-

The U.S. economy is on solid footing except for one potential trouble spot, according to Bank of America's Chief Executive Brian Moynihan: leveraged loans — a business the bank has dominated for a decade.

June 5 -

The online lending marketplace will use the equity financing from WestBridge Capital to diversify the digital products its offers banks trying to compete for small-business borrowers, its CEO says.

June 4 -

Lawmakers waded into a growing debate about the threat posed by corporate credit risk.

June 4 -

Five executives were appointed to new roles within the revamped business unit that houses business banking, government and institutional banking and middle-market banking. All will report to commercial banking head Kyle Hranicky.

June 4 -

Critics have knocked the product, which provides workers access to their wages before payday, as another form of predatory lending. But California has a new bill that would create a legal framework for this short-term lending alternative, and policymakers elsewhere should follow the state's lead.

June 3 Nevcaut Ventures

Nevcaut Ventures - cuj daily briefing lead

Credit unions often tout their member-friendly nature but recent coverage of how the movement handled taxi medallion loans could open the industry up to a reputational hit.

June 3 -

While Noah Bank’s CEO has been accused of self-dealing in connection with SBA loans, its chairman says the directors had a succession plan ready to go and are rallying to rescue the bank’s reputation.

May 31 -

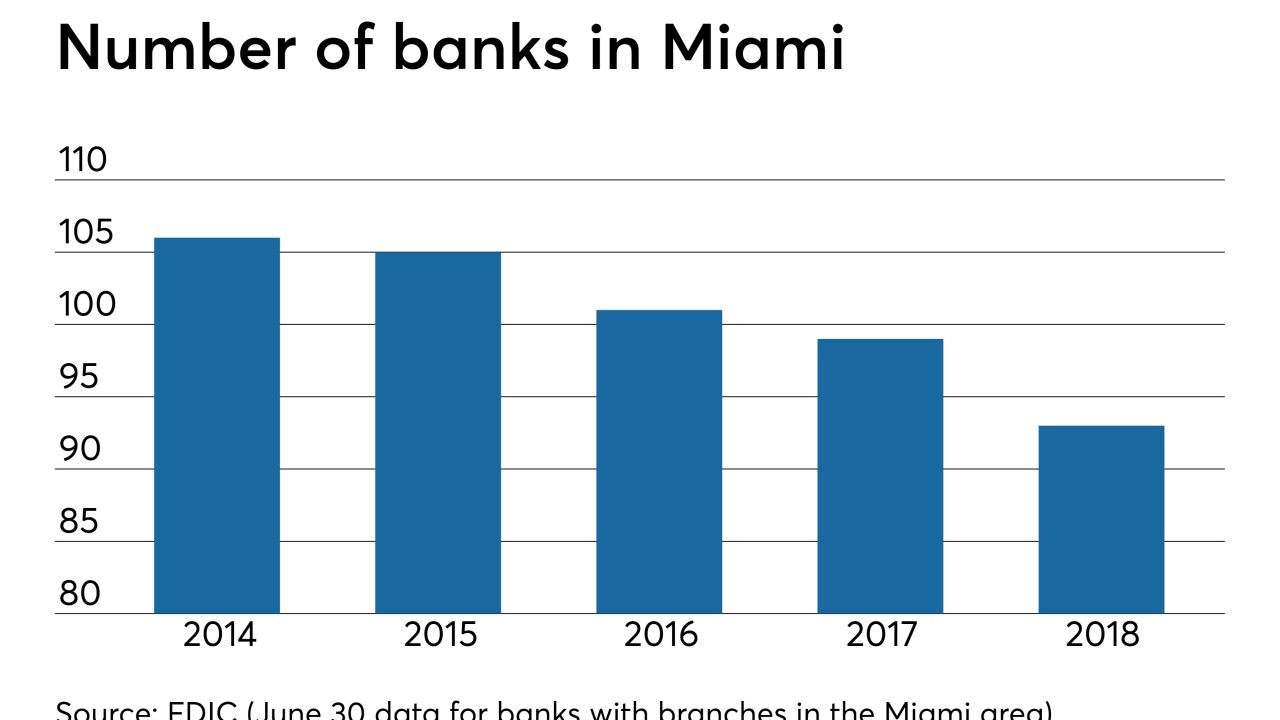

A strong economy and the chance to court Hispanic customers and businesses have banks interested in the region once more.

May 29 -

Jelena McWilliams said federal bank regulators could begin "within a week or so" to discuss a draft proposal for reforming the Community Reinvestment Act.

May 29 -

More than 66% of the banks reported a jump in net income during the first quarter but new risks are emerging in interest rates and underwriting, the Federal Deposit Insurance Corp. said Wednesday.

May 29 -

The agency's spring rulemaking agenda includes the process for collecting small-business data as well as underwriting rules for GSE-backed loans. But what's missing from the list may be just as important.

May 28 -

The JPMorgan chief executive said he couldn't understand why Wells Fargo could have CEO Tim Sloan step down without a successor ready to go.

May 28 -

In a state where laws are unusually favorable to high-cost business lenders, taxi drivers are not the only small-business people getting trapped in loans they can't afford to pay back. The question is, what are policymakers going to do about it?

May 24 American Banker

American Banker -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Some financial institutions' card portfolios are taking a hit.

May 24 -

Readers weigh in on the role of the Financial Accounting Standards Board, consider personnel changes at the Consumer Financial Protection Bureau, debate the viability of public banks and more.

May 23 -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Banks' card portfolios are taking a hit.

May 23 -

Biz2Credit is offering its Biz2X platform to all banks after gaining HSBC and Popular Bank as clients.

May 21 -

First Internet will gain lenders and servicing staff, along with offices in Chicago and Indianapolis, from the deal.

May 21 -

Although higher corporate debt could hurt the economy, Federal Reserve Chair Jerome Powell argued changes made since the last crisis will guard against a meltdown.

May 20 -

The Bay Area is a booming market with a limited number of smaller banks. The high premium Presidio is receiving from Heritage Commerce might spark more M&A activity.

May 20