-

JPMorgan Chase, the biggest funder of fossil-fuel companies globally, is pledging a 35% reduction in “operational carbon intensity” for its oil and gas portfolio by the end of this decade.

May 13 -

Applications for small business and commercial real estate loans are rising, creating some optimism among lenders — and more temptation to loosen standards to land those borrowers.

May 13 -

The Pennsylvania company will offer commercial loans and treasury management services after hiring bankers in Dallas and Orlando.

May 12 -

Some worry the Senate’s rejection of the OCC rule hampers efforts to clarify legal standards for banks selling loans to fintechs.

May 12 -

On Dec. 31, 2020. Dollars in thousands.

May 10 -

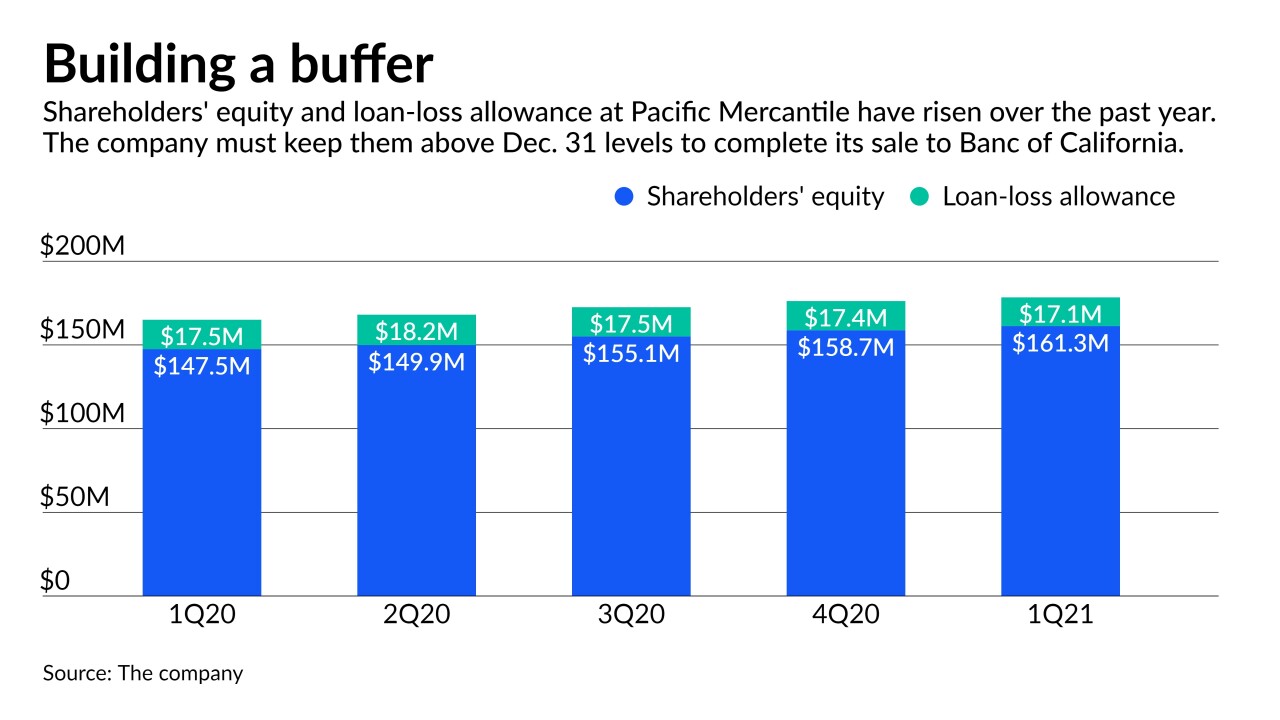

About 13% of Pacific Mercantile Bancorp's loans are tied to high-risk sectors such as entertainment and food services. The company must build shareholders' equity or its loan-loss allowance above last year's levels to make sure the sale goes through.

May 6 -

Younger is an executive director on BBVA's loan syndication team.

May 5 -

The head of government guaranteed lending at WSFS, Caruso aims to parlay the bank's success with Paycheck Protection Program lending to better serve early-stage small businesses.

May 5 -

As chief credit officer, Horton oversaw the bank's certification as a Small Business Administration lender and participation in the Paycheck Protection Program.

May 5 -

Most executives are comfortable crossing over $1 billion of assets, where more frequent exams are the biggest supervisory change. But few are eager to take on the compliance burdens that accompany the jump above $10 billion.

