Consumer banking

Consumer banking

-

A year ago, the National Community Reinvestment Coalition accused KeyBank of redlining. On Wednesday, the NCRC and Key announced a $25 million "agreement" that NCRC CEO Jesse Van Tol says could open the door to a new community benefits plan.

April 3 -

Letitia James, the New York state attorney general, sued Citigroup and argued it should be liable for fraud cases involving consumer wire transfers. But Citi said the AG's view would bring about a "sea change in banking law."

April 3 -

Banking regulators and the Department of Justice must decide whether the blockbuster deal raises antitrust concerns. Looming over their analyses are questions about how broadly or narrowly to define the relevant markets.

April 2 -

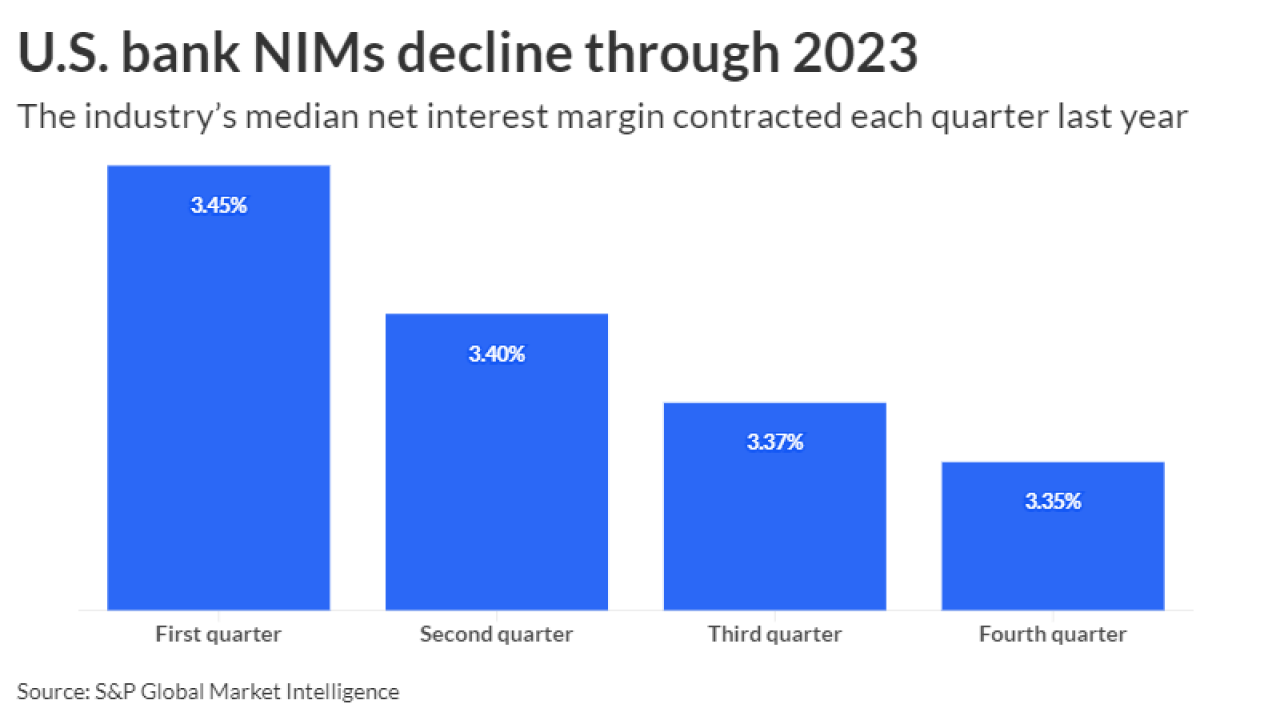

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Houston-based Prosperity Bancshares said it closed its purchase of Lone Star State Bancshares about a year later than initially planned.

April 2 -

Mergers have left Virginia without an independent statewide financial institution. Atlantic Union CEO John Asbury is trying to change that.

April 1 -

The proposed data sharing rules could create opportunities for forward-thinking financial institutions to better serve their customers and meet ever-growing expectations for digital finance.

March 29 -

There are lingering questions related to the agency's 1033 proposal, including how to balance access to information with fraud prevention. But financial institutions should look for ways that access to additional data could help them create better products.

March 29 -

The U.S. arm of Spanish banking giant Santander has hired Swati Bhatia to oversee retail banking and its digital transformation efforts. Bhatia joins at "an inflection point" for the company, which aims to be "a digital bank with branches," CEO Tim Wennes said.

March 28 -

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

Managers often find themselves frustrated that their expectations aren't being met. Instead of assuming the worst about employees, first ask yourself whether you have clearly expressed what you want from your team.

March 28 -

Ally Financial ended a six-month search for its next chief executive by hiring Discover CEO Michael Rhodes. The move adds a new wrinkle to Discover's pending sale, though Discover said that Rhodes hadn't been expected to have a long-term role at Capital One following the merger's completion.

March 27 -

VersaBank in London, Ontario, agreed nearly two years ago to buy a small Minnesota bank. The buyer's CEO says he remains hopeful approval will come soon.

March 27 -

Each spring during the rush of annual meetings, a handful of financial institutions take heat from shareholders who demand new strategies, management shakeups and, at times, even a sale of the company.

March 26 -

A lawsuit filed by the American Fintech Council and two other trade groups has implications for other states that also want to keep out high-cost consumer lenders.

March 26 -

The credit card giant says that it is "proactively meeting" with advocacy organizations to gather feedback that would help with the creation of a community benefits plan. The National Community Reinvestment Coalition, which has negotiated 21 such deals since 2016, opposes Capital One's proposed acquisition of Discover.

March 26 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

March 26 -

Lower commodity prices and decreases in government assistance are expected to push farm income lower this year and raise credit risk for banks.

March 25 -

The Justice Department and the CFPB are increasingly relying on emails among employees that contain discriminatory comments to strengthen their hand in cases against lenders.

March 24 -

Harborstone Credit Union in suburban Lakewood, Washington, plans to buy Savi Financial. That's seven deals in less than three months this year; the highest full-year total was 16 in 2022.

March 22