-

Lynn Harton, the Georgia bank's CEO and a 20-year BB&T veteran, is considering acquisitions in Alabama, Florida and Tennessee markets where the entity soon to be named Truist Financial has a high profile.

June 13 -

Despite renewed calls from Democrats looking to USPS to offer banking services, policymakers should instead consider reforms that would permit private-sector firms like Walmart and Amazon to offer a wider array of financial products.

June 13

-

The Los Angeles company has established a network that is designed to help verify the identities of consumer and small-business borrowers. It says 20 lenders are participating and that it is trying to recruit more.

June 12 -

The Rhode Island company is counting on disruption from the megamerger to accelerate its Southeast expansion, according to commercial banking chief Don McCree. But BB&T’s Kelly King has a message for him: Not so fast.

June 11 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

On Mar. 31, 2019. Dollars in thousands.

June 10 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7 -

The CFPB issued a final rule late Thursday to delay the compliance date for mandatory underwriting provisions of the 2017 payday lending rule.

June 7 -

Readers weigh potential risks in the leveraged loans market, debate Herb Sandler's legacy, consider the role the Fed should play in real-time payments and more.

June 6 -

Options include legislation to study the risk of leveraged loans, more aggressive action by the Financial Stability Oversight Council and additional capital buffers. Policymakers may also choose to do nothing.

June 6 -

Nominated for a full term at the central bank, Michelle Bowman told senators that bankers should not fear repercussions for servicing hemp growers after the crop was legalized.

June 6 -

The U.S. economy is on solid footing except for one potential trouble spot, according to Bank of America's Chief Executive Brian Moynihan: leveraged loans — a business the bank has dominated for a decade.

June 5 -

The online lending marketplace will use the equity financing from WestBridge Capital to diversify the digital products its offers banks trying to compete for small-business borrowers, its CEO says.

June 4 -

Lawmakers waded into a growing debate about the threat posed by corporate credit risk.

June 4 -

Five executives were appointed to new roles within the revamped business unit that houses business banking, government and institutional banking and middle-market banking. All will report to commercial banking head Kyle Hranicky.

June 4 -

Critics have knocked the product, which provides workers access to their wages before payday, as another form of predatory lending. But California has a new bill that would create a legal framework for this short-term lending alternative, and policymakers elsewhere should follow the state's lead.

June 3 Nevcaut Ventures

Nevcaut Ventures - cuj daily briefing lead

Credit unions often tout their member-friendly nature but recent coverage of how the movement handled taxi medallion loans could open the industry up to a reputational hit.

June 3 -

While Noah Bank’s CEO has been accused of self-dealing in connection with SBA loans, its chairman says the directors had a succession plan ready to go and are rallying to rescue the bank’s reputation.

May 31 -

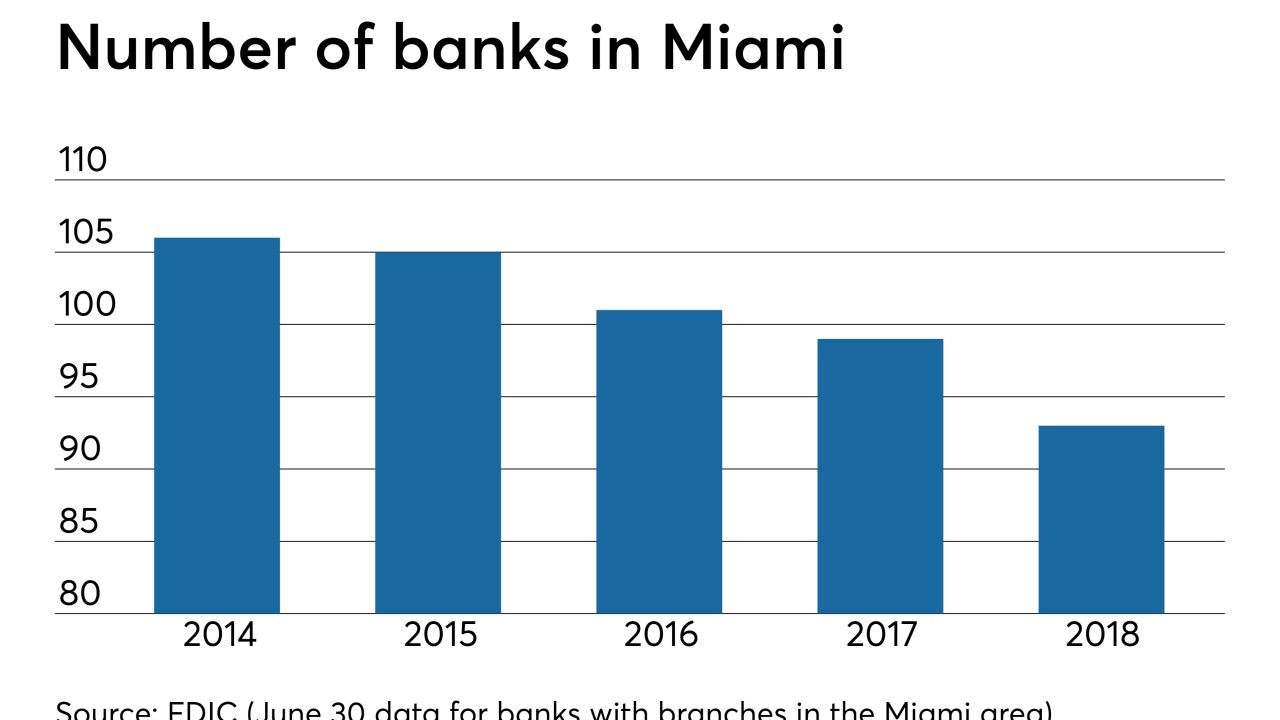

A strong economy and the chance to court Hispanic customers and businesses have banks interested in the region once more.

May 29 -

Jelena McWilliams said federal bank regulators could begin "within a week or so" to discuss a draft proposal for reforming the Community Reinvestment Act.

May 29