Consumer banking

Consumer banking

-

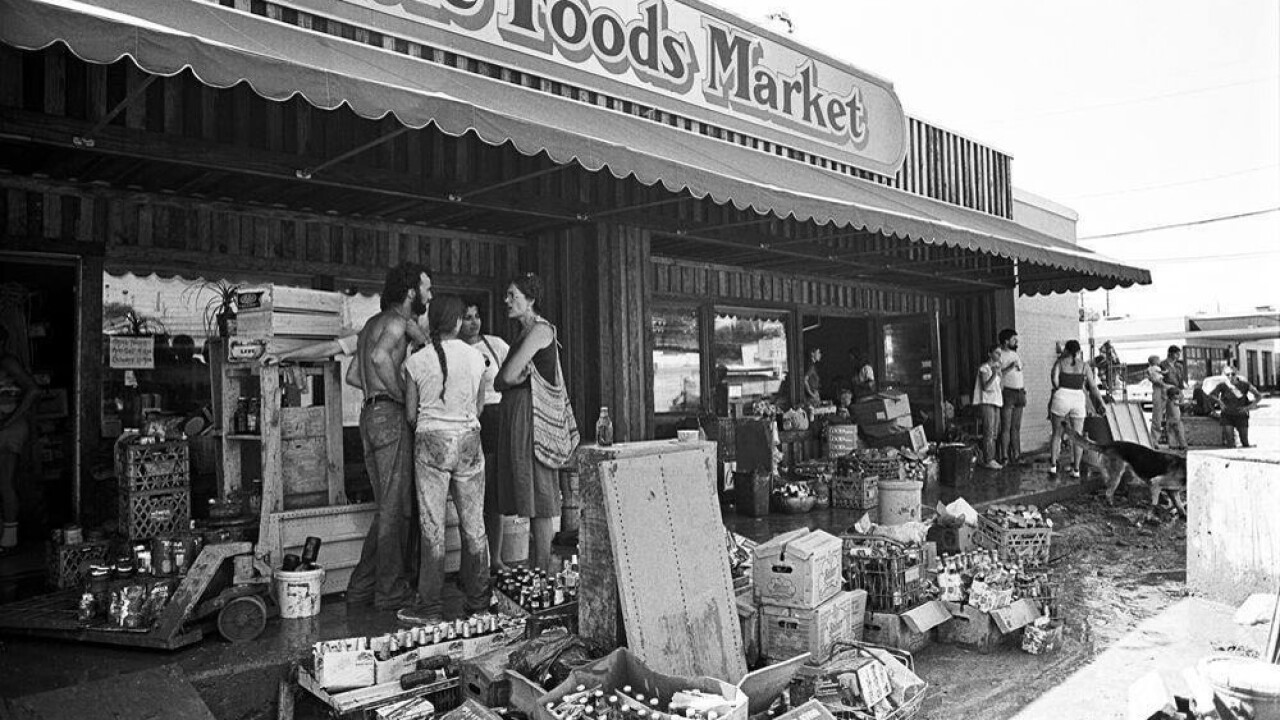

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

With the line between banks and fintechs growing ever blurrier, financial services supervisors ought to consider adjusting regulation to fit the kinds of activity an institution is engaged in.

July 3 -

During a panel discussion at American Banker's Digital Banking conference last week, experts from American Commerce Bank discussed the launch of its virtual banking platform and theorized why other executives might be slow adopters.

July 2 -

With the Federal Reserve holding interest rates at elevated levels through the first half of the year, analysts are sharpening their collective focus on possible fallout from high deposit and borrowing costs.

July 2 -

Old Glory Bank, which has ties to conservative political figures and touts itself as "pro-America," needs to raise more capital to meet its regulator's requirements. "Failure is not an option. We're going to figure this out," the bank's president and CEO said.

July 2 -

The top five community banks have more than $1.2 billion in combined farm loan portfolios as of March 31, 2024.

July 2 -

New top executives were lined up for lenders across the West and Midwest, including Bank of North Dakota.

June 28 -

VersaBank plans to use the one-branch Stearns Bank Holdingford in Minnesota as a platform to expand a lucrative niche business acquiring loan and lease receivables from point-of-sale lenders.

June 27 -

When TD Bank launched an audio brand identity across its communication channels early this year, the new jingle triggered a surprising reaction from consumers using the firm's ATMs.

