Consumer banking

Consumer banking

-

In-person branch use will continue, but retail banks should nonetheless double down on building intuitive, easy-to-use mobile experiences that drive customer satisfaction and brand loyalty.

March 23 -

Banc of California, which last bought a bank in 2013, has agreed to pay $235 million in stock for Pacific Mercantile, which is based in Costa Mesa, Calif.

March 22 -

The depositor-owned banks are discouraged from participating in the Emergency Capital Investment Program because they can't issue preferred stock to back loans for underserved communities. It's another reason to overhaul their capital rules, mutuals argue.

March 22 -

Front-line employees yearn to be told they still have a critical role to play, as more customers are seeking in-person help amid the pandemic.

March 19 -

The Florida bank will expand to the east with its pending purchase of Hillsboro Bank.

March 18 -

Like the fintechs SoFi and LendingClub, DLP Real Estate Capital is acquiring a community bank largely to lower the cost of funding loans.

March 18 -

Members of the Gunther family who own about a third of the Utah company's stock said they plan to vote against several directors at this year's annual meeting.

March 18 -

The American Fintech Council and the Financial Technology Association say they’ll promote responsible innovation, fair access to financial services and more. Their dozens of members include some of the biggest names in fintech.

March 17 -

Showcasing contactless ATM access and enabling easier use of stimulus funds are among the ways the megabank and digital upstart are tailoring services to customers acquired during the pandemic.

March 17 -

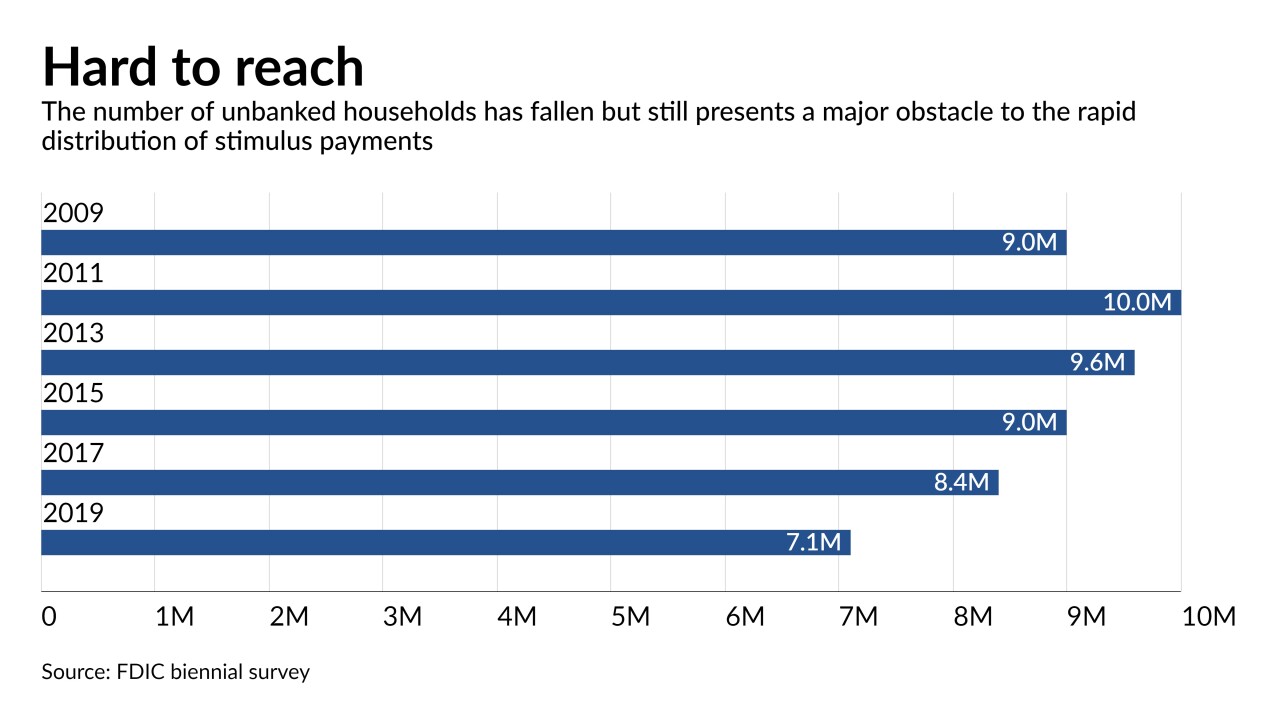

The IRS, FDIC and more than 70 banks and credit unions are urging consumers to open affordable accounts so they can receive their Economic Impact Payments quickly and safely. Many people have signed up, but millions lack accounts and will be harder to serve.

March 17