-

Executives say they can still meet their goal of $480 million in cost savings this year from the combination of BB&T and SunTrust despite unexpected expenses, unless the economy fails to rebound quickly.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

Federal Reserve Bank of Minneapolis President Neel Kashkari says that large U.S. banks should raise $200 billion from private investors and stop paying dividends so they can support the economy.

April 16 -

Reports from the Singapore office, a coronavirus war room and a hardworking IT staff all helped TD Bank Group get nearly all employees ready to work from home and able to handle a tripling of remote deposit capture activity.

April 15 -

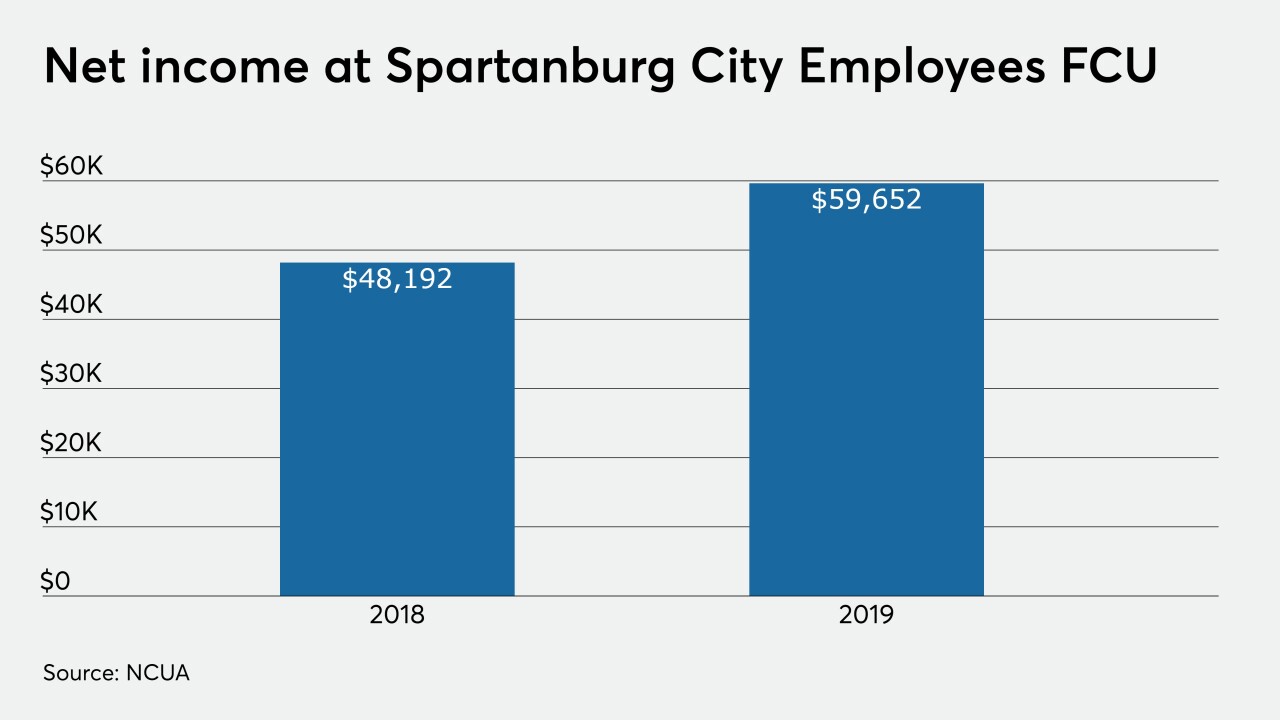

The $1.8 billion-asset institution will likely absorb Spartanburg City Employees FCU later this year, following a vote of that CU's members next month.

April 15 -

The industry was already on a path toward increased digital services, but the global pandemic is showing why CUs need to speed up that process.

April 14 nCino

nCino -

The heads of two congressional committees are requesting a briefing from the agency after a watchdog recommended improvements in how it prepares for crises.

April 14 -

Unlike in 2008, banks have become a steady force during the coronavirus pandemic.

April 14IntraFi Network -

Sherrod Brown, the top Democrat on the Senate Banking Committee, explains why consumer protection is so important as the coronavirus pandemic ravages the economy.

April 13 -

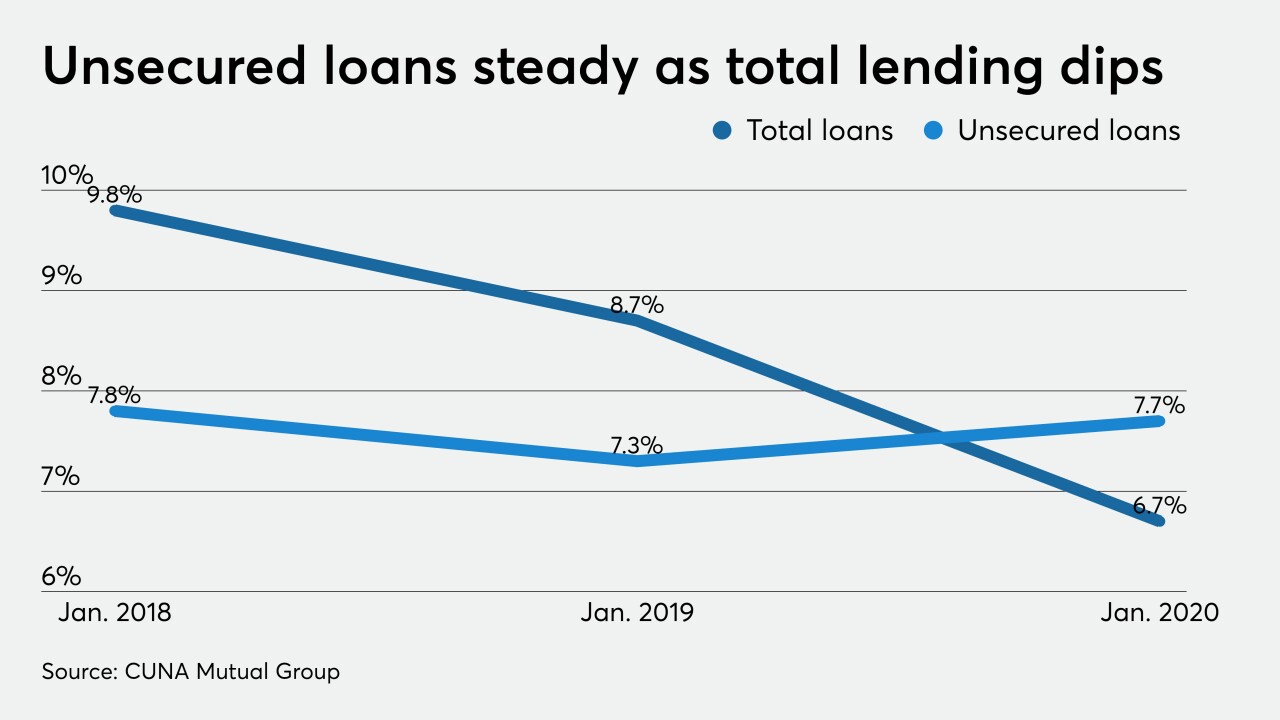

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13