June 27 -

Eras come and go, but the ongoing investments in developing, empowering, leading and retaining superior personnel will remain the highest priority of top-performing financial institutions.

June 26 -

General Motors' financial arm has halted its quest for an industrial loan company charter from the FDIC, but is signaling that it will try again. Observers said the automaker may wait until after the presidential election to decide how to move forward.

June 25 -

There were 27 bank acquisitions worth $5.45 billion announced in the second quarter as of mid-June. That was more than the $5.2 billion combined value of deals announced over the previous five quarters.

June 24 -

These 20 bankers and fintech executives are helping banks go digital in new ways.

June 24 -

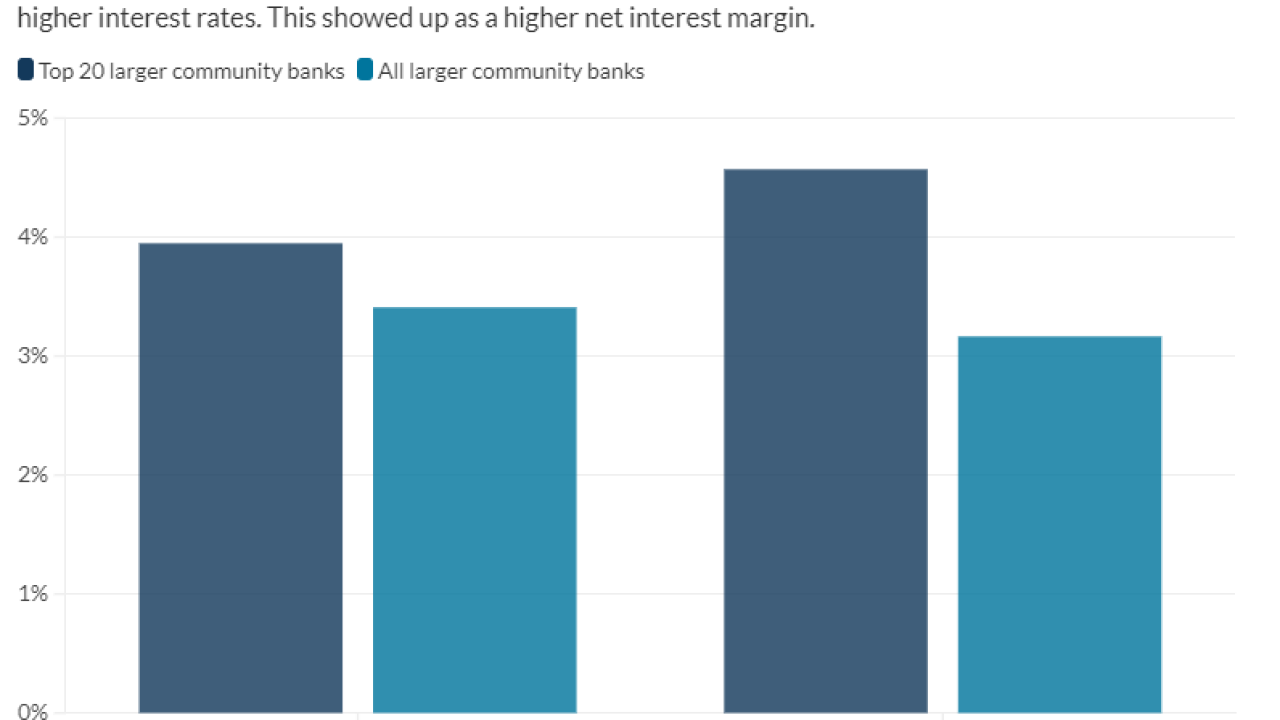

This year Texas banks dominated American Banker's annual list of the top-performing larger community banks. See which institution came in at No. 1 for this asset class.

June 23 -

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

The head of digital product management, platforms and innovation at BMO Bank is one of American Banker's 2024 Innovators of the Year.

June 21 -

The founder and CEO of Owners Bank, a division of Liberty Bank, is one of American Banker's 2024 Innovators of the Year.

June 21 -

Why banks believe fraud prevention and customer experience are both top priorities

June 21 -

Vancouver, Washington's Riverview Bancorp announces Nicole Sherman as its next president and CEO; Happauge, New York-based Dime Community Bancshares is expanding its deposits strategy to Manhattan; UBS hires Guggenheim banker Ananya Das; and more in this week's banking news roundup.

June 21 -

U.K. banks are testing machines that can accept deposits from multiple machines.

June 21