-

Thousands of bankers are set for a reprieve as Citigroup, Wells Fargo and Morgan Stanley joined European lenders in pledging to preserve jobs amid the widespread impact of the coronavirus.

March 27 -

The novel coronavirus poses not only an unprecedented health crisis, but an unprecedented financial crisis as well. Can we forestall a worst-case scenario?

March 26 -

Many banks are offering low-interest loans to help consumers and small businesses withstand the economic shocks of the pandemic. Some are also doing away with ATM, overdraft and late fees because, as one CEO put it, that revenue “is not the most important thing right now.”

March 25 -

Banks and credit unions should make it their top priority to pair with the central bank in distributing financial relief to small businesses, even if that means putting everything else on hold.

March 25 Community Bank Advocates LLC

Community Bank Advocates LLC -

Margins will be squeezed after the Federal Reserve lowered interest rates earlier this month to counteract the economic fallout from the coronavirus.

March 25 -

The COVID-19 crisis is forcing many banks to hold their spring shareholder meetings online only.

March 24 -

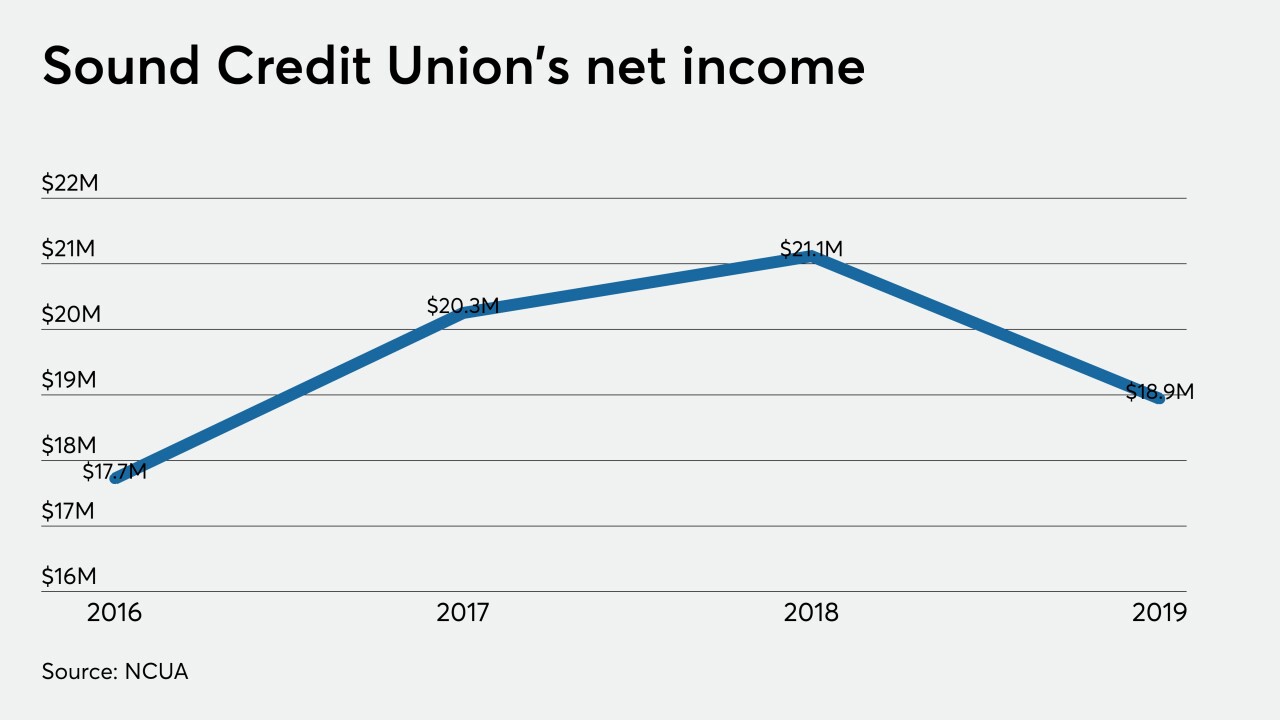

Fluke Employees Federal Credit Union has agreed to become part of Sound Credit Union and the transaction should close later this year.

March 24 -

The Fed announced several new lending facilities and virtually “unlimited” purchases of Treasury bonds; Ana Botín will donate the money to a coronavirus fund.

March 24 -

The credit union regulator's Office of Credit Union Resources and Expansion is making grants of up to $7,500 available to low-income designated institutions.

March 23 -

The coronavirus is changing how consumers interact in branches and banking online. Bank leaders should be prepared.

March 23