-

Following a merger earlier this fall, McCone County FCU has unveiled its new name.

December 20 -

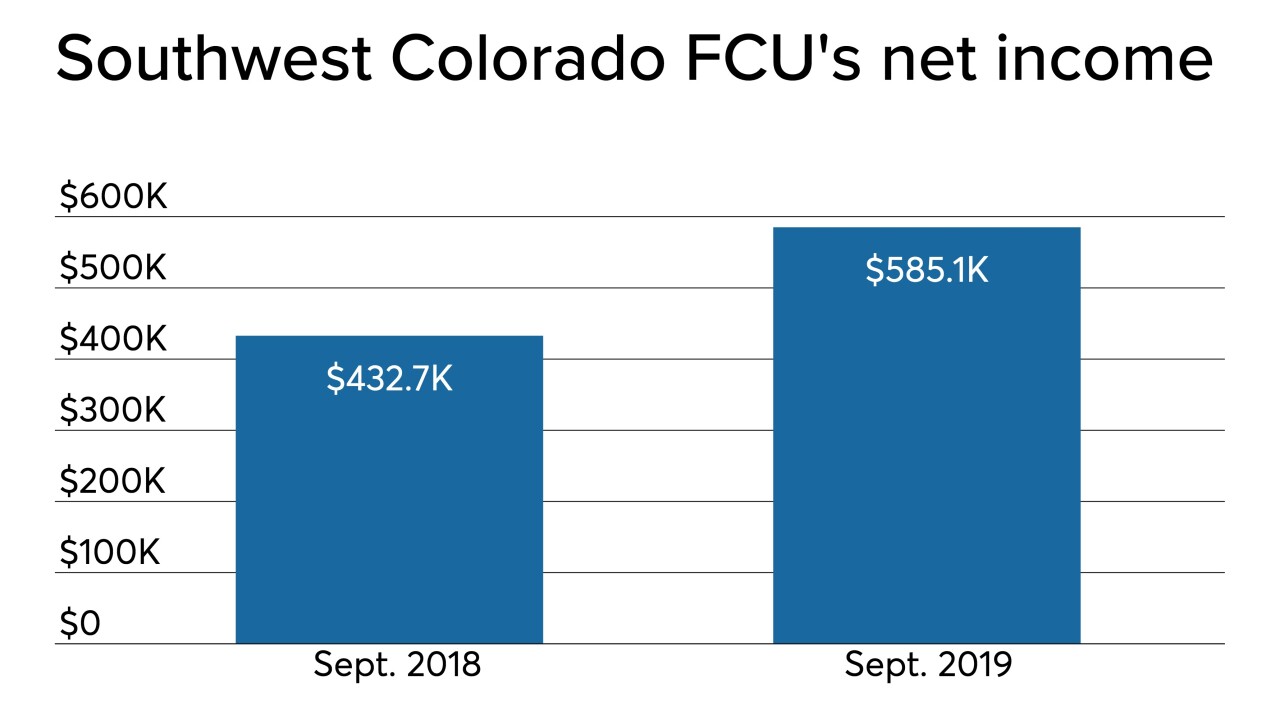

Members of Southwest Colorado Federal Credit Union in Durango have approved a deal that will see the $55 million-asset shop merge into Credit Union of Colorado.

December 20 -

The upstate New York company will gain branches in Rochester as part of its $35 million purchase of FSB Bancorp.

December 20 -

The company will pay about $58 million in cash for Melrose Bancorp.

December 19 -

Five years after rebranding as a growth strategy, small Turbine FCU has been approved to merge into Durham, N.C.-based Self-Help Credit Union.

December 19 -

The Tennessee company said Rob Garcia will be in charge of building a commercial banking team in the city.

December 19 -

The company will pay $94 million for a bank with operations in New Jersey's Somerset and Morris counties.

December 19 -

The Mississippi company will also top $4 billion in assets when it buys Southwest Georgia Financial.

December 18 -

The Pennsylvania company will pay $65 million for six branches that will join its Buffalo, N.Y., division.

December 18 -

The company, which recently bought Monument Bank, has agreed to acquire Covenant Financial.

December 18 -

Charles Peck, the head of public finance, is temporarily joining the leadership of the public affairs team.

December 18 -

A dearth of bigger acquirers will likely force more banks with less than $2 billion in assets to seek out their own deals.

December 18 -

The New Jersey company paid $336 million for all stock owned by Blue Harbour Group.

December 18 -

The credit union service organization has returned more than $20 million to member-owner institutions each year since at least 2016.

December 18 -

Bangor will pay $35 million in cash to gain branches in five communities.

December 17 -

Wichita Falls Bancshares will gain four branches when it buys Chico Bancorp.

December 17 -

Consumers are becoming less tolerant of downtime, especially when it’s inhibiting them from accessing their money, says Arcserve's Oussama El-Hilali.

December 17 Arcserve

Arcserve -

New York is the latest state to change its statutes regarding public deposits and credit unions as more institutions seek out strategies to boost liquidity.

December 17 -

Consumers may be concerned about a possible economic downturn next year, but credit union marketers have no plans to curtail their spending in 2020.

December 16 -

An appeals court on Thursday denied bank groups an en banc hearing from all 11 appellate judges, but bankers said Friday that they're considering taking the case to the Supreme Court.

December 13