Financial institutions could testify before the bipartisan commission overseeing the unprecedented economic aid for industries hit by the COVID-19 pandemic. But without subpoena authority, the panel’s impact may be limited.

The office and retail markets could look very different in the aftermath of the coronavirus pandemic. Here's what it could mean for lenders.

A backlog has formed since the first round of Paycheck Protection Program funding dried up, threatening to further strain a platform that struggled to handle the initial workload.

Banks had an opportunity to delay compliance with the new accounting standard, but many opted to move forward to get ahead of credit issues that could arise from the coronavirus outbreak.

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

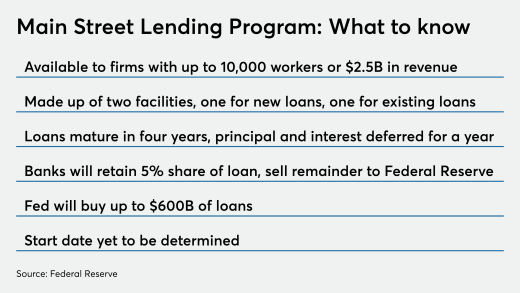

The Federal Reserve’s Main Street Lending Program is meant to be a lifeline for midsize businesses, but two weeks after its unveiling, those firms and their lenders remain on edge about what strings will be attached.

Canada's biggest banks have spent more than $71 billion on technology since the last financial crisis in a bet that clients would eventually become more digitally savvy. The pandemic is hastening that shift faster than they could've expected.

Firms that create virtual assistants for financial institutions are training their bots to answer questions about the pandemic and relieve phone lines from a barrage of customer calls.

-

Financial institutions could testify before the bipartisan commission overseeing the unprecedented economic aid for industries hit by the COVID-19 pandemic. But without subpoena authority, the panel’s impact may be limited.

April 22 -

The office and retail markets could look very different in the aftermath of the coronavirus pandemic. Here's what it could mean for lenders.

April 22 -

A backlog has formed since the first round of Paycheck Protection Program funding dried up, threatening to further strain a platform that struggled to handle the initial workload.

April 22 -

Banks had an opportunity to delay compliance with the new accounting standard, but many opted to move forward to get ahead of credit issues that could arise from the coronavirus outbreak.

April 22 -

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

April 22 -

The Federal Reserve’s Main Street Lending Program is meant to be a lifeline for midsize businesses, but two weeks after its unveiling, those firms and their lenders remain on edge about what strings will be attached.

April 22 -

Canada's biggest banks have spent more than $71 billion on technology since the last financial crisis in a bet that clients would eventually become more digitally savvy. The pandemic is hastening that shift faster than they could've expected.

April 22