May 5 -

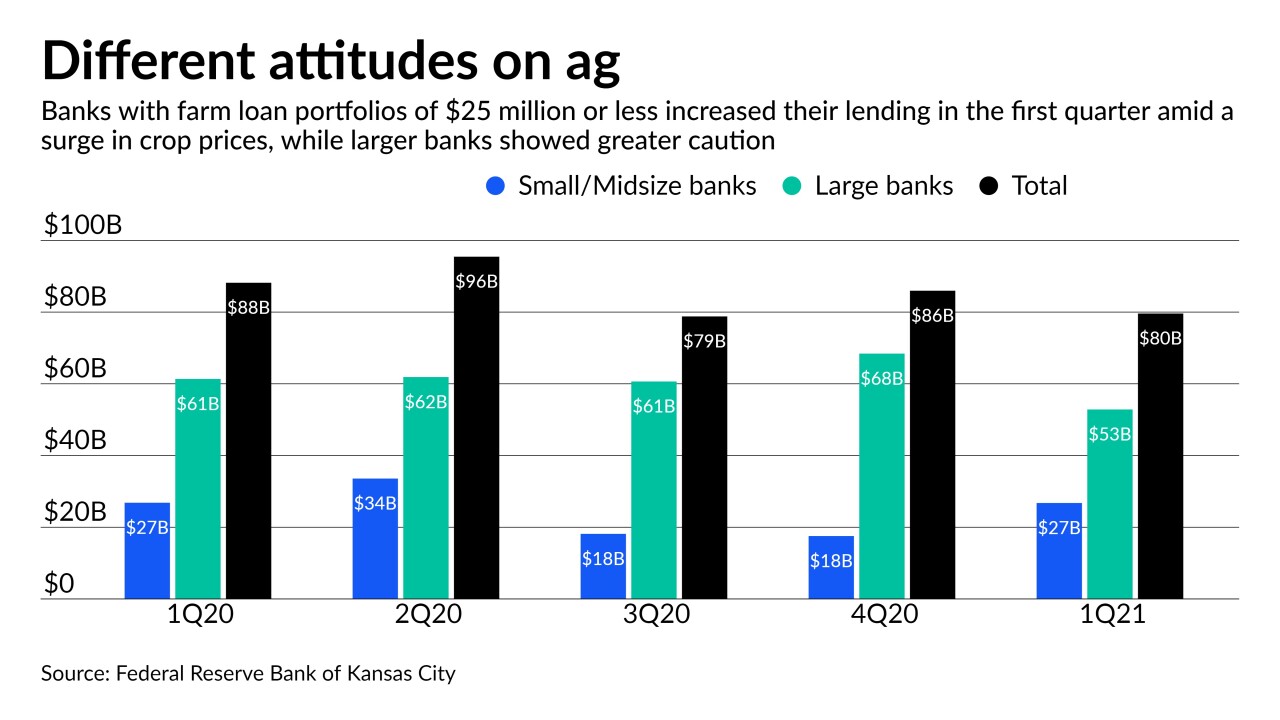

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

May 5 -

The Paycheck Protection Program has about $8 billion remaining, with those funds earmarked for community development financial institutions, minority depository institutions and other mission-driven lenders.

May 5 -

Lenders including Howard Bancorp and First Carolina Bank are shunning acquisitions as a route into new markets, to avoid overpaying for targets and inheriting potential loan problems.

May 5 -

The specialty lender provides leases for preowned Ferraris, Porsches, McLarens, Lamborghinis and other luxury cars.

May 4 -

With the Paycheck Protection Program likely winding down at the end of the month, many lenders are seeing heightened demand for the Small Business Administration’s 7(a) and 504 loans.

May 3 -

The Tennessee bank's deal for Fountain Leasing is set to close this month.

May 3 -

The fintech credit card provider is pitching to banks the same software it uses to determine borrowers' creditworthiness. But whether banks are ready for technology that emphasizes cash-flow analysis over traditional credit scoring is open to debate.

April 28 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

April 28 -

The investment, tied to PNC's deal to acquire BBVA USA, was always going to be large but seemed to grow as CEO Bill Demchak got intimately involved in the discussions and the needs of communities and businesses hit hard by the coronavirus pandemic became more apparent.

April 28 -

Banks could be a better option than payday lenders to meet consumers’ short-term credit needs. But all the OCC’s regulation does is enable partnerships that circumvent state usury laws.

April 28 The Pew Charitable Trusts

The Pew Charitable Trusts