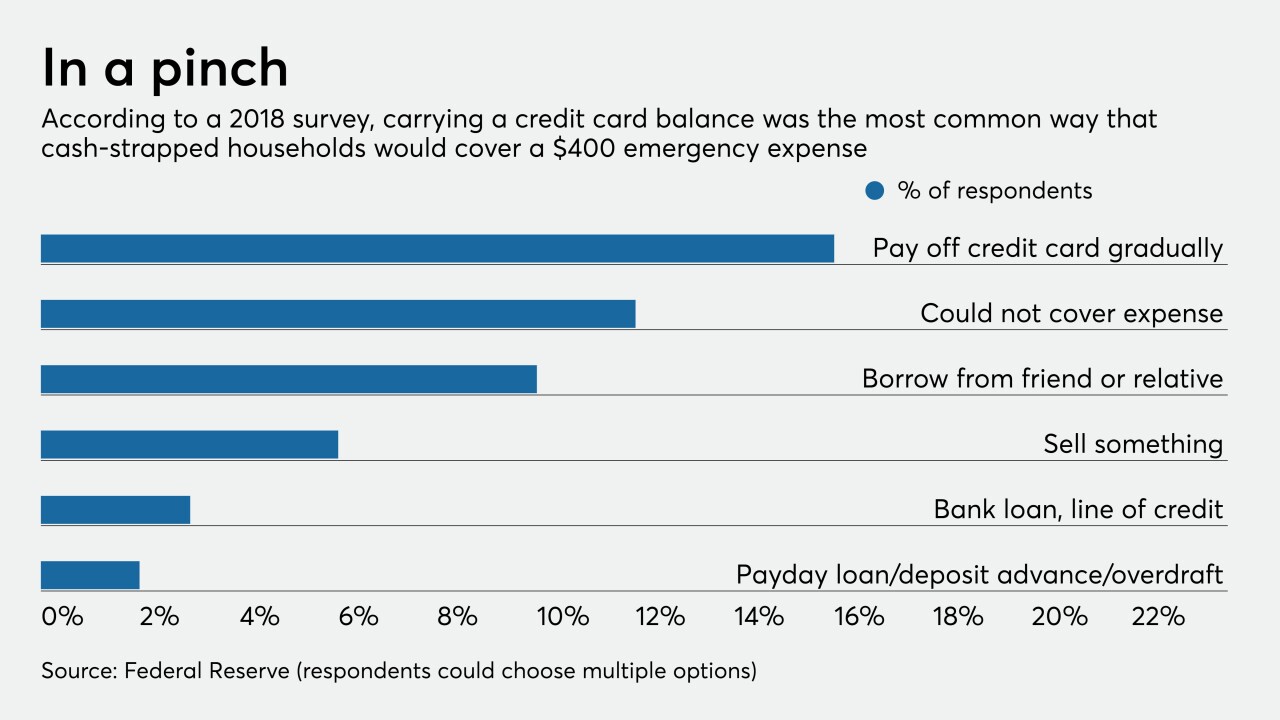

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

Lenders can offer deferred payments and capitalize on digital banking to help small businesses and consumers get back on their feet.

April 2

-

The one-year relief is intended to free up lending to consumers and businesses; the online small business lender not making loans, shrinks credit lines, staff.

April 2 -

The pandemic may force the Small Business Administration to rely more on fintechs and digital channels to hasten loan approvals, a shift that could stick.

April 1 -

The firms say they can't handle crushing loan demand from small and medium-sized businesses.

April 1 -

Online lenders can help the agency distribute loans faster as it gets set to deploy emergency funding to small businesses.

April 1 Kabbage Inc.

Kabbage Inc. -

Lenders and government guarantors can use loan technology to bring immediate relief to business owners, former OCC official Jo Ann Barefoot says.

April 1 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

The Treasury Department and Small Business Administration are responsible for distributing $350 billion in coming months.

March 31 -

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

March 31 -

The 2008 package proved some banks were too big to fail. But the rushed $2.2 billion stimulus shows now any company can be bailed out.

March 31 Polyient Labs

Polyient Labs -

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

On Dec. 31, 2019. Dollars in thousands, except for average loan amount.

March 30 -

Some corporations are willing to oblige, turning instead to new, pricier term loans or revolving credit lines rather than tapping existing ones, industry officials say.

March 30 -

Commercial real estate is facing another crisis as companies shift to work-from-home policies. Banks and regulators should brace themselves.

March 30 Community Bank Consulting Services

Community Bank Consulting Services -

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

March 27 -

The U.S. government will shortly funnel trillions of dollars into the economy to soften the coronavirus’ impact on a variety of industries and small businesses. Payment companies that are also lenders will soon find out if it’s enough to save the market.

March 27 -

Online lenders can help the agency distribute loans faster as it gets set to deploy emergency funding to small businesses.

March 27 Kabbage Inc.

Kabbage Inc. -

Citigroup CEO says it’s a “fine line” between supporting customers and burdening them with debt; Goldman gives away 600,000 N95 masks it had from prior scares.

March 27 -

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

March 26