With an economic downturn almost a certainty, credit unions need to move forward cautiously with member business lending.

MBLs totaled $80.7 billion at the end of December, making up 7.1% of all credit union loans, according to the February Credit Union Trends Report by CUNA Mutual Group.

There were already signs that demand for commercial credit was waning before the COVID-19 outbreak, but now that trend could accelerate further. With more Americans increasingly staying home to halt the spread of the disease, many businesses have seen big revenue hit. Credit unions need to monitor portfolios and implement comprehensive risk analysis to ensure they are prepared to weather the slowdown.

“There’s COVID-19 and the uncertainty of where our economy is headed,” said Dana Gray, SVP of commercial and business lending at Boeing Employees Credit Union. “The question now is more around not if a recession will occur, but how deep and how long?”

Several years ago the National Credit Union Administration

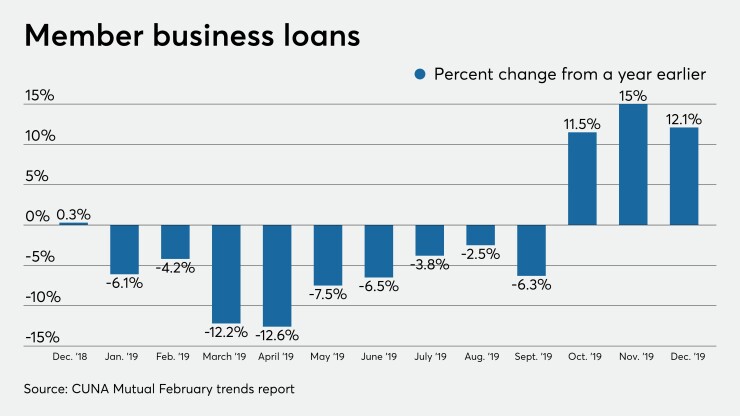

However, that is likely coming to an end. In 2019, credit unions posted a decline in member business loans in nine out of the 12 months from the same period a year earlier, according to the CUNA Mutual report. And in January, the percentage of approvals for small business loans at credit unions reached a new record low of 39.6%, down 0.7% year over year, according to data from Biz2Credit.

Credit unions’ failure to keep up with technology and the cap that limits most credit unions to lending no more than 12.25% of their assets fueled this dip, said Rohit Arora, CEO of Biz2Credit, which offers financing to small businesses.

“This trend will accelerate further now because credit unions are not able to keep pace with the technology spend they need in order to give a better online experience to customers,” Arora said. “Meanwhile, they cannot do much business lending or grow their asset base with the cap at 12.25%.”

The upcoming election may also cause credit unions to be conservative, said Greyson Tuck, board member at the consulting and law firm, Gerrish Smith Tuck. With a Republican in the White House, a more positive outlook on the prospects of business growth, government support and tax accommodation is likely, he added.

“Accordingly, if a Republican is elected, I think there would be more borrower demand than there would be if a Democrat is elected,” he said.

But now credit unions are facing more than just political uncertainty that comes with an election year. COVID-19 has upended much of daily life. Officials in many states have ordered non-essential businesses to close, schools to shutter and prohibited large gatherings. Jobless claims are expected to skyrocket this week as businesses lay off workers due to a decline in demand.

The Federal Reserve has taken a number of actions to try and stem the economic pain, including cutting interest rates.

Last year, interest rates were forecast at much higher levels than what actually happened, leading to higher-than-expected demand for commercial real estate loans with a good balance between purchase and refinance volumes, Gray said. Most of credit union member business lending is in CRE, and that holds true for the $22.2 billion-asset BECU. Ninety-seven percent of its business loan balances are in the CRE sector, and the institution has had virtually no delinquencies.

But now with interest rates so low and lenders perhaps reluctant to book new loans, activity is likely to skew to refinancing.

“This year we are now expecting significantly higher levels of refinance activity,” BECU’s Gray said. “Commercial refinance must now be looked at through a conservative lens, with greater consideration given to cash-back requests, debt yields by asset class and refinance-ability at loan expiration.”

Credit unions need to keep a close eye on other areas of commercial lending, such as non-owner occupied CRE and commercial-and-industrial loans, that are generally riskier than CRE. The higher risk embedded in non-owner occupied CRE is particularly evident in the retail segment, said Joel Pruis, senior director of Cornerstone Advisors. That’s because retail space can be increasingly unproductive as society transitions from brick-and-mortar stores to e-commerce retailers.

And that was before a global pandemic. Consumers may increasingly turn to online shopping now as a way to socially distance themselves from others.

C&I loans can be problematic because offering these loans may require a credit union to expand into treasury management, resulting in a significant investment, Pruis said.

To better navigate these risks, credit unions can identify business clients who are showing signs of deterioration in other behaviors, Pruis said. For instance, their lines of credit may be maxed out, or their credit score has declined.

“Those are warning factors that the business has run into problems,” he said. “Credit unions should really intervene with that matter to help correct the behavior so both can come out much better seated.”

In addition, gauging the strength of asset classes over multiple cycles and conducting regular scenario analysis can reveal important information about the portfolio, Gray said.

“We keep ourselves challenged to understand how the asset class performs through the cycle, not just in periods of economic strike and success,” she said. “Regional characteristics may look different but we believe the asset class with the lowest historical and projected loss rate is multifamily.”

Although COVID-19 is causing economic turmoil, it is different than what the industry experienced during the financial crisis. Wide swings in real estate activity contributed to loosening of underwriting standards, which eased dramatically in the run-up to the 2008 financial crisis. Credit unions made changes in response to the financial crisis and are in a better position today.

Still, credit unions should scrutinize loan portfolios and the specific industries they have loaned to.

“That’s not the case anymore — the belief that the collateral is going to continue to improve,” Tuck said. “The underwriting criteria is much stronger today than 2008 and I think we are better situated. If you've been through battle once and you made it through, when you go to battle again, you'll be battle-tested.”