Consumer banking

Consumer banking

-

The central bank is creating a facility to provide financing to banks participating in the Small Business Administration’s Paycheck Protection Program.

April 6 -

Credit unions in the Great Lakes State saw widespread membership growth in 2019 but it was the third consecutive year in which the pace of growth slowed.

April 6 -

After Congress temporarily lowered the leverage ratio used by smaller institutions, the federal agencies said they would allow a one-year transition before banks have to comply again with the regular standard.

April 6 -

Few lenders are finding creative ways to provide much-needed financial advice and emergency services online.

April 6 -

The only current CEO who steered a major U.S. bank through the financial crisis, Dimon said JPMorgan’s earnings will be “down meaningfully” this year as a result of the coronavirus pandemic.

April 6 -

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

Sen. Marco Rubio, R-Fla., said that $349 billion will likely not be enough meet loan demand from small businesses seeking a lifeline to help them weather the economic downturn brought on by the coronavirus outbreak.

April 5 -

While the federal government is touting the early success of the Paycheck Protection Program, community banks are complaining about headaches and glitches.

April 3 -

CUs in the Eastern European nation were originally shuttered out of fears they could further the spread of COVID-19 but have been allowed to resume operations provided certain safety precautions are met.

April 3 -

The $5.9 billion-asset Liberty Bank in Middletown had set aside $5 million to make small-dollar loans to customers affected by the coronavirus pandemic.

April 3 -

The proposed Agility Bank would rely heavily on digital offerings. It is pursing a national charter with the Office of the Comptroller of the Currency.

April 3 -

Limiting access to branches because of the pandemic has forced executives to re-examine whether they offer enough mobile and online services.

April 3 -

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

April 2 -

Digital banks outscored brick-and-mortar banks in a recent J.D. Power study of customer satisfaction. However, the survey pointed to shortcomings in call center services, which are in high demand during the COVID-19 pandemic.

April 2 -

Like his longtime boss and mentor, Bob Wilmers, Jones is deeply committed to investing in communities, controlling expenses and delivering value for investors. But he also has novel ideas for modernizing M&T, like doing away with its "permission culture," improving the customer journey and positioning it as a go-to bank for tech talent.

April 2 -

The U.K. company has recruited Bruce Wallace, formerly of Silicon Valley Bank, and Ronald Oliveira, who was with AvidBank, to lead its expansion here.

April 2 -

Lenders can offer deferred payments and capitalize on digital banking to help small businesses and consumers get back on their feet.

April 2 -

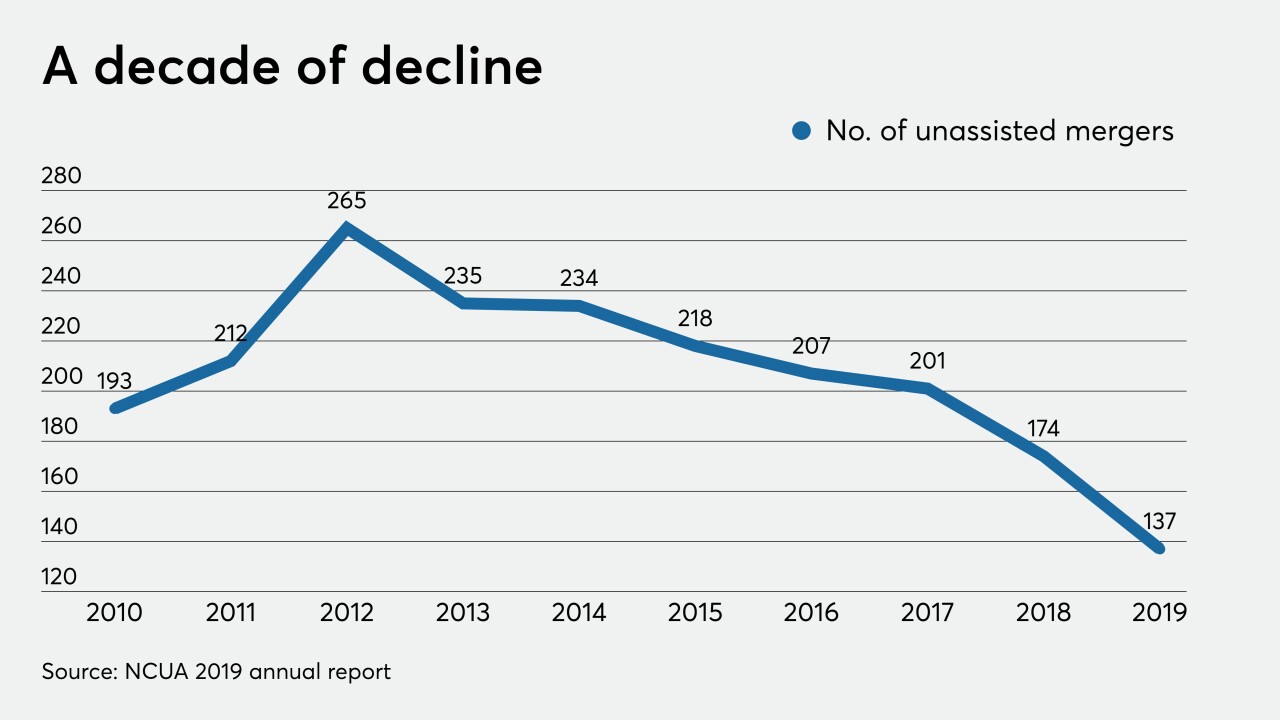

The number of deals per year was declining even before the pandemic, and it's unclear when things might pick up again.

April 2 -

The pandemic may force the Small Business Administration to rely more on fintechs and digital channels to hasten loan approvals, a shift that could stick.

April 1 -

The app, set to roll out this month, will be offered to the 38 million Office 365 users and can connect via the data aggregator Plaid to all bank and card accounts.

April 1